- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1045

Undiscovered Gems Promising Stocks To Explore In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts in Europe and expectations of further rate adjustments by the Federal Reserve, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming against larger-cap indices. Amidst this backdrop of fluctuating economic indicators and shifting market sentiment, identifying promising small-cap opportunities requires a keen focus on companies with robust fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

APT Satellite Holdings (SEHK:1045)

Simply Wall St Value Rating: ★★★★★★

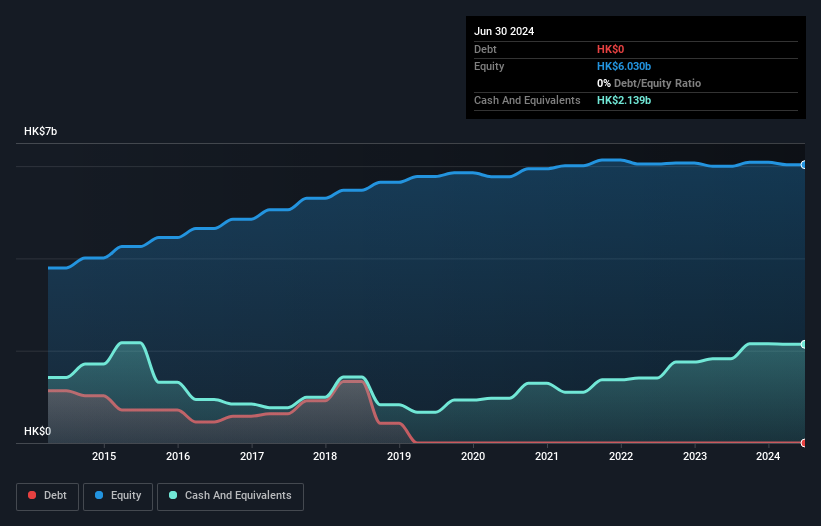

Overview: APT Satellite Holdings Limited is an investment holding company that maintains, operates, and provides satellite transponder capacity and related services, along with satellite-based broadcasting and telecommunications services, with a market cap of HK$2.07 billion.

Operations: APT Satellite Holdings derives its revenue primarily from the provision of satellite transponder capacity and related services, generating HK$806.09 million. The company's financial performance is influenced by its cost structure and operational efficiency, reflected in its profit margins.

APT Satellite Holdings, a compact player in the telecommunications sector, is trading at 73.5% below its estimated fair value, suggesting potential undervaluation. Despite earnings declining by 10% annually over the past five years, the company remains debt-free and enjoys high-quality earnings. Over the last year, its earnings grew by 2.7%, although this pace lagged behind the broader telecom industry's growth of 5.5%. With positive free cash flow and no debt concerns impacting interest coverage or cash runway, APT Satellite seems positioned to leverage its financial health for future opportunities in a competitive market landscape.

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Value Rating: ★★★★★★

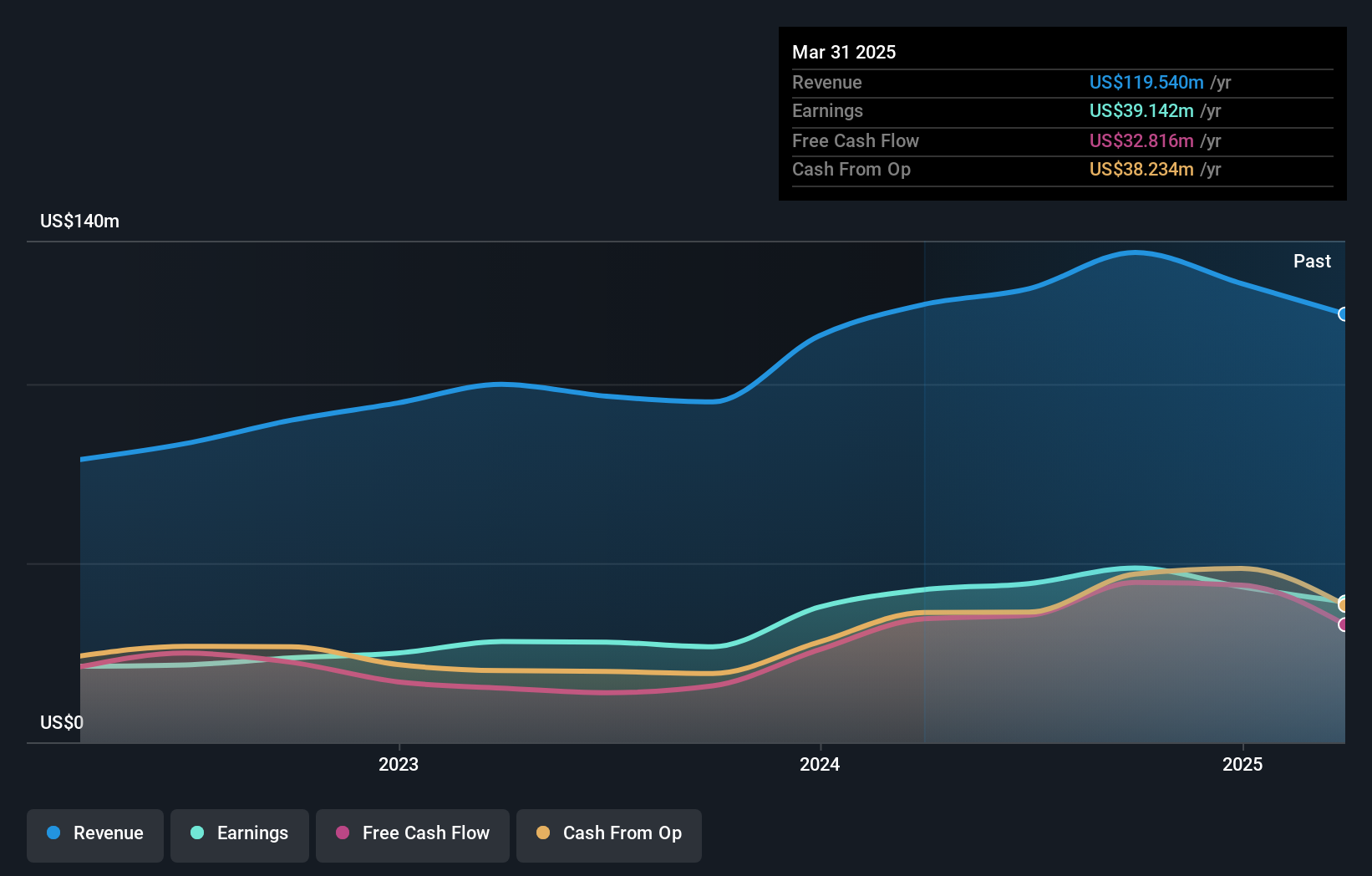

Overview: FMS Enterprises Migun Ltd specializes in the global production and sale of ballistic protection raw materials and products, with a market capitalization of ₪1.34 billion.

Operations: FMS Enterprises Migun Ltd's primary revenue stream is from the Aerospace & Defense segment, generating $136.76 million.

FMS Enterprises Migun, a player in the Aerospace & Defense sector, has been making waves with its impressive earnings growth of 82.5% over the past year, outpacing industry averages. The company reported third-quarter sales of US$32.7 million, up from US$22.54 million last year, and net income rose to US$10.08 million from US$5.68 million previously. With no debt on its books for five years and a robust free cash flow position—US$44.6 million as of September 2024—it seems well-positioned to capitalize on future opportunities while maintaining high-quality earnings standards.

- Navigate through the intricacies of FMS Enterprises Migun with our comprehensive health report here.

Gain insights into FMS Enterprises Migun's past trends and performance with our Past report.

Kyokuto Kaihatsu KogyoLtd (TSE:7226)

Simply Wall St Value Rating: ★★★★☆☆

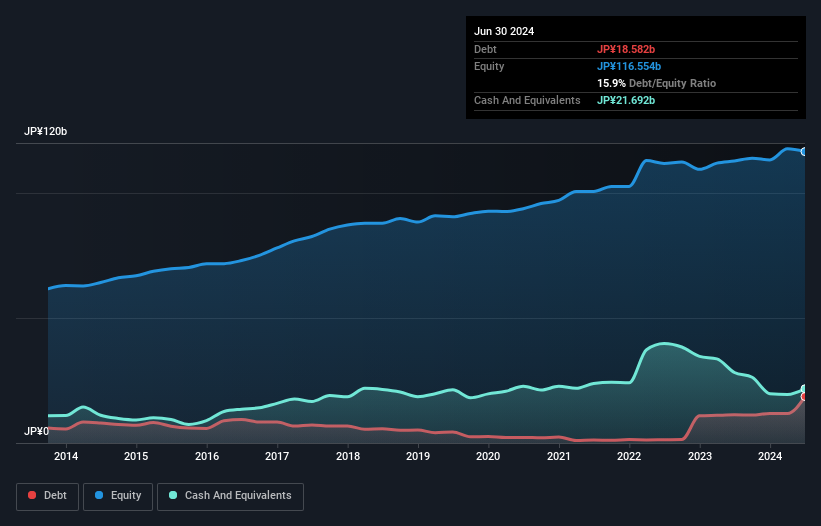

Overview: Kyokuto Kaihatsu Kogyo Co., Ltd. is a Japanese company engaged in the manufacturing and sales of special purpose vehicles, environmental equipment and systems, and car parking systems, with a market capitalization of approximately ¥91.33 billion.

Operations: Kyokuto Kaihatsu Kogyo generates revenue primarily from special purpose vehicles (¥111.07 billion), environmental business (¥13.76 billion), and parking systems (¥8.29 billion). The majority of its revenue comes from the special vehicle segment, highlighting its significance in the company's financial structure.

Kyokuto Kaihatsu Kogyo, a small player in the machinery sector, has shown impressive earnings growth of 40.6% over the past year, outpacing the industry's 0.8%. Despite this growth spurt, its earnings have seen a decline of 5.6% annually over five years. The company trades at an attractive valuation, being priced 8.1% below its estimated fair value. However, it faces challenges with free cash flow being negative and a rising debt-to-equity ratio from 2.7 to 15.9 over five years. A notable ¥1.7 billion one-off gain recently impacted financial results, highlighting potential volatility in performance metrics.

Turning Ideas Into Actions

- Access the full spectrum of 4502 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1045

APT Satellite Holdings

An investment holding company, maintains, operates, and provides satellite transponder capacity and related services, satellite-based broadcasting and telecommunications services, and other services.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives