- Japan

- /

- Trade Distributors

- /

- TSE:8015

Toyota Tsusho's Green Supply Chain Shift Could Be a Game Changer for TSE:8015

Reviewed by Sasha Jovanovic

- In recent weeks, Toyota Tsusho has advanced its recycling, renewable energy, and decarbonization initiatives, including ramping up battery recycling and green steel projects, aiming to capture demand from global electrification trends.

- This move signals Toyota Tsusho's commitment to repositioning itself as a key player in ESG-driven supply chain transformation, standing out as broader industry trends accelerate.

- We'll examine how Toyota Tsusho's aggressive expansion into the circular economy impacts its investment narrative and future growth assumptions.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Toyota Tsusho Investment Narrative Recap

Investors drawn to Toyota Tsusho’s stock typically believe in the long-term potential of global decarbonization and supply chain transformation, especially as electrification gains speed across industries. The recent ramp-up in battery recycling and green steel may reinforce short-term optimism, but the most important near-term catalyst, sustained momentum in ESG-driven sectors, remains intact, while the biggest risk remains underperformance in core automotive markets, which is unchanged by this news.

Among Toyota Tsusho’s recent announcements, the joint venture with LG Energy Solution in North Carolina stands out. This investment in large-scale battery recycling directly supports the narrative around capturing demand from electrification and ESG supply chain growth, aligning with the biggest current catalysts for the business.

However, investors should be aware that, unlike the optimism from recent renewables expansion, persistent exposure to fragile automotive markets could...

Read the full narrative on Toyota Tsusho (it's free!)

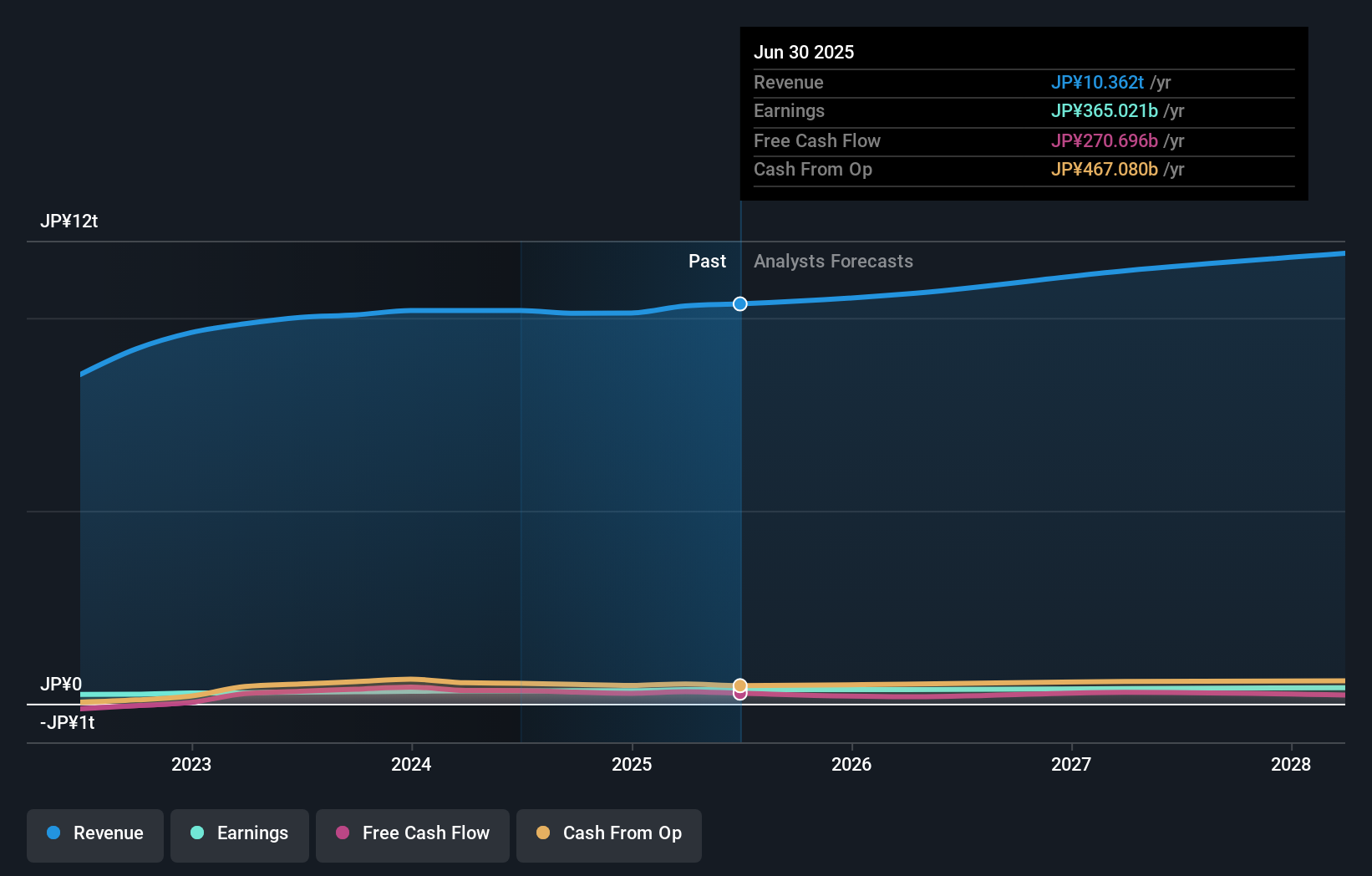

Toyota Tsusho is projected to reach ¥11,762.2 billion in revenue and ¥410.6 billion in earnings by 2028. This forecast assumes annual revenue growth of 4.3% and a ¥45.6 billion increase in earnings from the current ¥365.0 billion.

Uncover how Toyota Tsusho's forecasts yield a ¥4138 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates for Toyota Tsusho from ¥1,956 to ¥4,138, reflecting wide-ranging opinions across just two viewpoints. With ongoing challenges in the core automotive segment still in focus, you can explore how others interpret these mixed signals for future returns.

Explore 2 other fair value estimates on Toyota Tsusho - why the stock might be worth as much as ¥4138!

Build Your Own Toyota Tsusho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toyota Tsusho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toyota Tsusho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toyota Tsusho's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, circular economy, supply chain, mobility, green infrastructure, digital solutions, and lifestyle businesses.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives