In the face of a resilient U.S. labor market and persistent inflation concerns, global markets have experienced volatility, with U.S. equities recently seeing declines amid political uncertainty and economic data releases. As investors navigate these choppy waters, dividend stocks can offer a measure of stability by providing steady income through regular payouts, making them an attractive option in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.45% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.08% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 2003 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. offers retail banking, wholesale banking, and asset management services across the United States, Spain, Mexico, Turkey, South America, and other international markets with a market cap of €55.81 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A.'s revenue segments include €14.90 billion from Mexico, €3.26 billion from Turkey, €4.43 billion from South America, and €9.06 billion from Spain (including non-core real estate).

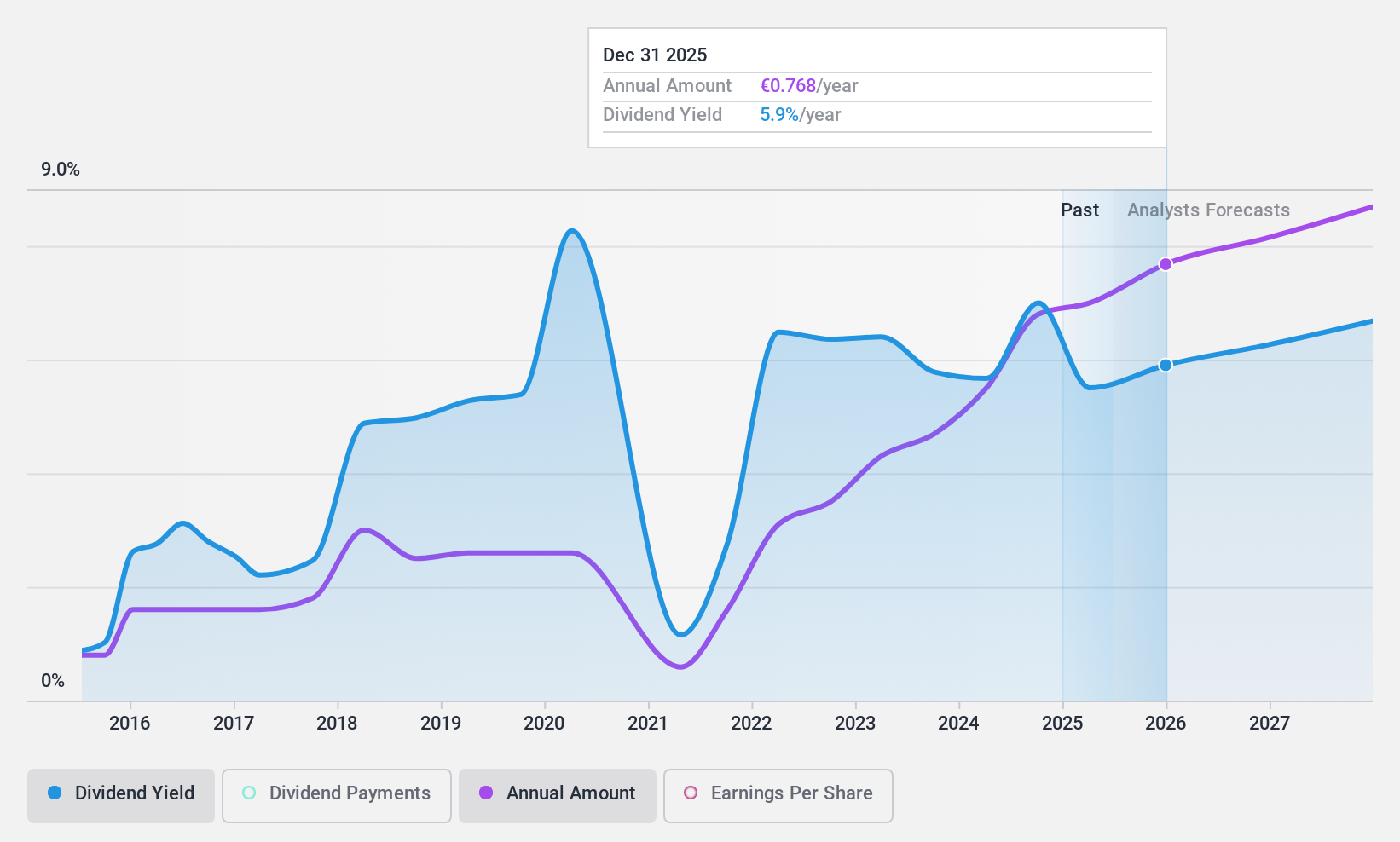

Dividend Yield: 6.5%

Banco Bilbao Vizcaya Argentaria has a volatile dividend history over the past decade, with payments occasionally dropping by over 20%. However, its current payout ratio of 42.2% suggests dividends are well-covered by earnings and expected to remain sustainable. Despite a high level of bad loans at 3.4%, BBVA's recent earnings growth and trading value below estimated fair value offer potential appeal for dividend investors. Recent fixed-income offerings may impact future financial flexibility.

- Unlock comprehensive insights into our analysis of Banco Bilbao Vizcaya Argentaria stock in this dividend report.

- In light of our recent valuation report, it seems possible that Banco Bilbao Vizcaya Argentaria is trading behind its estimated value.

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG specializes in the development, manufacturing, and distribution of precision machine tools for milling, turning, boring, grinding, and machining various materials such as metal, composites, and ceramics; it has a market cap of CHF216.36 million.

Operations: StarragTornos Group AG generates revenue through its precision machine tools designed for the machining of metal, composite materials, and ceramics.

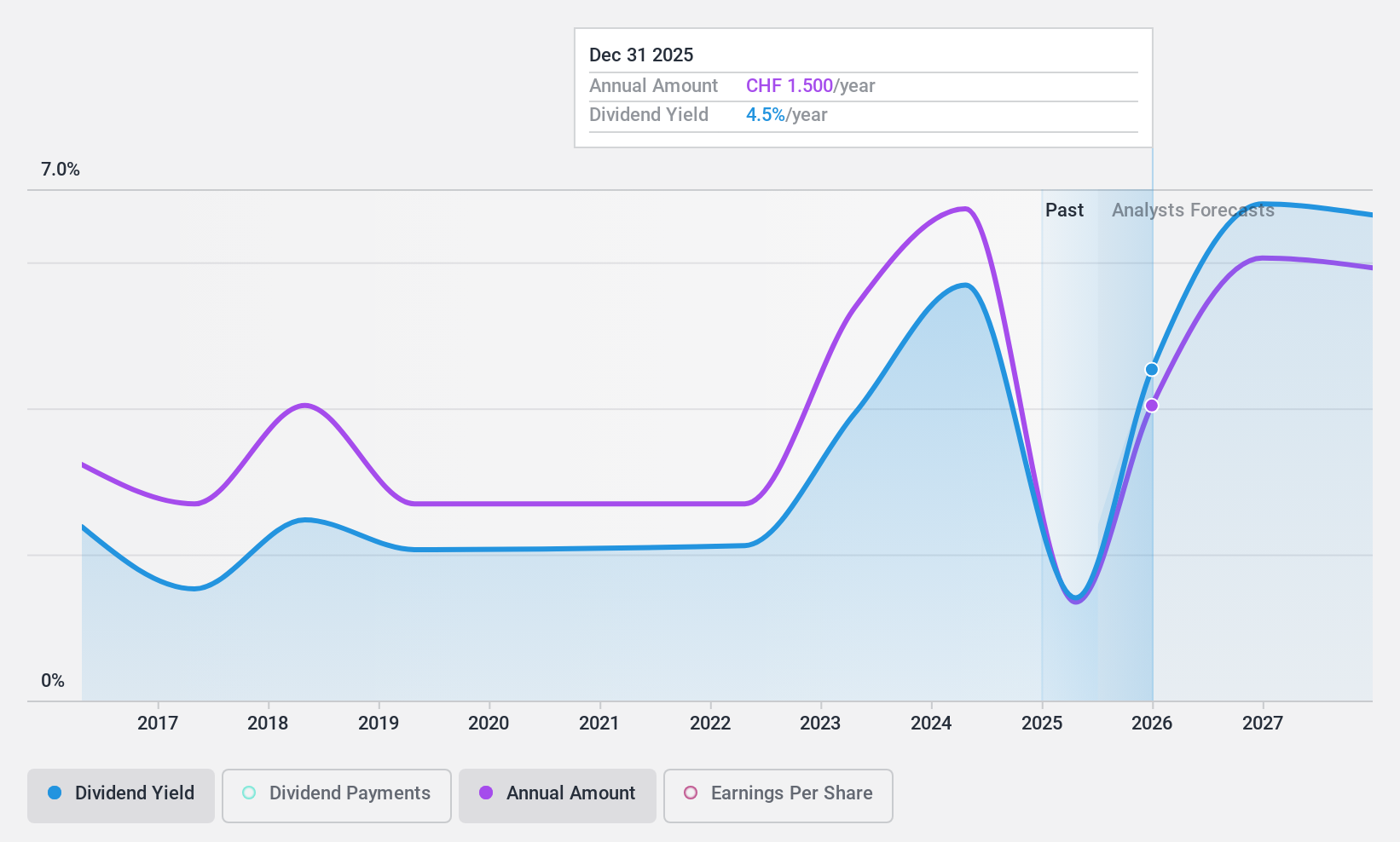

Dividend Yield: 6.3%

StarragTornos Group offers a high dividend yield of 6.28%, ranking in the top quartile of Swiss dividend payers, yet this is not supported by free cash flow, raising concerns about sustainability. Despite a reasonable payout ratio of 62.7% covered by earnings, the dividends have been volatile and unreliable over the past decade. Analysts see potential for stock price appreciation, as it trades significantly below estimated fair value, but volatility remains a risk factor.

- Get an in-depth perspective on StarragTornos Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that StarragTornos Group is priced lower than what may be justified by its financials.

Sanko Gosei (TSE:7888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanko Gosei Ltd. specializes in the molding and sale of plastic parts both in Japan and internationally, with a market cap of ¥19.91 billion.

Operations: Sanko Gosei Ltd. generates revenue through its operations in the molding and sale of plastic components across domestic and international markets.

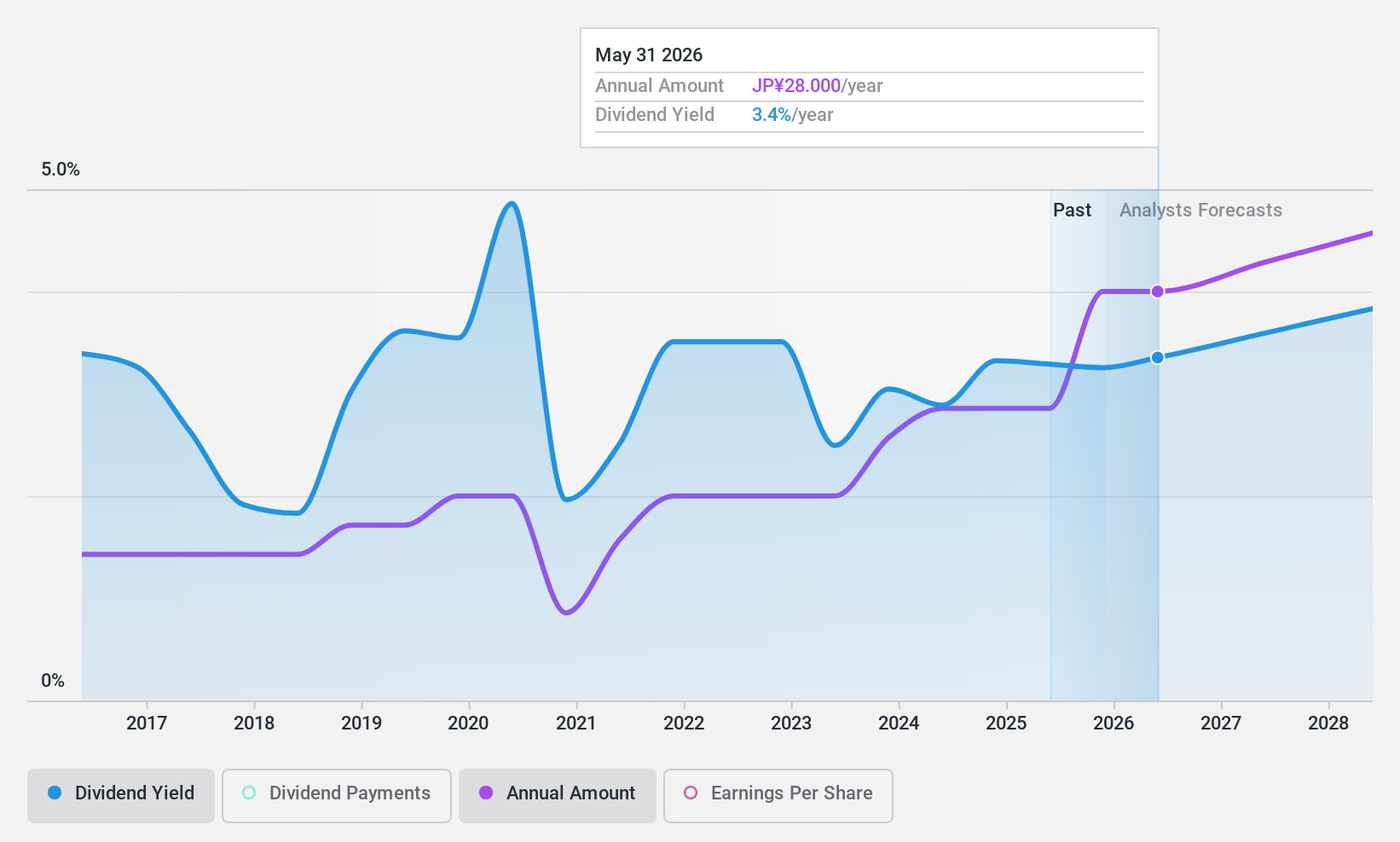

Dividend Yield: 3.1%

Sanko Gosei's dividends are well-covered by earnings and cash flows, with a low payout ratio of 9.5% and cash payout ratio of 26.5%. Despite trading significantly below estimated fair value, its dividend yield of 3.06% is lower than the top quartile in Japan. The company has a volatile dividend history over the past decade, though payments have increased during this period, indicating some growth potential despite an unstable track record.

- Take a closer look at Sanko Gosei's potential here in our dividend report.

- According our valuation report, there's an indication that Sanko Gosei's share price might be on the cheaper side.

Taking Advantage

- Click this link to deep-dive into the 2003 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7888

Sanko Gosei

Engages in the molding and sale of plastic parts in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives