Hino Motors (TSE:7205) adds JP¥17b to market cap in the past 7 days, though investors from five years ago are still down 49%

Hino Motors, Ltd. (TSE:7205) shareholders should be happy to see the share price up 23% in the last month. But over the last half decade, the stock has not performed well. In fact, the share price is down 50%, which falls well short of the return you could get by buying an index fund.

While the last five years has been tough for Hino Motors shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Hino Motors

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Hino Motors has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

It could be that the revenue decline of 3.3% per year is viewed as evidence that Hino Motors is shrinking. This has probably encouraged some shareholders to sell down the stock.

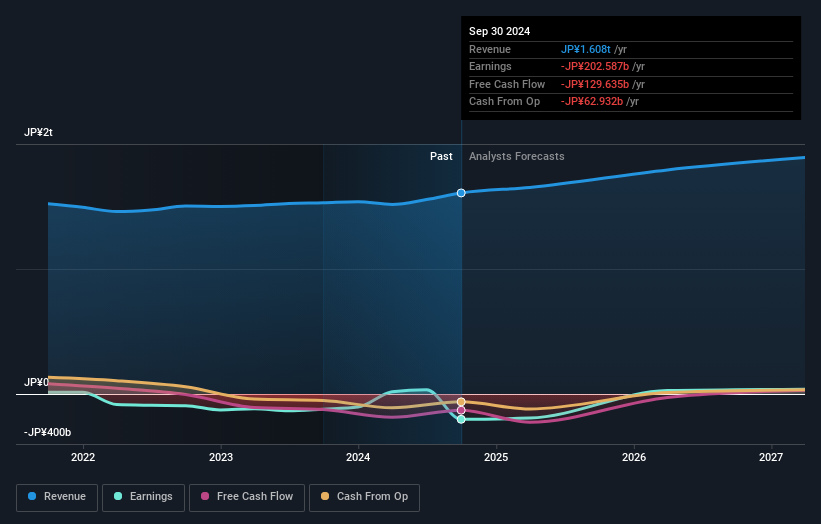

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Hino Motors is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Hino Motors stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's good to see that Hino Motors has rewarded shareholders with a total shareholder return of 14% in the last twelve months. That certainly beats the loss of about 8% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Hino Motors (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

We will like Hino Motors better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hino Motors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7205

Hino Motors

Manufactures and sells commercial vehicles under the Hino brand worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives