As global markets react to easing inflation and strong earnings reports, major indices like the S&P 500 and Dow Jones have seen significant gains, while value stocks continue to outperform growth shares. In this environment of cautious optimism, dividend stocks with attractive yields can provide investors with a steady income stream amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Evli Oyj (HLSE:EVLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evli Oyj, with a market cap of €482.03 million, operates as an asset manager serving institutional, corporate, and private clients in Finland, Sweden, and internationally through its subsidiaries.

Operations: Evli Oyj generates its revenue from three main segments: Group Operations (€9.20 million), Advisory and Corporate Clients (€12.80 million), and Wealth Management and Investor Clients (€91.10 million).

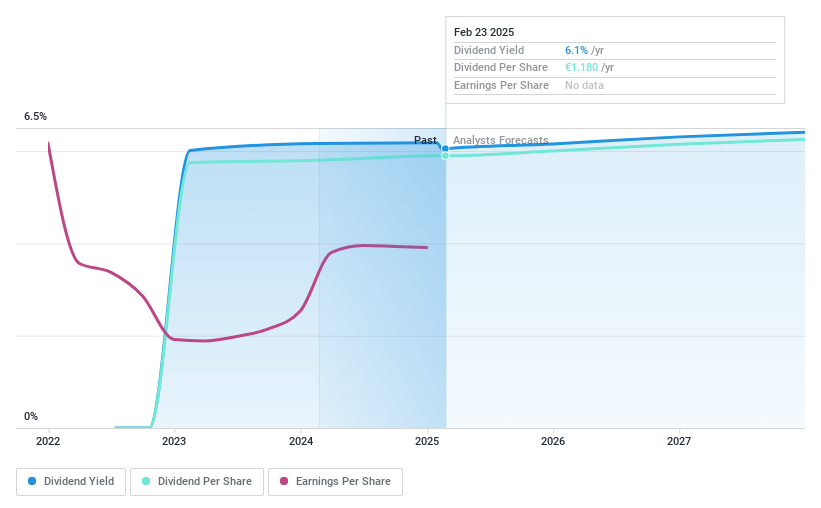

Dividend Yield: 6.4%

Evli Oyj offers a compelling dividend proposition with its dividends covered by earnings (payout ratio: 68.5%) and cash flows (cash payout ratio: 85.8%). Despite only two years of dividend payments, the yield is among the top 25% in Finland at 6.37%. Recent earnings show mixed results; third-quarter revenue slightly declined to €26.8 million, but nine-month figures improved significantly to €103.4 million, supporting potential future payouts amidst forecasted earnings decline.

- Click here and access our complete dividend analysis report to understand the dynamics of Evli Oyj.

- Our valuation report unveils the possibility Evli Oyj's shares may be trading at a discount.

NTN (TSE:6472)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NTN Corporation, along with its subsidiaries, manufactures and sells bearings, drive shafts, precision equipment, and other products both in Japan and internationally, with a market cap of ¥131.67 billion.

Operations: NTN Corporation's revenue is primarily derived from the manufacture and sale of bearings, drive shafts, and precision equipment in both domestic and international markets.

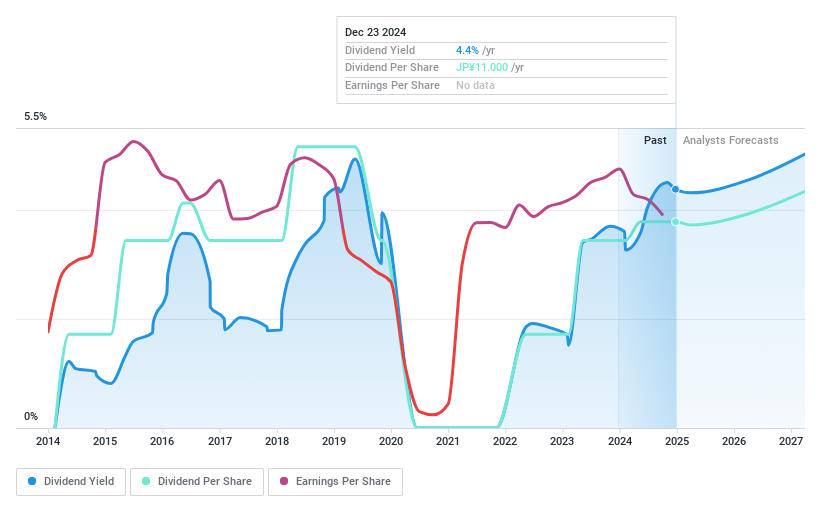

Dividend Yield: 4.4%

NTN's dividend yield of 4.42% ranks in the top 25% of Japan's market, but its high payout ratio (190.5%) indicates dividends are not well covered by earnings, raising sustainability concerns. Although dividends have grown over the past decade, they have been volatile with significant annual drops. Despite a low cash payout ratio (38.1%), profit margins have declined to 0.5%, and debt remains inadequately covered by operating cash flow, challenging financial stability for consistent dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of NTN.

- According our valuation report, there's an indication that NTN's share price might be on the cheaper side.

Aerospace Industrial Development (TWSE:2634)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aerospace Industrial Development Corporation is involved in the development, manufacturing, integration, assembly, and testing of aircraft systems and parts both in Taiwan and internationally, with a market cap of NT$42.62 billion.

Operations: Aerospace Industrial Development Corporation generates revenue from its Aerospace & Defense segment, amounting to NT$37.66 billion.

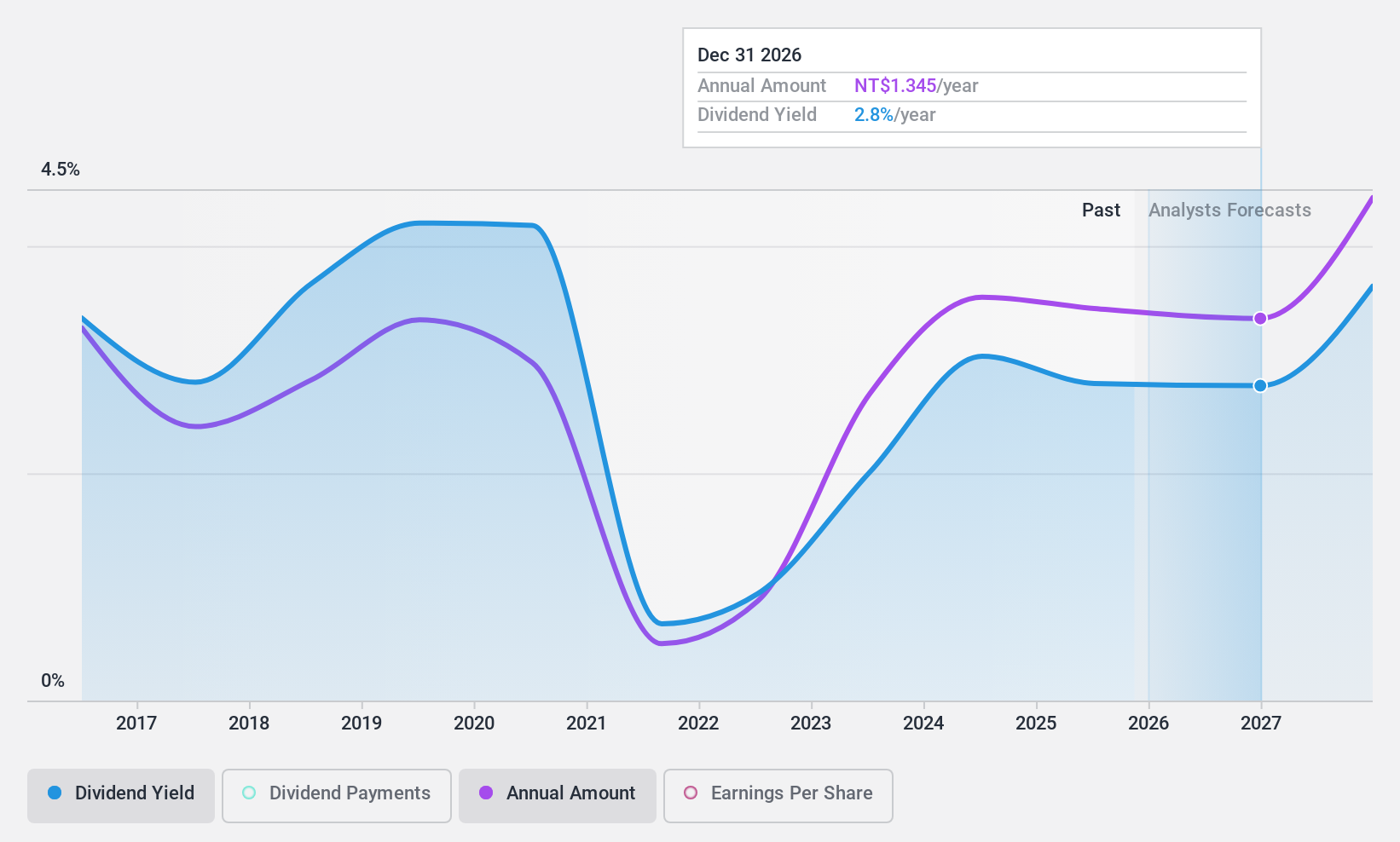

Dividend Yield: 3.1%

Aerospace Industrial Development's dividend yield of 3.14% is below Taiwan's top 25% payers, and its dividends have been volatile over the past decade despite some growth. The payout ratio of 70.8% suggests dividends are covered by earnings, and a low cash payout ratio (42%) indicates coverage by cash flows. However, recent earnings show decreased sales and net income, highlighting potential challenges in maintaining consistent dividend payments amidst high debt levels.

- Take a closer look at Aerospace Industrial Development's potential here in our dividend report.

- Our expertly prepared valuation report Aerospace Industrial Development implies its share price may be too high.

Make It Happen

- Get an in-depth perspective on all 1983 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6472

NTN

Engages in the manufacture and sale of bearings, drive shafts, and precision equipment and other products in Japan and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives