As global markets navigate a landscape of mixed economic signals and record highs in major indices, investors are keenly observing the performance of dividend stocks amid diverging sector trends. In this dynamic environment, identifying reliable dividend-paying stocks can offer a potential source of steady income, making them an attractive option for those looking to balance growth with stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.41% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

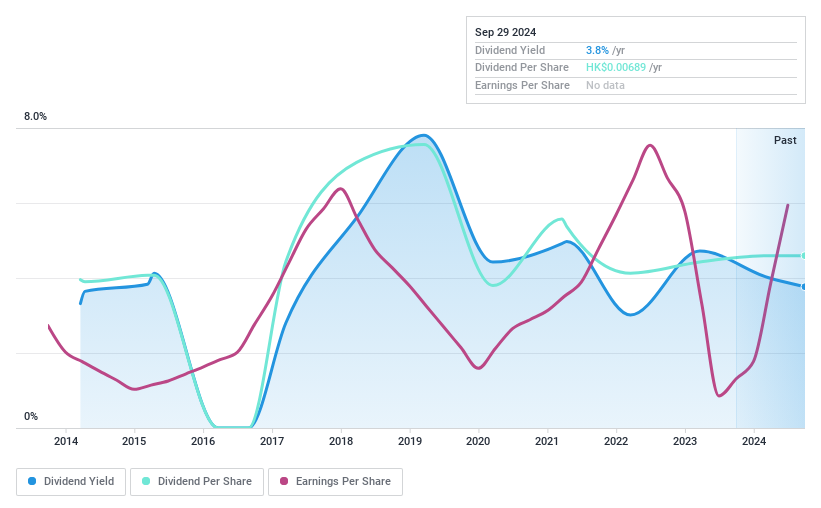

China Starch Holdings (SEHK:3838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Starch Holdings Limited is an investment holding company that manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and other corn-based products in China with a market cap of approximately HK$1.05 billion.

Operations: China Starch Holdings Limited generates revenue from Upstream Products amounting to CN¥9.80 billion and Fermented and Downstream Products totaling CN¥3.86 billion.

Dividend Yield: 3.7%

China Starch Holdings has seen significant earnings growth, rising by 594% over the past year. Despite a low payout ratio of 10.4%, indicating dividends are well covered by earnings, its dividend history is unstable with past volatility and unreliability. The cash payout ratio stands at 25.8%, further supporting dividend coverage by cash flows. However, the current dividend yield of 3.73% is modest compared to top-tier Hong Kong market payers at 8%.

- Dive into the specifics of China Starch Holdings here with our thorough dividend report.

- Upon reviewing our latest valuation report, China Starch Holdings' share price might be too pessimistic.

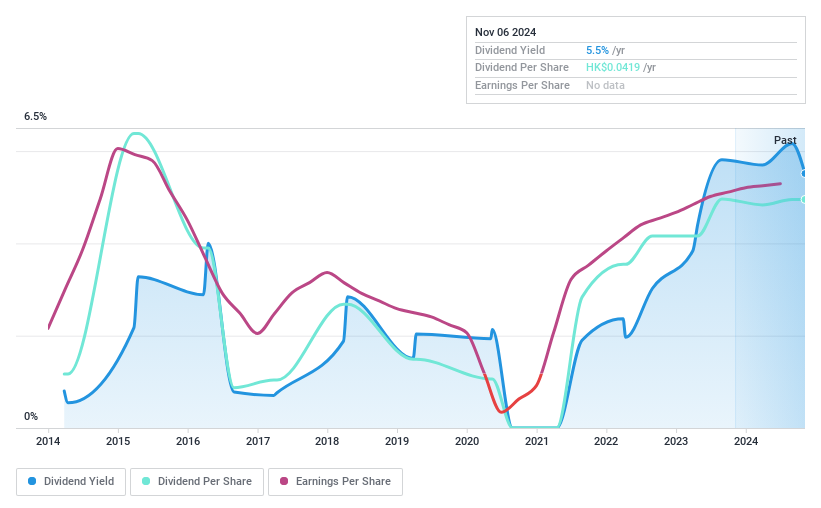

EVA Precision Industrial Holdings (SEHK:838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVA Precision Industrial Holdings Limited is an investment holding company offering precision manufacturing services in China, Vietnam, and Mexico with a market cap of HK$1.18 billion.

Operations: EVA Precision Industrial Holdings Limited generates revenue from its precision manufacturing services primarily through its Automotive Components segment, which accounts for HK$1.98 billion, and its Office Automation Equipment segment, contributing HK$4.34 billion.

Dividend Yield: 6.2%

EVA Precision Industrial Holdings offers a dividend yield of 6.16%, which is below the top 25% in the Hong Kong market. Despite past volatility and unreliability in dividend payments, dividends are well covered by earnings with a payout ratio of 30.1% and cash flows at 34%. Earnings have grown significantly at 40.6% annually over five years, supporting sustainability, while trading at a good value relative to peers and industry benchmarks.

- Unlock comprehensive insights into our analysis of EVA Precision Industrial Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that EVA Precision Industrial Holdings is priced lower than what may be justified by its financials.

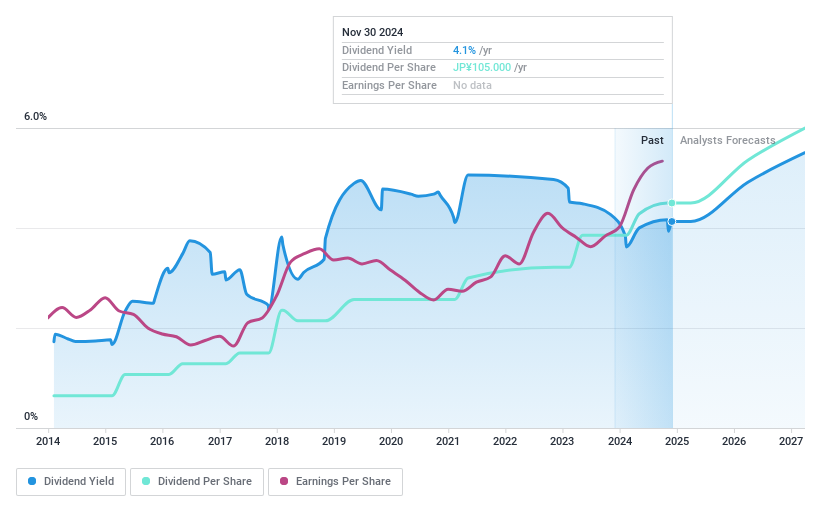

Kanematsu (TSE:8020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kanematsu Corporation engages in the trading of commercial products both in Japan and internationally, with a market cap of ¥215.71 billion.

Operations: Kanematsu Corporation's revenue segments include trading activities in commercial products across various industries both domestically and internationally.

Dividend Yield: 4.1%

Kanematsu Corporation's dividend yield of 4.07% ranks in the top 25% of the JP market, supported by a low payout ratio of 31.3% and cash payout ratio of 13.9%, ensuring coverage by earnings and cash flows despite past volatility. Recent guidance revisions project increased profits, with dividends rising to ¥52.50 per share for Q2 2024 from ¥45.00 a year prior, indicating potential stability improvements amid high debt levels and favorable trading value compared to peers.

- Click here to discover the nuances of Kanematsu with our detailed analytical dividend report.

- Our expertly prepared valuation report Kanematsu implies its share price may be lower than expected.

Seize The Opportunity

- Click this link to deep-dive into the 1944 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3838

China Starch Holdings

An investment holding company, manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and ancillary corn-based and corn-refined products in the People’s Republic of China.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives