Hoden Seimitsu Kako Kenkyusho's (TSE:6469) Shareholders Should Assess Earnings With Caution

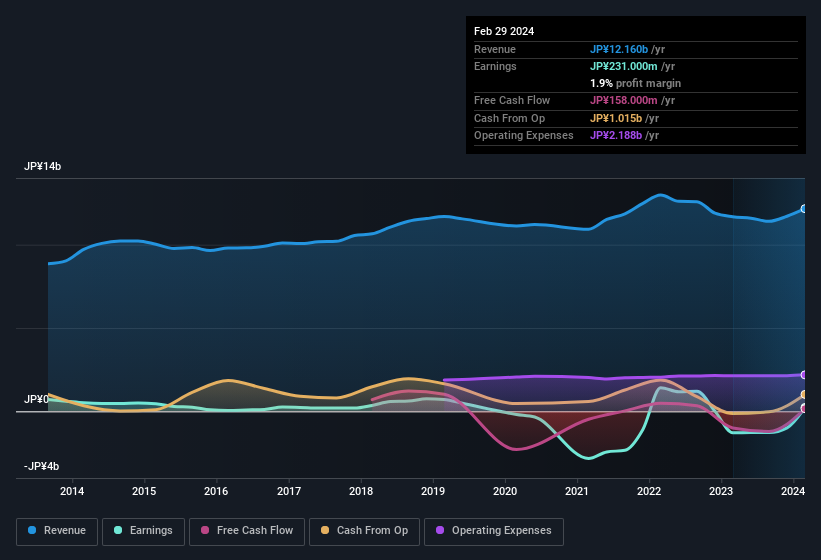

Even though Hoden Seimitsu Kako Kenkyusho Co., Ltd. (TSE:6469) posted strong earnings recently, the stock hasn't reacted in a large way. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

View our latest analysis for Hoden Seimitsu Kako Kenkyusho

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Hoden Seimitsu Kako Kenkyusho increased the number of shares on issue by 50% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Hoden Seimitsu Kako Kenkyusho's historical EPS growth by clicking on this link.

How Is Dilution Impacting Hoden Seimitsu Kako Kenkyusho's Earnings Per Share (EPS)?

Three years ago, Hoden Seimitsu Kako Kenkyusho lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

If Hoden Seimitsu Kako Kenkyusho's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hoden Seimitsu Kako Kenkyusho.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Hoden Seimitsu Kako Kenkyusho's net profit by JP¥40m over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If Hoden Seimitsu Kako Kenkyusho doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Hoden Seimitsu Kako Kenkyusho's Profit Performance

In its last report Hoden Seimitsu Kako Kenkyusho benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Hoden Seimitsu Kako Kenkyusho's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 4 warning signs we've spotted with Hoden Seimitsu Kako Kenkyusho (including 2 which are a bit concerning).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

If you're looking to trade Hoden Seimitsu Kako Kenkyusho, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hoden Seimitsu Kako Kenkyusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6469

Hoden Seimitsu Kako Kenkyusho

Manufactures and sells electric discharge machining, industrial gas turbine parts, and other metal products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives