Can IHI's (TSE:7013) Satellite Ambitions Transform Its Competitive Position in Aerospace Technology?

Reviewed by Sasha Jovanovic

- IHI and Innovar Technologies recently announced a partnership to develop satellite technology aimed at enhancing maritime surveillance, with involvement from IHI’s subsidiary Myoukodenki and Australian startup Innovar Technologies.

- This agreement signals IHI's intention to broaden its presence in advanced aerospace and security technology, which could reshape its industry position beyond its traditional engineering focus.

- We'll explore how IHI's move into satellite-based maritime security may influence its investment outlook and long-term growth prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

IHI Investment Narrative Recap

Investors in IHI need to have confidence in the company's ability to leverage its established aerospace engineering strength while expanding into advanced security technologies, such as satellite-based maritime surveillance. The recent partnership with Innovar Technologies connects IHI more deeply to the evolving defense technology sector, but it is not expected to materially shift the current short-term focus on sustaining strong sales in civil aero engines, the company's main profit driver, or mitigate existing risks tied to operational performance and cost pressures. IHI’s May alliance with ICEYE to develop a synthetic aperture radar satellite constellation stands out as a relevant precursor to the Innovar partnership. This effort reinforces IHI’s movement into high-tech sectors, supporting its ambitions for diversified revenue streams and possibly smoothing over cyclical weakness in its traditional spare parts business. Yet for all the promise, investors should be aware that increasing SG&A costs from provisions for doubtful accounts remain a risk if future cash collection falls short...

Read the full narrative on IHI (it's free!)

IHI's outlook projects revenues of ¥1,734.8 billion and earnings of ¥103.1 billion by 2028. This is based on an annual revenue growth rate of 2.6% and a decrease in earnings of ¥15.1 billion from the current ¥118.2 billion.

Uncover how IHI's forecasts yield a ¥17483 fair value, a 491% upside to its current price.

Exploring Other Perspectives

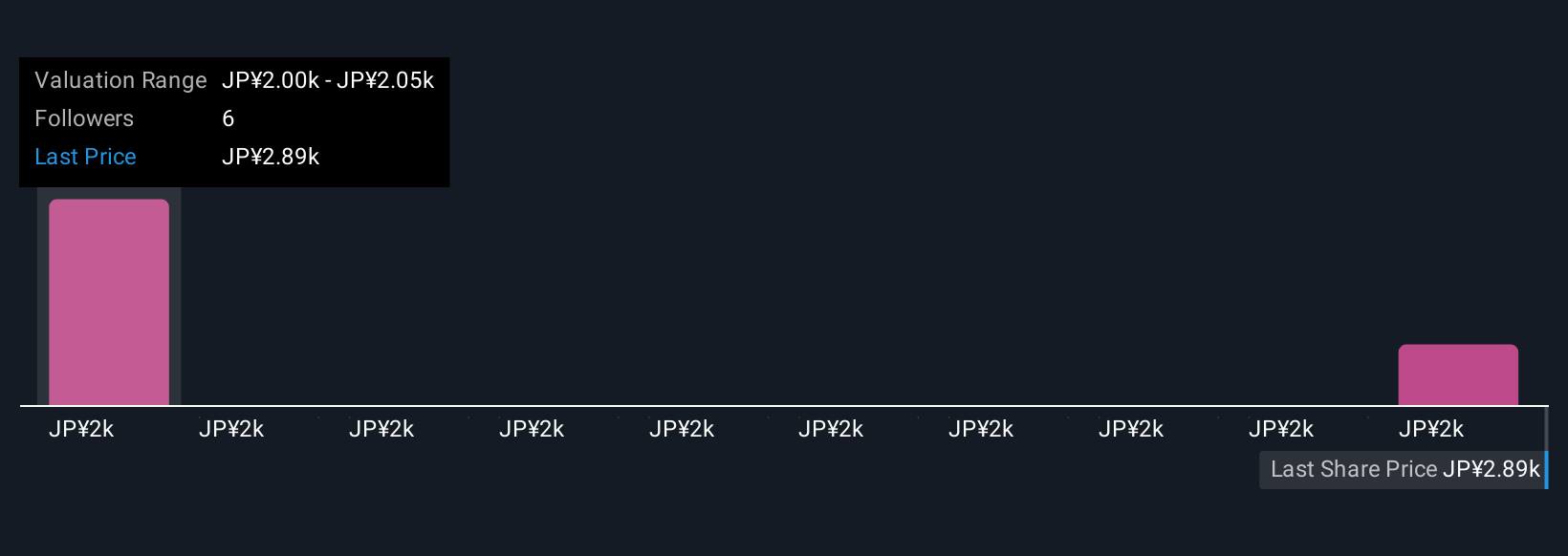

Simply Wall St Community members have shared two fair value estimates for IHI, ranging widely from ¥2,015 to ¥17,483. These diverse views highlight how future SG&A expense trends and cash collection could have wide-reaching effects for the company's financial stability and performance.

Explore 2 other fair value estimates on IHI - why the stock might be worth 32% less than the current price!

Build Your Own IHI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IHI research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IHI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IHI's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7013

IHI

Designs and builds engineering solutions in Japan and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives