- China

- /

- Professional Services

- /

- SZSE:300492

Undiscovered Gems And 2 Other Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced some turbulence, with major indexes like the S&P 500 and Nasdaq Composite pulling back after reaching record highs. Despite these fluctuations, small-cap stocks have shown relative resilience compared to their larger counterparts, highlighting potential opportunities for investors seeking growth in less prominent sectors. In this environment, identifying stocks with strong fundamentals becomes crucial. Companies that exhibit solid financial health and sustainable business models can offer promising prospects even amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 10.19% | 19.02% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Kinergy Advancement Berhad | 60.88% | 6.26% | 33.33% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Shanghai Sinyang Semiconductor Materials (SZSE:300236)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. operates in the semiconductor materials industry and has a market cap of CN¥12.20 billion.

Operations: The company generates revenue primarily from its semiconductor materials segment. It has a market capitalization of CN¥12.20 billion, reflecting its position in the industry.

Sinyang Semiconductor, a smaller player in the semiconductor materials sector, has shown robust growth with earnings rising 19.4% over the past year, outpacing the industry average of 12.9%. Its net income for the nine months ended September 2024 was CNY 129.76 million, up from CNY 113.83 million last year, reflecting a steady climb despite a notable one-off gain of CN¥45.6M impacting recent results. The company’s debt situation appears manageable with interest payments well-covered by EBIT at four times coverage and more cash than total debt on its books, indicating financial stability amidst expansion efforts.

Huatu Cendes (SZSE:300492)

Simply Wall St Value Rating: ★★★★☆☆

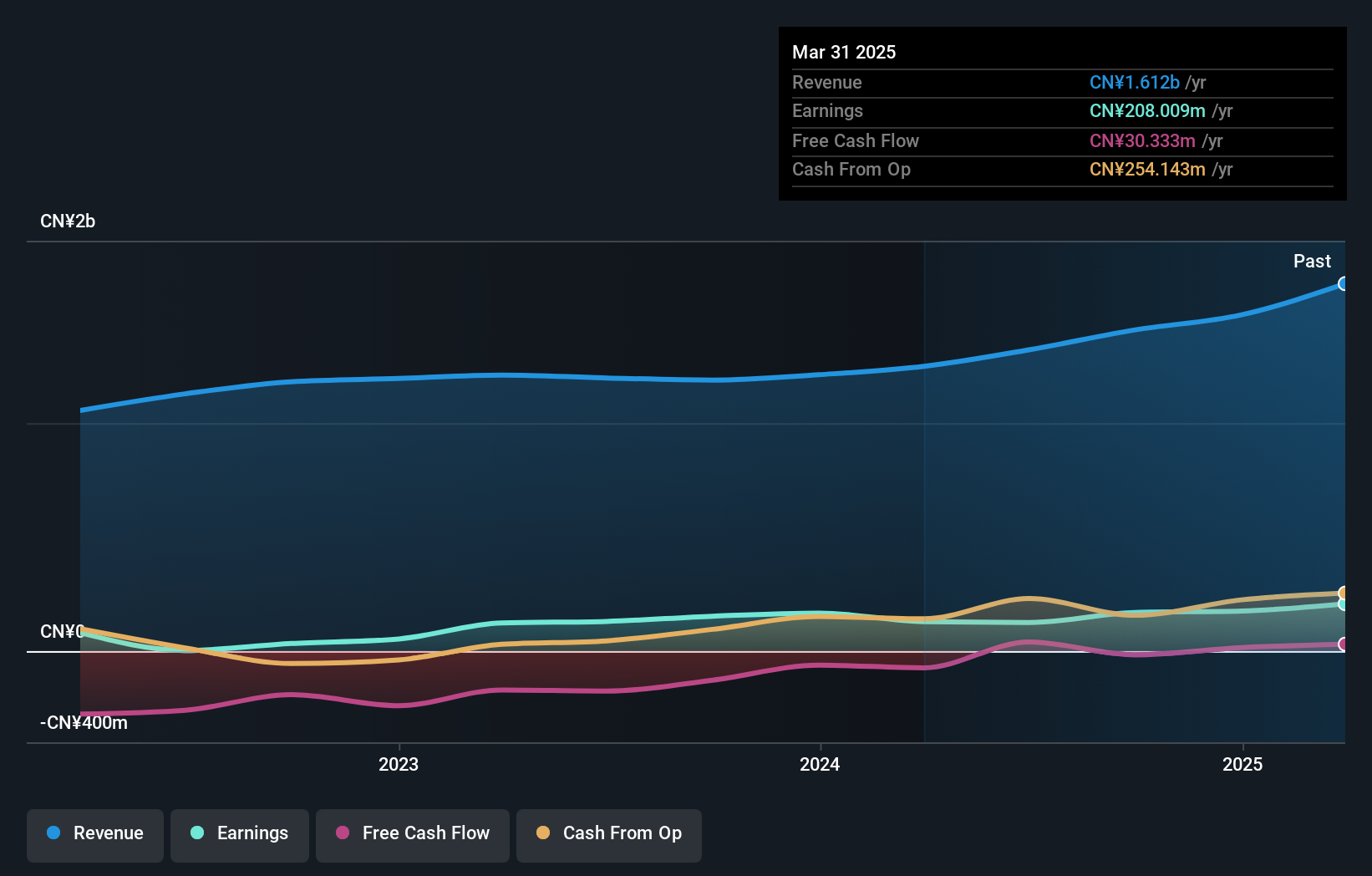

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to various clients in China, with a market cap of CN¥10.81 billion.

Operations: Huatu Cendes generates revenue through its architectural design, consulting, and engineering services offered to a diverse clientele in China. The company's market capitalization stands at approximately CN¥10.81 billion.

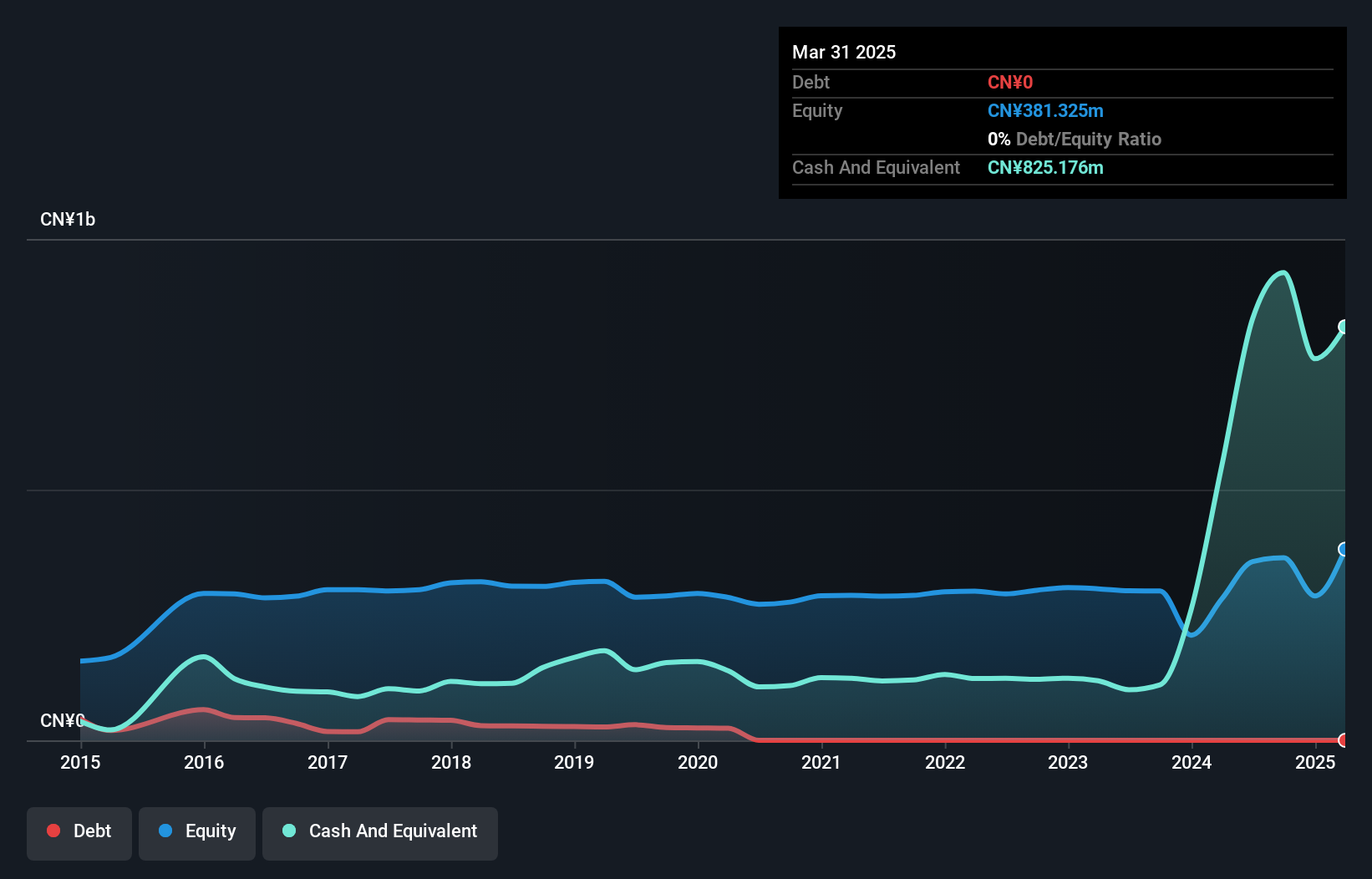

Huatu Cendes has made a remarkable turnaround with sales reaching CNY 2,130.88 million for the first nine months of 2024, a significant jump from CNY 44.37 million last year. Net income also saw a dramatic improvement to CNY 129.43 million from a net loss of CNY 3.7 million previously, highlighting its robust earnings growth of over 2933% compared to the industry average decline of -1.2%. Despite an increase in its debt-to-equity ratio from 8.8% to 44.9% over five years, the company remains financially sound with more cash than total debt and trades at nearly half its estimated fair value, suggesting potential undervaluation in the market.

- Get an in-depth perspective on Huatu Cendes' performance by reading our health report here.

Explore historical data to track Huatu Cendes' performance over time in our Past section.

Kanematsu (TSE:8020)

Simply Wall St Value Rating: ★★★★☆☆

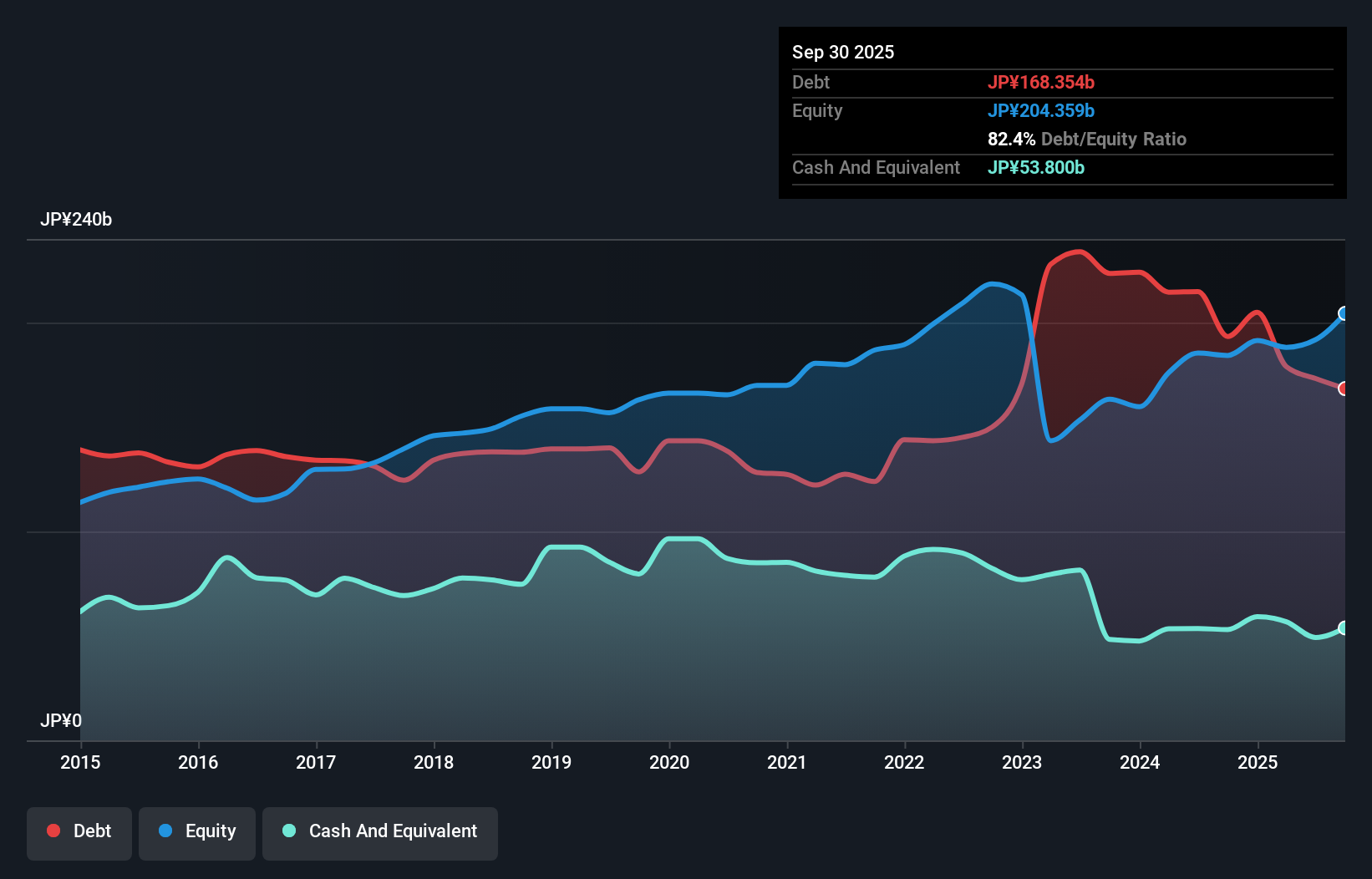

Overview: Kanematsu Corporation is engaged in the trading of commercial products both in Japan and internationally, with a market capitalization of ¥194.02 billion.

Operations: Kanematsu generates revenue primarily from its Electronic Devices and Food, Meat & Grain segments, contributing ¥350.19 billion and ¥350.11 billion respectively. The Steel / Materials / Plants segment also plays a significant role with revenues of ¥210.71 billion.

Kanematsu, a relatively small player in its sector, showcases impressive earnings growth of 39.1% over the past year, outpacing the Trade Distributors industry average of 5.3%. Despite a high net debt to equity ratio of 76.2%, its interest payments are well-covered with EBIT at 13 times coverage, indicating robust financial management. The company trades at an attractive valuation, reportedly 97.6% below fair value estimates. Recently filing for a follow-on equity offering with over five million shares suggests potential capital raising efforts to support future growth initiatives or manage existing debt levels efficiently.

- Unlock comprehensive insights into our analysis of Kanematsu stock in this health report.

Understand Kanematsu's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 4738 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huatu Cendes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300492

Huatu Cendes

Huatu Cendes Co., Ltd., an architectural design company, provides professional, designing, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Exceptional growth potential with excellent balance sheet.