- Japan

- /

- Electrical

- /

- TSE:6882

Why Investors Shouldn't Be Surprised By Sansha Electric Manufacturing Co.,Ltd.'s (TSE:6882) 27% Share Price Plunge

The Sansha Electric Manufacturing Co.,Ltd. (TSE:6882) share price has fared very poorly over the last month, falling by a substantial 27%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

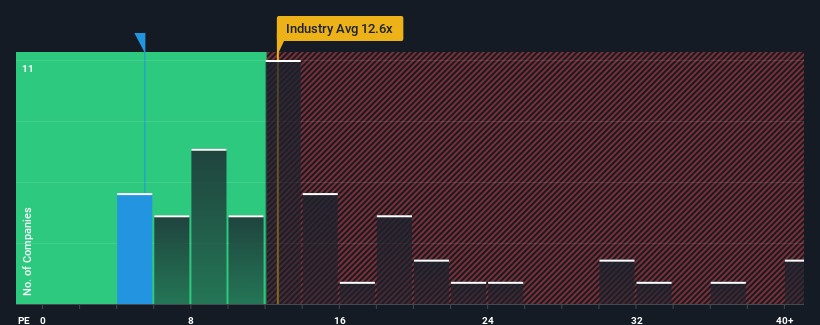

In spite of the heavy fall in price, Sansha Electric ManufacturingLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.5x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 23x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Sansha Electric ManufacturingLtd as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Sansha Electric ManufacturingLtd

Is There Any Growth For Sansha Electric ManufacturingLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Sansha Electric ManufacturingLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 133%. Pleasingly, EPS has also lifted 528% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 19% over the next year. With the market predicted to deliver 11% growth , that's a disappointing outcome.

In light of this, it's understandable that Sansha Electric ManufacturingLtd's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Sansha Electric ManufacturingLtd's P/E?

Shares in Sansha Electric ManufacturingLtd have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Sansha Electric ManufacturingLtd's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Sansha Electric ManufacturingLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6882

Sansha Electric ManufacturingLtd

Manufactures and sells semiconductor devices and power supply equipment in Japan and internationally.

Excellent balance sheet established dividend payer.