- Japan

- /

- Trade Distributors

- /

- TSE:8001

ITOCHU (TSE:8001) strengthens market position with dividend hike and Aviz Networks partnership

Reviewed by Simply Wall St

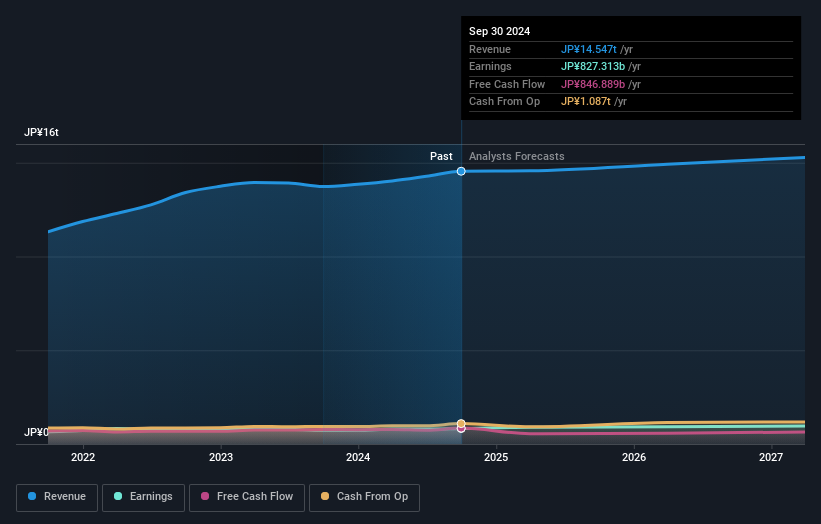

ITOCHU (TSE:8001) continues to strengthen its market position with a notable 13.3% earnings growth over the past year, significantly outpacing the industry average, and a strategic dividend increase to JPY 100 per share. Recent developments include a strategic partnership with Aviz Networks to integrate advanced AI solutions, demonstrating a commitment to innovation and operational efficiency. The upcoming earnings call on November 6, 2024, will provide further insights into ITOCHU's financial health and strategic initiatives, with key areas of focus including technological investments, market expansion, and regulatory challenges.

Get an in-depth perspective on ITOCHU's performance by reading our analysis here.

Unique Capabilities Enhancing ITOCHU's Market Position

Strong financial health is evident with ITOCHU's earnings growth of 13.3% in the past year, surpassing the industry average of 4.9%. This performance is further complemented by a 12.3% annual earnings growth over five years. The company's commitment to shareholder value is highlighted by its dividend increase to JPY 100 per share, up from JPY 80, showcasing a reliable dividend history. Notably, ITOCHU's strategic alliances, such as the partnership with Aviz Networks, enhance its market position by integrating advanced AI solutions, reflecting a forward-thinking approach. These strengths underscore a solid foundation for sustained growth.

Vulnerabilities Impacting ITOCHU

Despite its strong earnings, ITOCHU's Price-To-Earnings Ratio of 13.8x is higher than the industry average of 9.9x, suggesting a premium valuation. The forecasted Return on Equity of 14.4% falls short of the ideal 20%, indicating room for improvement. Additionally, the company's revenue growth forecast of 1.7% lags behind the JP market's 4.2%, posing challenges in maintaining competitive edge. Operational inefficiencies, particularly in supply chain management, have led to increased costs, as acknowledged by CFO Tsuyoshi Hachimura, necessitating strategic adjustments.

Areas for Expansion and Innovation for ITOCHU

ITOCHU is poised to capitalize on emerging opportunities, particularly through technological investments and market expansion. The strategic partnership with Aviz Networks is a testament to its commitment to innovation, aiming to enhance operational efficiency and customer engagement. Exploring new markets, as mentioned by President Keita Ishii, reflects a proactive growth strategy. These initiatives, alongside reliable dividend payments, not only attract income-focused investors but also position ITOCHU to leverage future market dynamics effectively.

Regulatory Challenges Facing ITOCHU

Economic headwinds and regulatory changes present significant challenges. Keita Ishii emphasized the need for strategic caution amidst these uncertainties. Additionally, supply chain vulnerabilities remain a concern, with efforts to diversify suppliers underway. These external factors, coupled with competitive pressures, necessitate vigilant risk management to safeguard market share and ensure long-term stability.

Conclusion

ITOCHU's strong financial performance, with a notable 13.3% earnings growth in the past year and a consistent dividend increase, highlights its commitment to shareholder value and positions it well for future growth. However, the company's Price-To-Earnings Ratio of 13.8x, while higher than industry and peer averages, suggests market expectations of continued strong performance, despite some concerns about its revenue growth and operational inefficiencies. Strategic partnerships, such as with Aviz Networks, and a focus on innovation and market expansion provide avenues for addressing these challenges, though careful management of regulatory and supply chain risks will be crucial. Ultimately, while ITOCHU faces certain vulnerabilities, its strategic initiatives and financial health offer a promising outlook, contingent upon effective execution and adaptation to market dynamics.

Taking Advantage

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8001

ITOCHU

Engages in trading and importing/exporting various products worldwide.

Solid track record with excellent balance sheet and pays a dividend.