- Japan

- /

- Trade Distributors

- /

- TSE:8015

Is Toyota Tsusho’s Rally Sustainable After 58% Surge and New Battery Recycling Venture?

Reviewed by Bailey Pemberton

Thinking about what to do with Toyota Tsusho stock? You’re definitely not alone. With a 427.4% gain over five years and a 58.0% jump just since the start of this year, Toyota Tsusho’s latest moves are catching the eye of investors everywhere. Whether you’ve been holding on for years or are wondering if it’s worth jumping in, the bigger question right now is valuation. The stock has enjoyed a 2.7% bump over the last week and a 9.4% move in the past month, reflecting growing confidence in the company’s role within supply chains as shifting market conditions spark interest across the Japanese trading sector.

Despite all that momentum, a look at the numbers shows that Toyota Tsusho’s current value score is 1, meaning the company appears undervalued on only one out of six valuation checks. That is definitely something to consider as you weigh the balance between past performance and price. Is the market’s optimism outpacing fundamentals, or is there still room to run? Let’s dig into the main valuation approaches to see how the stock stacks up. Keep in mind, we will also look at an even smarter way to assess undervaluation by the end of this article.

Toyota Tsusho scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Toyota Tsusho Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method provides a measure of what the stock should be worth, based on the company’s ability to generate cash in the future.

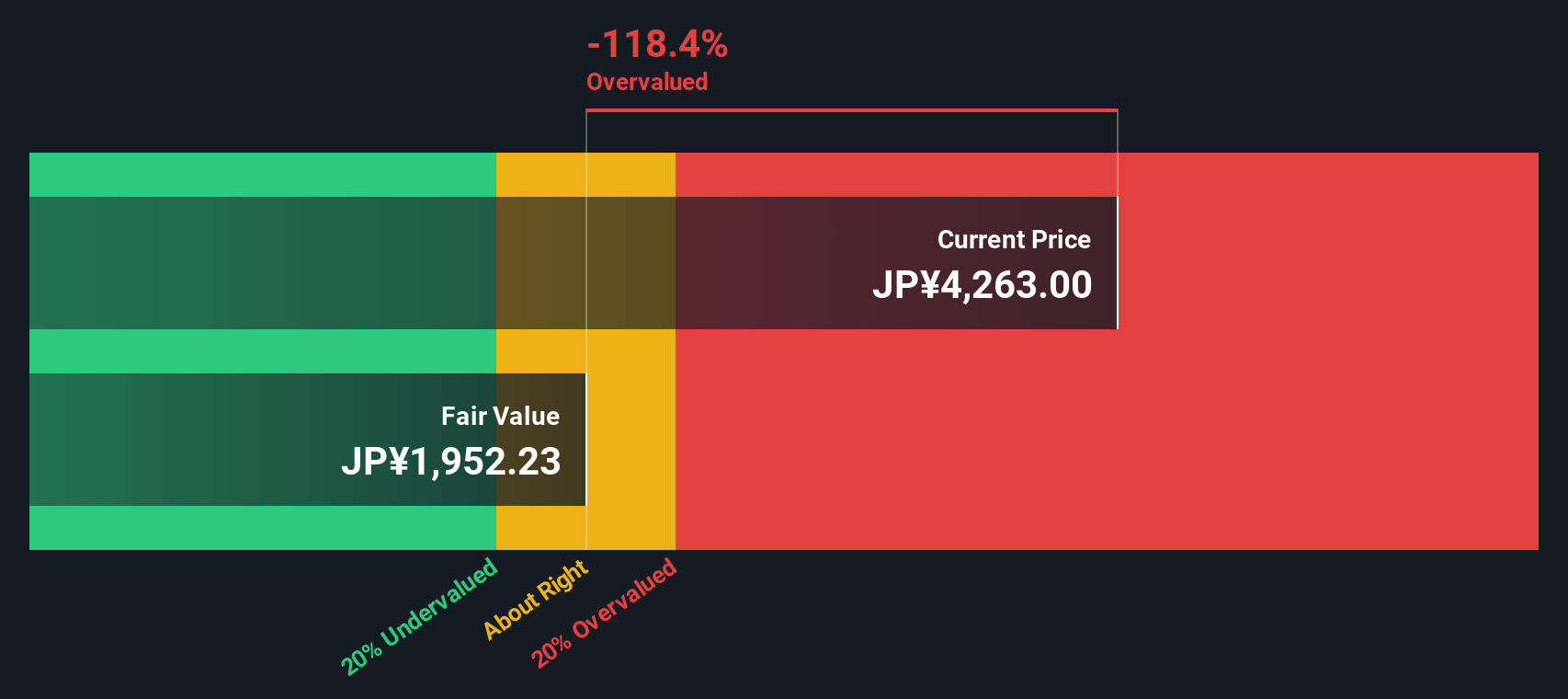

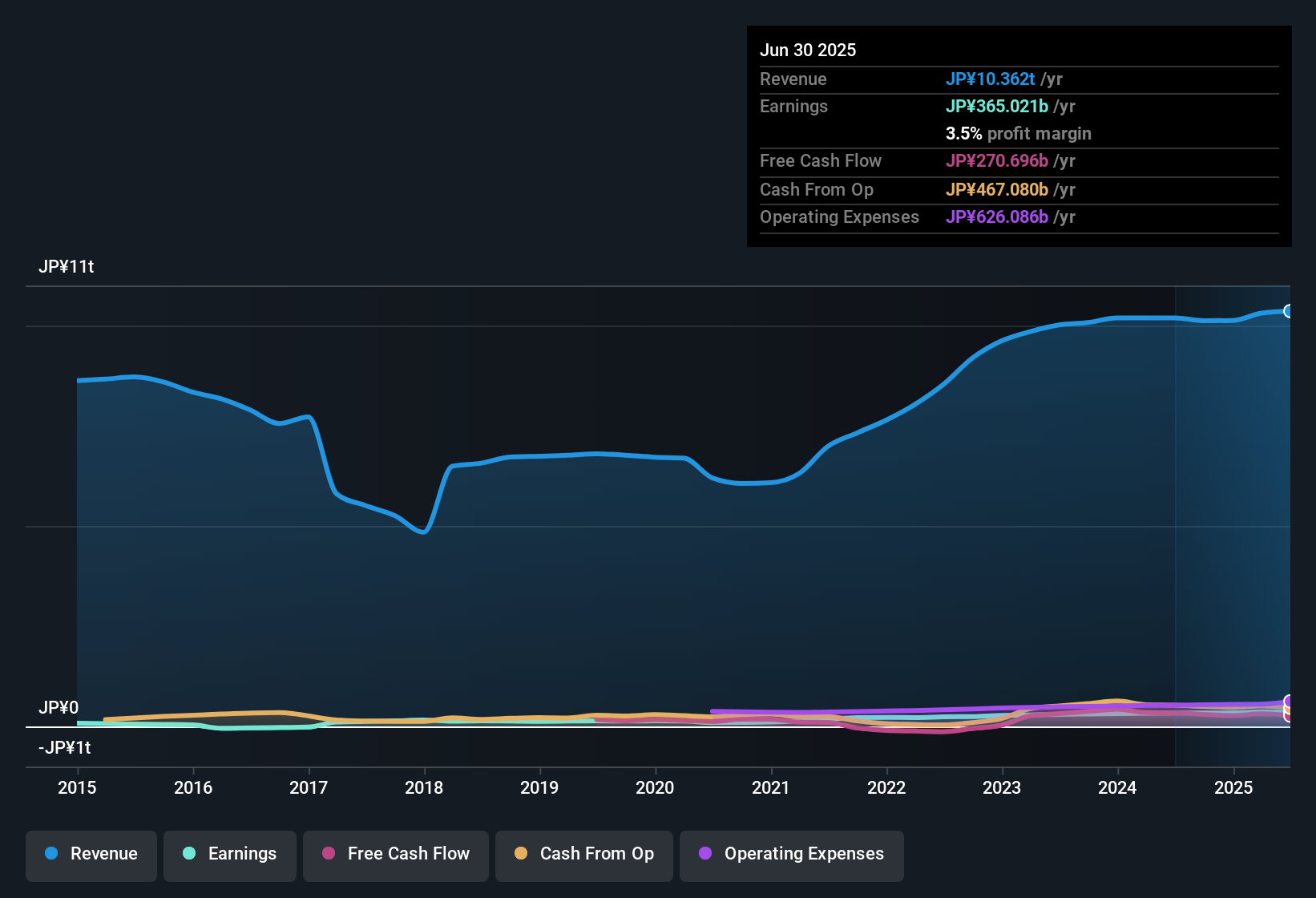

For Toyota Tsusho, the latest reported Free Cash Flow stands at ¥271.5 billion for the last twelve months. Looking ahead, analyst forecasts suggest annual free cash flows will fluctuate, reaching ¥166.0 billion by 2030. Notably, analyst estimates cover the first five years. Simply Wall St has extrapolated future values beyond that. These numbers reflect the complex nature of forecasting in the trading and distribution sector.

After running the two-stage DCF model, the estimated intrinsic value lands at ¥1,968 per share. However, this value reflects a significant disconnect with the current market price and shows the stock is about 120.6% overvalued according to the model.

The DCF result suggests market optimism may have pushed Toyota Tsusho’s share price too far above justified fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Toyota Tsusho may be overvalued by 120.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Toyota Tsusho Price vs Earnings (PE)

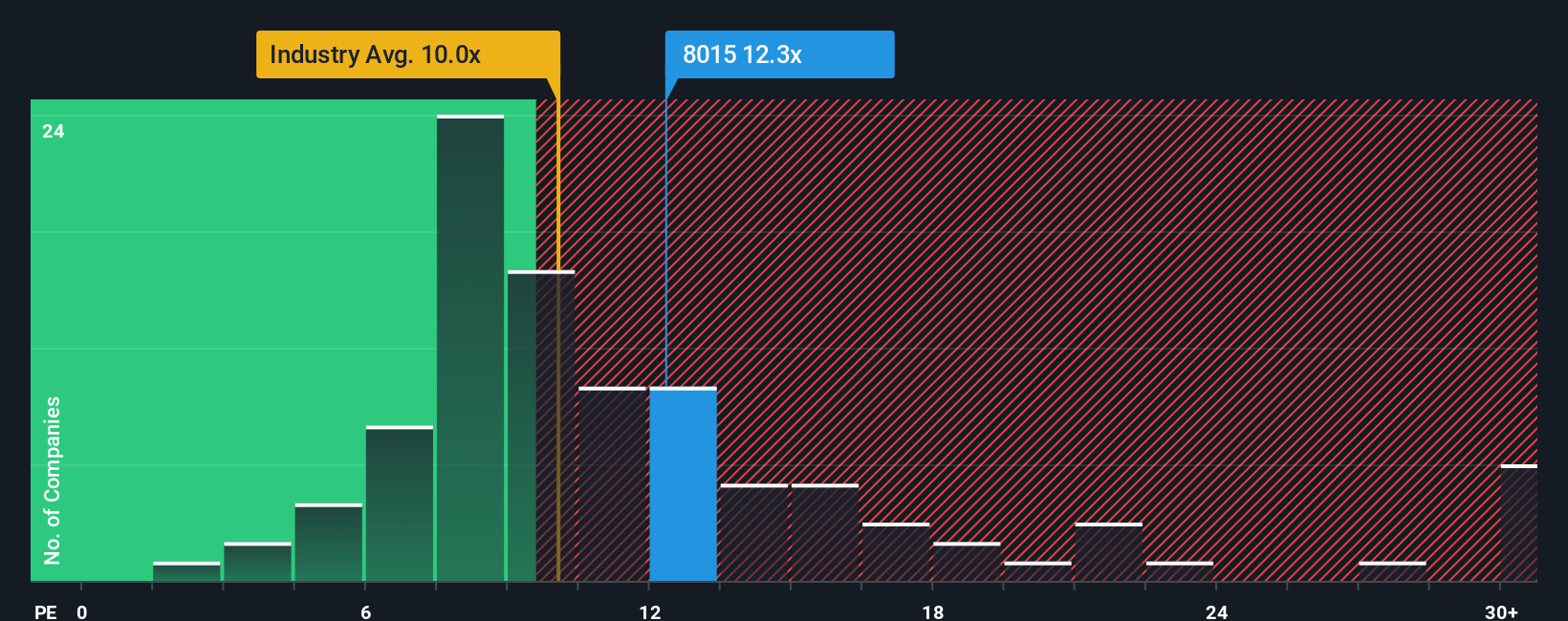

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics, especially for profitable companies like Toyota Tsusho. This metric gives investors a sense of how much they are paying for each yen of earnings, which is a direct reflection of profitability and future earnings potential.

The "normal" or "fair" PE ratio for a company is influenced by several factors, including expectations for future growth and the perceived risk of investing in that company. Higher growth prospects and lower risks often justify a higher PE, while slower growth and increased uncertainty usually mean a lower fair value multiple.

Toyota Tsusho currently trades at a PE of 12.6x. Compared to the Trade Distributors industry average of 10.0x and a peer group average of 11.7x, the company is valued at a modest premium. However, using Simply Wall St's proprietary Fair Ratio approach, the fair value PE for Toyota Tsusho is calculated as 20.9x. This proprietary metric goes beyond basic comparisons by factoring in unique elements such as the company’s long-term earnings growth, profitability, size, risks, and the dynamics of its specific industry.

The Fair Ratio provides a more tailored benchmark than simply using the industry or peers, as it accounts for the realities of Toyota Tsusho’s business rather than relying on broad averages that may not reflect its strengths or challenges. By comparing the actual PE of 12.6x against the Fair Ratio of 20.9x, the stock appears attractively valued based on earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toyota Tsusho Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized investment story, where you connect your perspective on Toyota Tsusho’s future, such as what you expect for revenue growth, profit margins, or industry drivers, to your own estimates of fair value. Narratives bridge the gap between what is happening inside the company and the numbers, allowing you to test your investment thesis in a truly practical way.

Simply Wall St’s Community page makes creating and tracking Narratives simple and intuitive, empowering millions of investors to set assumptions, forecast outcomes, and compare their Narrative's Fair Value directly against the current price. This way, you can see at a glance if you believe the stock is overvalued or undervalued. Narratives do not stand still. As soon as earnings or company news breaks, your forecasts and values update automatically, keeping your view current as markets move.

For Toyota Tsusho, some users’ Narratives are bullish and price in a future driven by strong growth in recycling and renewables, while others are more cautious, spotlighting risks from volatile commodity markets or exposure to the automotive sector. This results in Fair Value estimates ranging from as low as ¥2,700 to as high as ¥4,700. Narratives let you align your investment decisions with your unique outlook so you can make choices based on what you believe, not just the consensus.

Do you think there's more to the story for Toyota Tsusho? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, circular economy, supply chain, mobility, green infrastructure, digital solutions, and lifestyle businesses.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives