- Japan

- /

- Electrical

- /

- TSE:6594

3 High-Growth Stocks With Insider Ownership Up To 39%

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes nearing record highs and positive economic indicators like low jobless claims boosting sentiment, investors are increasingly focusing on stocks that combine growth potential with strong insider ownership. In such a climate, companies where insiders hold significant stakes can be particularly appealing as they suggest confidence in the business's future prospects and align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here we highlight a subset of our preferred stocks from the screener.

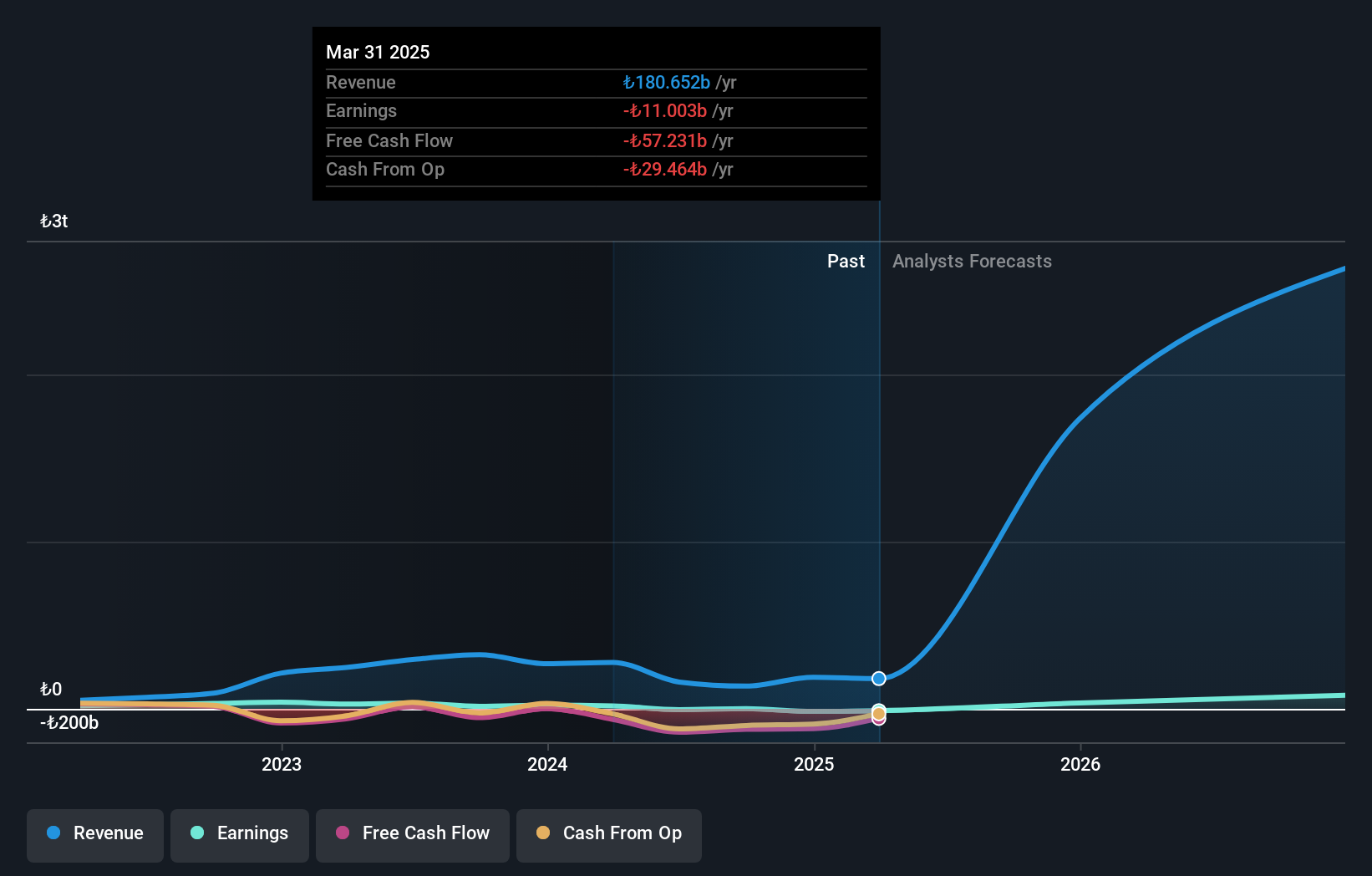

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Haci Ömer Sabanci Holding A.S. is a multinational conglomerate engaged in finance, manufacturing, and trading sectors with a market cap of TRY192.60 billion.

Operations: The company's revenue segments include Energy (TRY156.09 billion), Banking (TRY465.63 billion), Digital (TRY52.14 billion), and Financial Services (TRY42.20 billion).

Insider Ownership: 20.7%

Haci Ömer Sabanci Holding is poised for significant growth, with earnings forecasted to increase substantially by 114.3% annually, outpacing the Turkish market's 38.3%. Despite a challenging year with net losses and reduced profit margins, its revenue growth rate of 82.5% per year remains robust compared to the market's 25.9%. The company is exploring an IPO for its joint venture Enerjisa Uretim Santralleri AS, potentially enhancing its financial flexibility and future prospects.

- Unlock comprehensive insights into our analysis of Haci Ömer Sabanci Holding stock in this growth report.

- Our valuation report unveils the possibility Haci Ömer Sabanci Holding's shares may be trading at a premium.

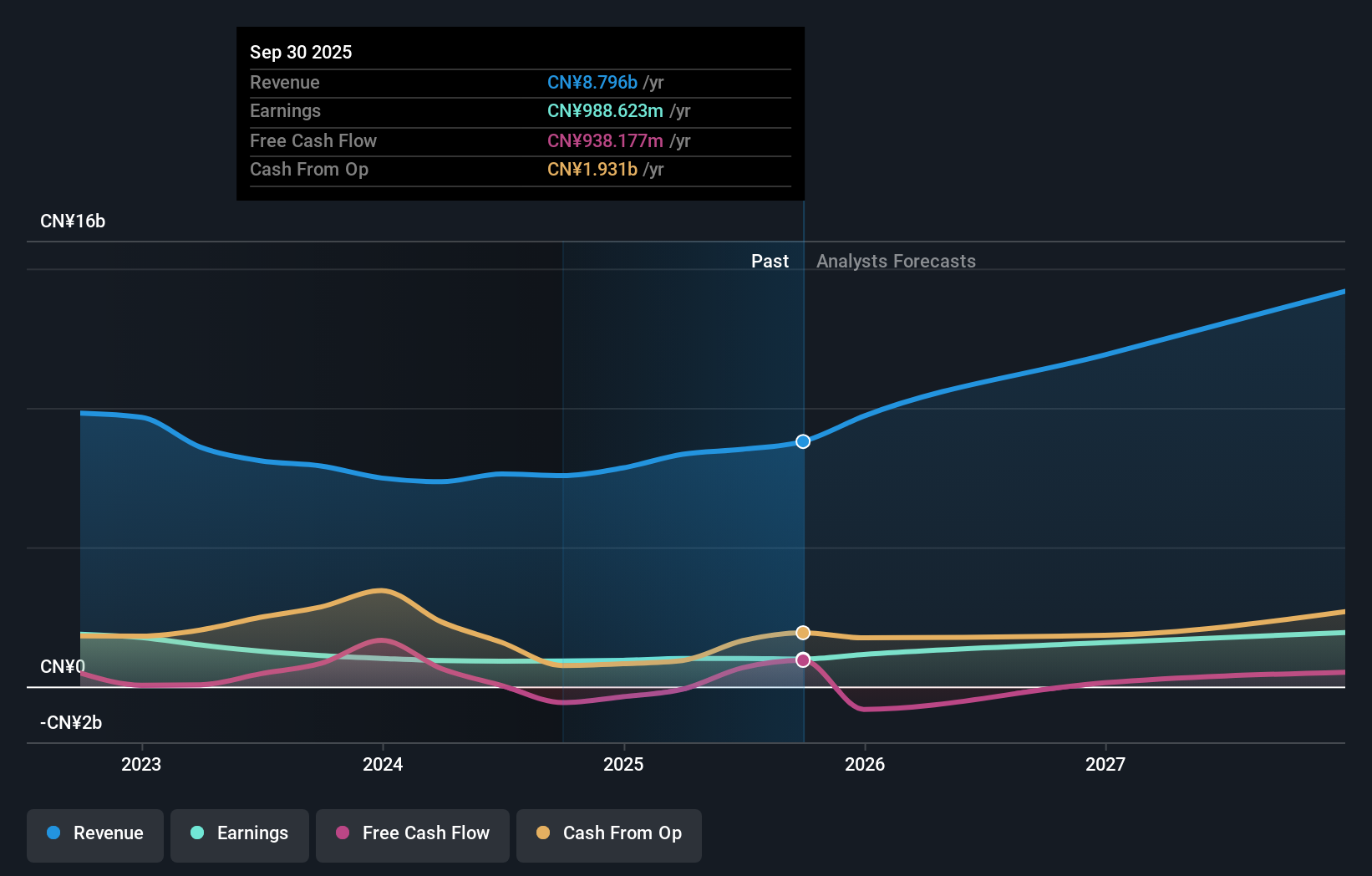

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Capchem Technology Co., Ltd. is engaged in the research, development, production, sale, and servicing of electronic chemicals and functional materials in China with a market cap of approximately CN¥33.16 billion.

Operations: The company generates revenue from its core activities in electronic chemicals and functional materials within China.

Insider Ownership: 39.4%

Shenzhen Capchem Technology exhibits potential for growth, with earnings expected to increase by 29% annually, surpassing the Chinese market's 26.2%. Revenue is also projected to grow at a robust 22.9% per year. However, recent financials show a decline in net income to CNY 701.47 million from CNY 797.16 million year-over-year. The company completed a share buyback worth CNY 60.42 million, indicating confidence despite lower earnings and modest insider ownership changes recently noted.

- Click to explore a detailed breakdown of our findings in Shenzhen Capchem Technology's earnings growth report.

- Upon reviewing our latest valuation report, Shenzhen Capchem Technology's share price might be too optimistic.

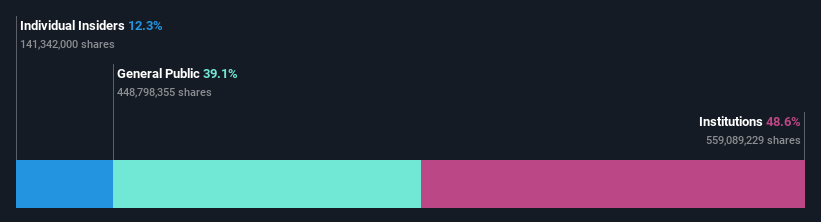

Nidec (TSE:6594)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nidec Corporation, along with its subsidiaries, is engaged in the development, manufacturing, and sale of motors, electronics and optical components, and related products both in Japan and internationally, with a market cap of ¥3.28 trillion.

Operations: Nidec's revenue is primarily derived from its motors segment, generating ¥1.54 trillion, followed by electronics and optical components at ¥0.78 trillion, with related products contributing ¥0.43 trillion.

Insider Ownership: 12.3%

Nidec's growth prospects are underscored by its earnings forecast to grow significantly at 22.7% annually, outpacing the Japanese market. Recent collaboration with Renesas Electronics on an innovative E-Axle system for EVs highlights strategic advancements in automotive technology, potentially enhancing future revenue streams. Despite no significant insider trading activity recently, Nidec trades below its estimated fair value, suggesting potential undervaluation. However, a forecasted low return on equity of 12.2% warrants cautious optimism about long-term profitability.

- Dive into the specifics of Nidec here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Nidec is trading beyond its estimated value.

Where To Now?

- Delve into our full catalog of 1527 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Nidec, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.