- Japan

- /

- Trade Distributors

- /

- TSE:8053

How Soracle’s Osaka Air Taxi Rollout Has Changed the Investment Story at Sumitomo (TSE:8053)

Reviewed by Sasha Jovanovic

- Soracle, a joint venture between Japan Airlines and Sumitomo Corporation, recently announced plans to lead the rollout of air taxi services in Osaka using Archer Aviation’s Midnight eVTOL aircraft.

- This move positions Sumitomo at the forefront of Japan’s urban air mobility innovation while spotlighting U.S.-Japan cooperation in sustainable transportation.

- We’ll look at how Sumitomo’s leadership in next-generation air mobility shapes its investment narrative amid ongoing industry transformations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sumitomo's Investment Narrative?

To be comfortable as a Sumitomo shareholder, conviction often revolves around its broad-based approach to growth, balancing steady returns from established operations with bold moves in next-generation areas like urban air mobility. The recent announcement of Soracle's air taxi rollout positions the company as a visible innovator, yet most short-term investor attention is likely to remain on core profit delivery, capital returns through buybacks, and coming earnings updates. While such news burnishes Sumitomo’s credentials as a partner in emerging mobility projects, it isn’t likely to materially shift short-term catalysts, which are still tied more to operating performance, dividend reliability, and execution during a stretch of management turnover. Risks remain: profit growth is forecast to flatten, management tenure is short by industry standards, debt coverage could become an issue if cash flow weakens, and board renewal is ongoing. The air mobility news is a positive signpost for the long term, but most near-term outcomes will depend on execution in existing businesses and how well the company manages recent leadership changes. On the other hand, recent management turnover may pose challenges to steady performance in the near term.

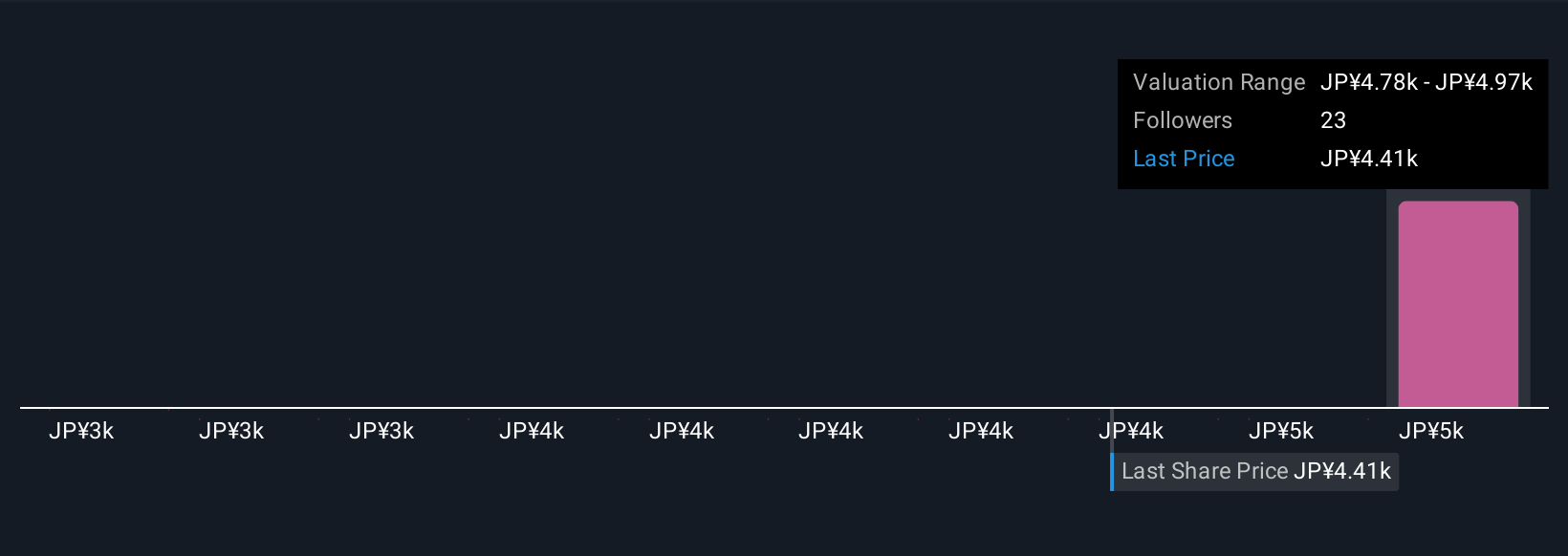

Sumitomo's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Sumitomo - why the stock might be worth as much as 12% more than the current price!

Build Your Own Sumitomo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sumitomo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives