- Japan

- /

- Auto Components

- /

- TSE:6584

Premier Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing inflation and robust bank earnings in the U.S., investors are increasingly optimistic about potential rate cuts later in the year. Amid this backdrop, dividend stocks present an appealing option for those seeking steady income and stability, especially given their potential to outperform during periods of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

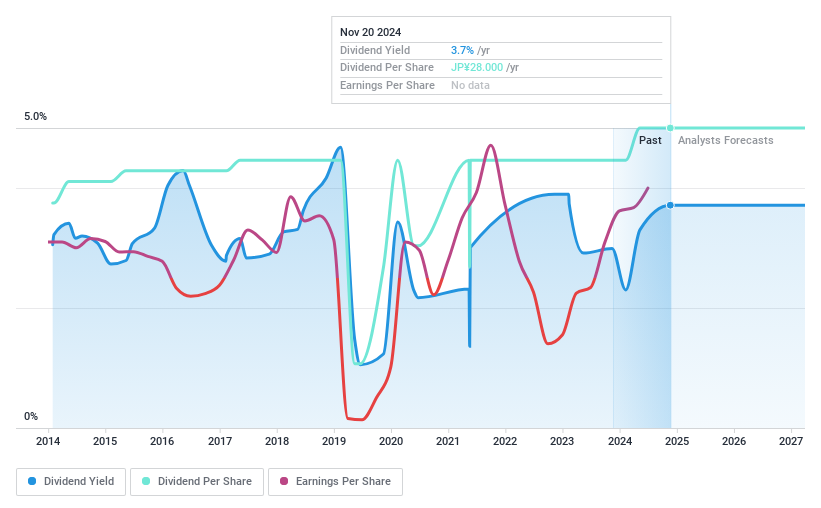

Sanoh Industrial (TSE:6584)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanoh Industrial Co., Ltd. manufactures and sells automotive parts worldwide, with a market capitalization of ¥26.38 billion.

Operations: Sanoh Industrial Co., Ltd.'s revenue is derived from several regions, including ¥29.72 billion from Asia, ¥17.16 billion from China, ¥49.66 billion from Japan, ¥23.32 billion from Europe, and ¥66.40 billion from North and South America.

Dividend Yield: 3.8%

Sanoh Industrial's dividend strategy shows mixed attributes. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 24.8% and 18%, respectively. Despite a history of volatility, dividends have grown over the past decade. However, its current yield is slightly below top-tier market payers in Japan. Sanoh trades significantly below estimated fair value and benefits from strong earnings growth, although its dividend track record remains unstable.

- Click to explore a detailed breakdown of our findings in Sanoh Industrial's dividend report.

- The valuation report we've compiled suggests that Sanoh Industrial's current price could be quite moderate.

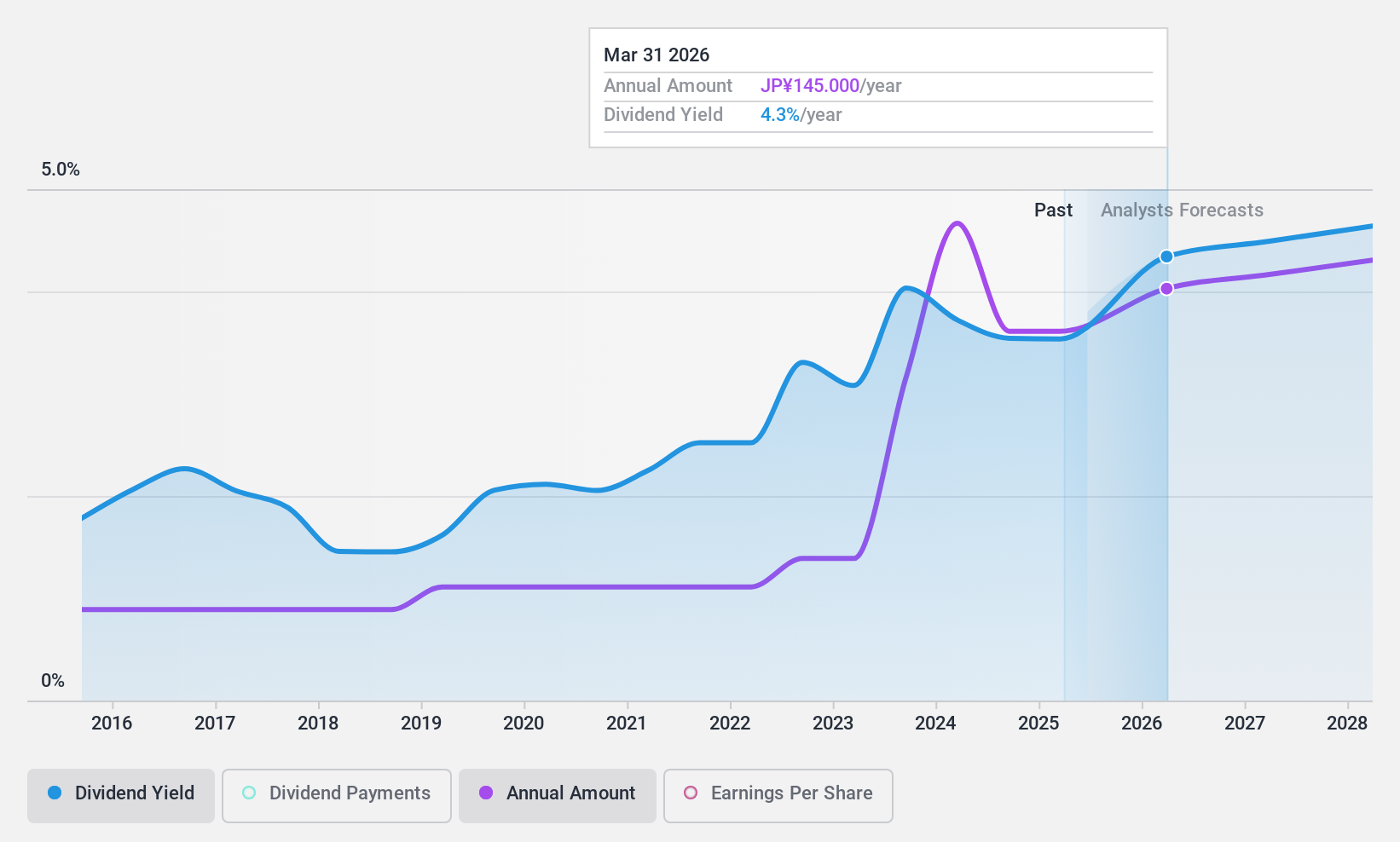

Mirai IndustryLtd (TSE:7931)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mirai Industry Co., Ltd. manufactures and sells electrical and pipe materials, as well as wiring devices in Japan, with a market cap of ¥62.10 billion.

Operations: Mirai Industry Co., Ltd.'s revenue primarily comes from its Electrical Materials and Pipe Materials segment, which generated ¥34.80 billion, followed by Wiring Accessories at ¥7.08 billion.

Dividend Yield: 3.4%

Mirai Industry's dividends are well-supported by earnings and cash flows, with payout ratios of 46.3% and 47.4%, respectively. Despite past volatility, dividends have grown over the decade but remain unreliable. Recent guidance indicates a decrease in year-end dividends to ¥80 per share from ¥100 previously, while mid-year dividends held steady at ¥50 per share. The dividend yield is below top-tier market levels in Japan, and the stock trades significantly below estimated fair value.

- Dive into the specifics of Mirai IndustryLtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Mirai IndustryLtd is trading behind its estimated value.

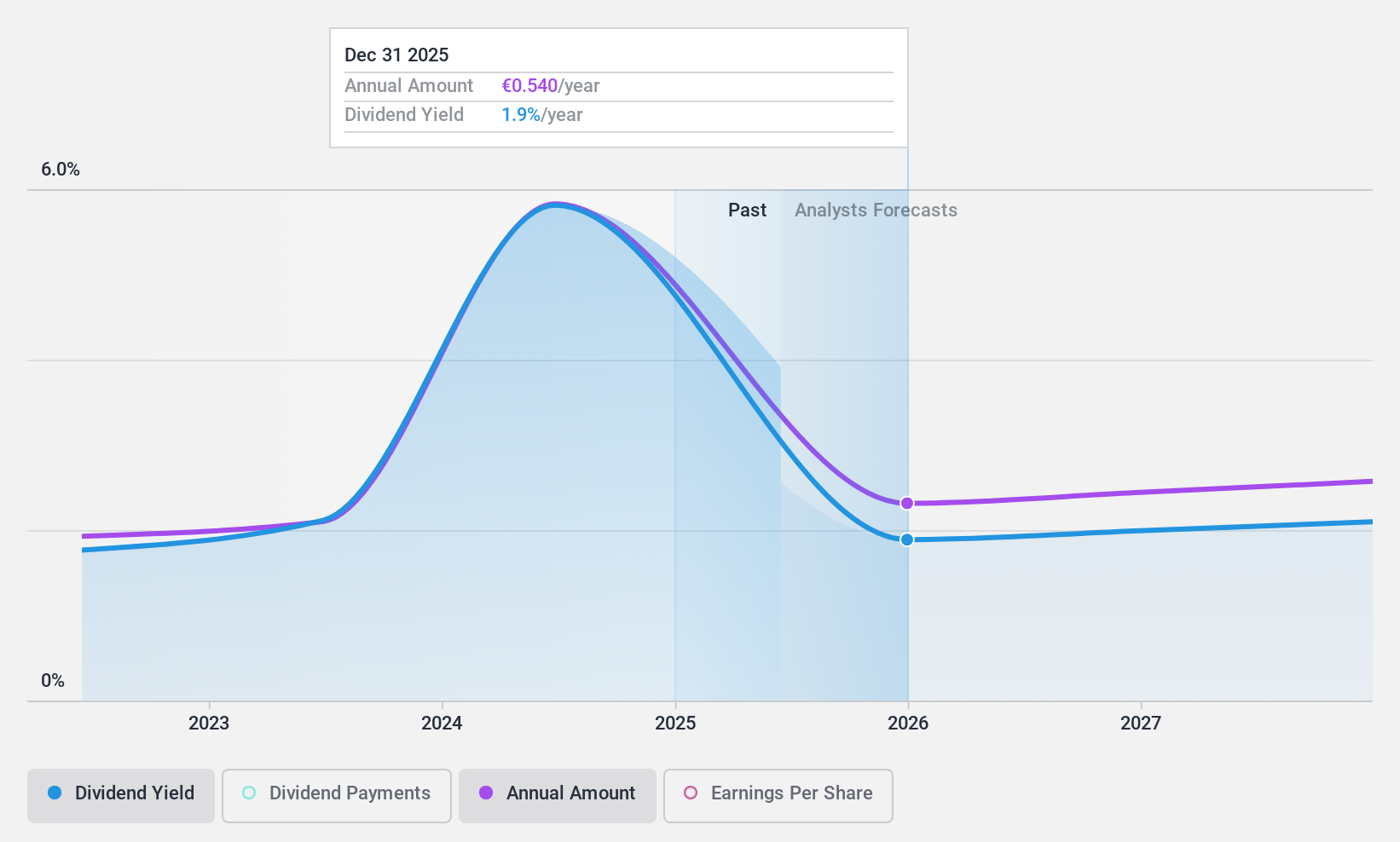

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany, with a market cap of €311.75 million.

Operations: PharmaSGP Holding SE generates its revenue from the Pharmaceuticals segment, which amounts to €114 million.

Dividend Yield: 5.2%

PharmaSGP Holding's dividend yield is among the top 25% in Germany, supported by a cash payout ratio of 57%, indicating coverage by cash flows. However, the dividend has been paid for only three years, limiting its historical reliability. The company trades significantly below estimated fair value but carries high debt levels. Recent earnings show growth, with sales reaching €88.58 million and net income at €14.05 million for the nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of PharmaSGP Holding.

- Our valuation report unveils the possibility PharmaSGP Holding's shares may be trading at a discount.

Turning Ideas Into Actions

- Dive into all 1983 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6584

Flawless balance sheet, undervalued and pays a dividend.