- Japan

- /

- Electrical

- /

- TSE:6504

Will Record Q1 Results and Upgraded Outlook Reshape Fuji Electric's (TSE:6504) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Fuji Electric reported record first-quarter sales and operating profit for fiscal 2025, with growth led by its Energy and Industry segments and improved cost efficiencies despite ongoing foreign exchange and cost headwinds.

- The company lifted its forecasts for both the first half and full fiscal year, signaling management's confidence in capturing long-term demand for electrification and grid modernization.

- We’ll explore how Fuji Electric’s upward revisions and strong segment performance influence the company’s investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Fuji Electric Investment Narrative Recap

To be a shareholder in Fuji Electric, you need to believe that the company can capture rising demand for electrification and grid modernization, both domestically and worldwide, even as it navigates cost and currency headwinds. While the latest results reinforce management's optimism and provide near-term reassurance, the most important short-term catalyst remains sustained growth in Energy and Industry segments, whereas the vulnerability of semiconductor margins and persistent overreliance on Japan's market stand out as key risks; the current news does not appear to materially shift these factors.

Of the recent announcements, Fuji Electric's upward revision of consolidated earnings guidance for fiscal 2025, released on July 31, is most relevant to this news. This guidance, which now forecasts JPY 1,155,000 million in net sales and JPY 124,000 million in operating profit for the coming year, aligns with the company’s strong first-quarter results and supports the narrative of long-term demand underpinning management’s confidence in earnings momentum.

However, in contrast to this upbeat outlook, investors should also be aware of ongoing pressures in the semiconductor segment and the implications for future earnings stability if...

Read the full narrative on Fuji Electric (it's free!)

Fuji Electric's outlook projects ¥1,278.5 billion in revenue and ¥105.6 billion in earnings by 2028. This scenario assumes a 4.1% annual revenue growth rate and an increase in earnings of ¥13.9 billion from the current ¥91.7 billion.

Uncover how Fuji Electric's forecasts yield a ¥10245 fair value, a 3% downside to its current price.

Exploring Other Perspectives

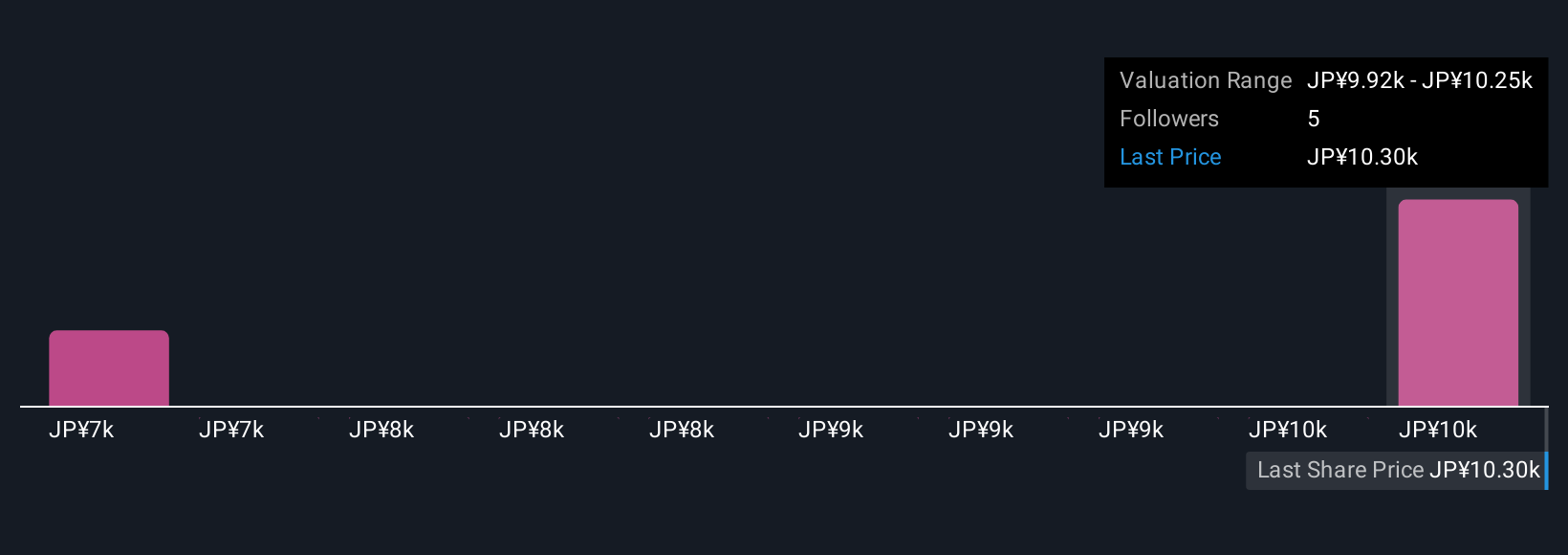

Fair value estimates from the Simply Wall St Community range widely, from ¥7,000 to ¥10,245, across three independent analyses. While optimism about infrastructure demand is reflected in recent guidance upgrades, these varied opinions show just how differently you might assess Fuji Electric’s growth and risk profile.

Explore 3 other fair value estimates on Fuji Electric - why the stock might be worth 34% less than the current price!

Build Your Own Fuji Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fuji Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fuji Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fuji Electric's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives