Tsubaki Nakashima Co., Ltd.'s (TSE:6464) 28% Share Price Plunge Could Signal Some Risk

The Tsubaki Nakashima Co., Ltd. (TSE:6464) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

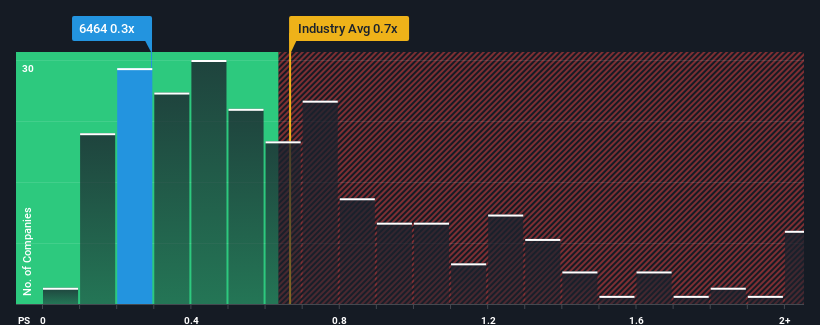

Although its price has dipped substantially, there still wouldn't be many who think Tsubaki Nakashima's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Japan's Machinery industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Tsubaki Nakashima

What Does Tsubaki Nakashima's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Tsubaki Nakashima has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Tsubaki Nakashima's future stacks up against the industry? In that case, our free report is a great place to start.How Is Tsubaki Nakashima's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Tsubaki Nakashima's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 47% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 1.0% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.5%, which is noticeably more attractive.

With this in mind, we find it intriguing that Tsubaki Nakashima's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Tsubaki Nakashima's P/S?

Following Tsubaki Nakashima's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Tsubaki Nakashima's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tsubaki Nakashima that you should be aware of.

If these risks are making you reconsider your opinion on Tsubaki Nakashima, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tsubaki Nakashima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6464

Tsubaki Nakashima

Manufactures and sells industrial precision balls, rollers, blowers, and medical equipment and hygiene equipment in Japan and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives