- Taiwan

- /

- Construction

- /

- TWSE:2404

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 reaching record highs and small-cap stocks rallying, investors are keenly observing how anticipated policy changes might influence economic growth and inflation. In this dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate these shifting market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 4.95% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

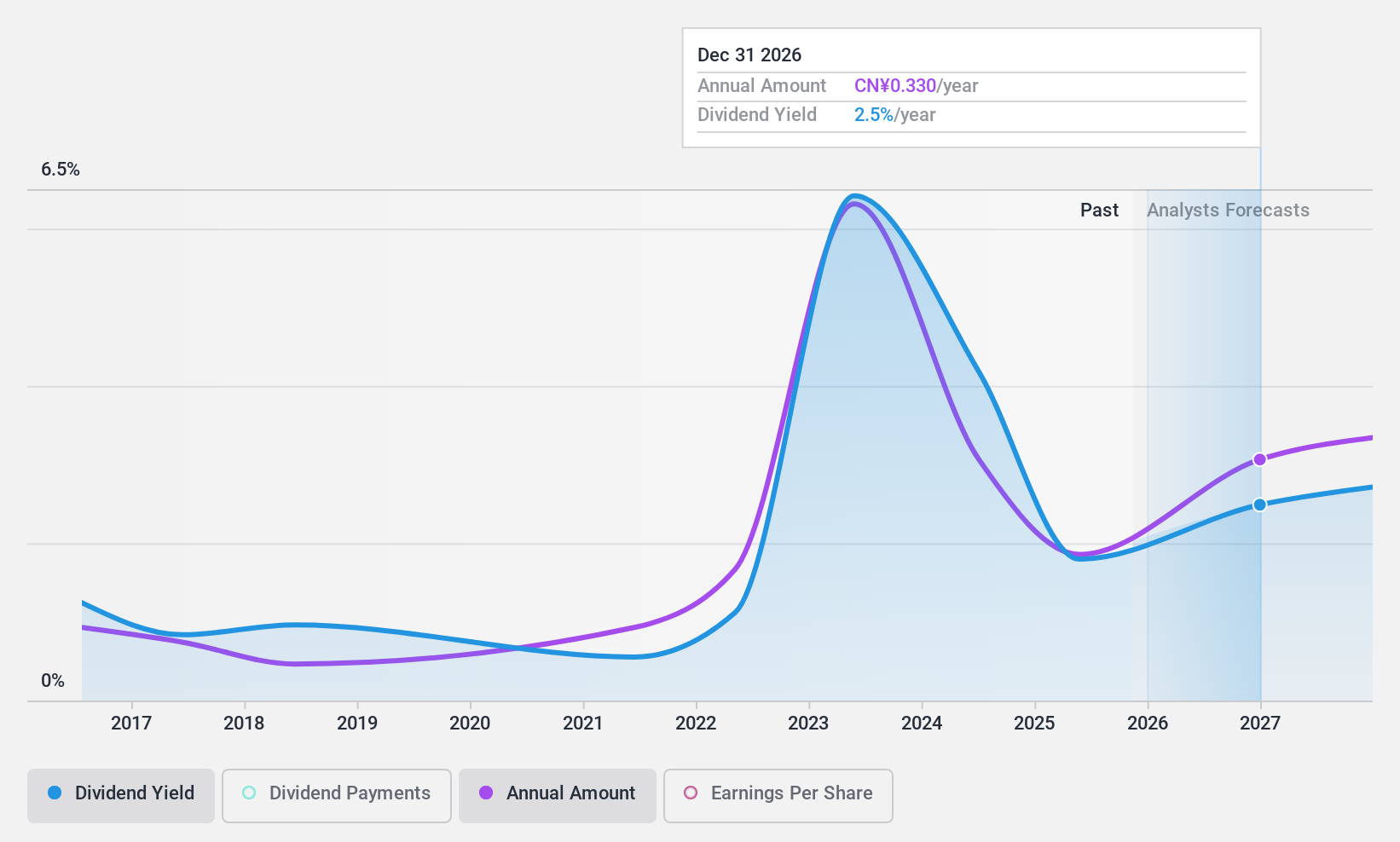

Keda Industrial Group (SHSE:600499)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Keda Industrial Group Co., Ltd. manufactures and sells building material machinery both in China and internationally, with a market cap of CN¥16.35 billion.

Operations: Keda Industrial Group Co., Ltd. generates its revenue from the sale of building material machinery across domestic and international markets.

Dividend Yield: 3.7%

Keda Industrial Group's dividend yield of 3.72% ranks in the top 25% of CN market payers, but it's not well covered by free cash flows and has been unreliable over the past decade. Despite earnings being sufficient to cover dividends, profit margins have decreased significantly from last year. Recent earnings show a decline in net income despite increased sales. The company initiated a share buyback program, potentially enhancing shareholder value through equity incentives and stock ownership plans.

- Delve into the full analysis dividend report here for a deeper understanding of Keda Industrial Group.

- In light of our recent valuation report, it seems possible that Keda Industrial Group is trading behind its estimated value.

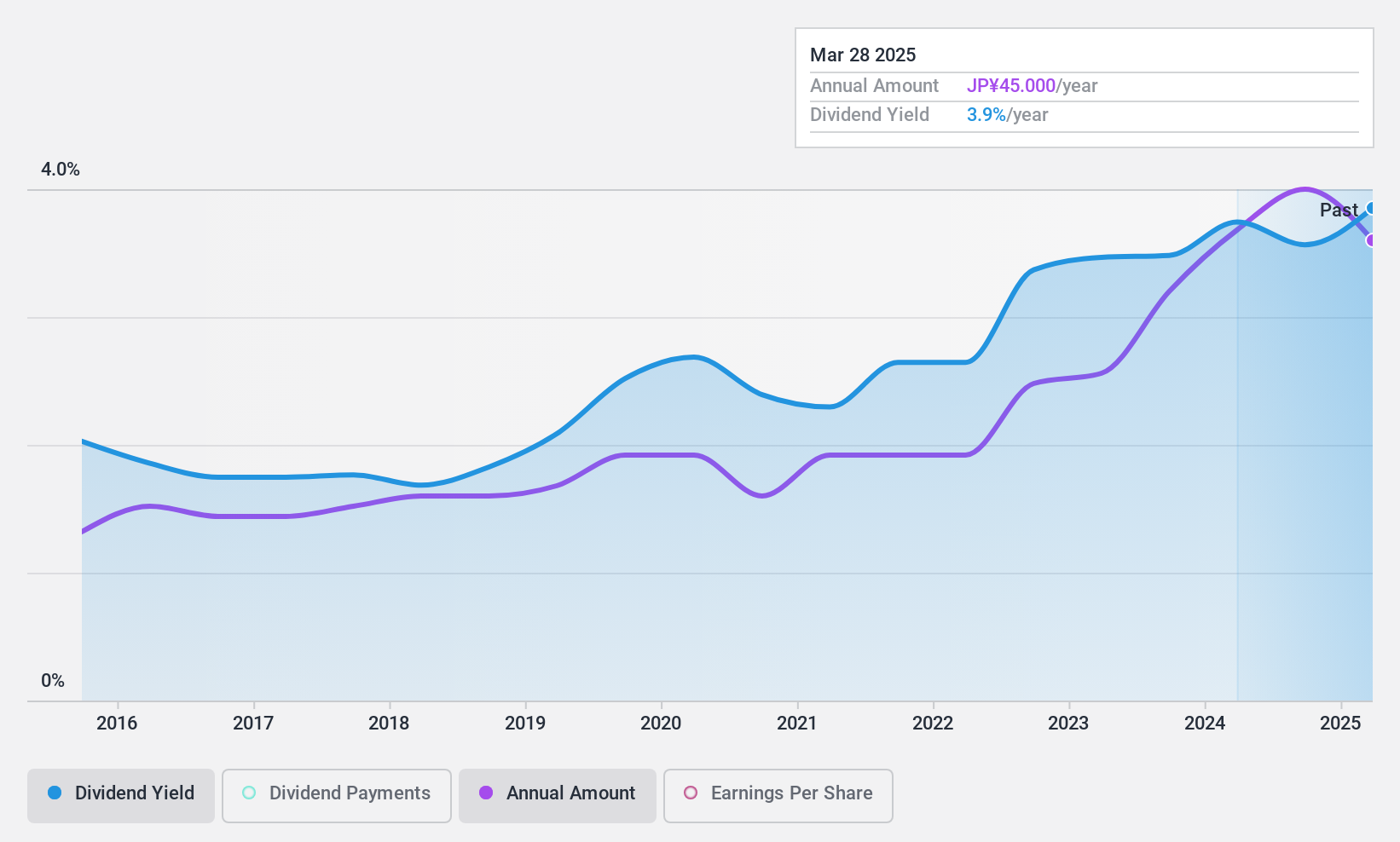

ANEST IWATA (TSE:6381)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANEST IWATA Corporation engages in the air energy and coating business across Japan, Europe, the Americas, China, and other international markets with a market cap of ¥58.02 billion.

Operations: ANEST IWATA Corporation generates revenue through its operations in the air energy and coating sectors across various global markets, including Japan, Europe, the Americas, and China.

Dividend Yield: 3.3%

ANEST IWATA's dividend payments are well covered by both earnings and cash flows, with payout ratios around 43%. However, dividends have been volatile over the past decade, lacking reliability and stability. The company's current dividend yield of 3.35% is below the top quartile in Japan. Recent share buyback initiatives aim to enhance shareholder returns and capital efficiency, with a program repurchasing up to 1.01% of issued share capital for ¥400 million by February 2025.

- Click to explore a detailed breakdown of our findings in ANEST IWATA's dividend report.

- Our comprehensive valuation report raises the possibility that ANEST IWATA is priced lower than what may be justified by its financials.

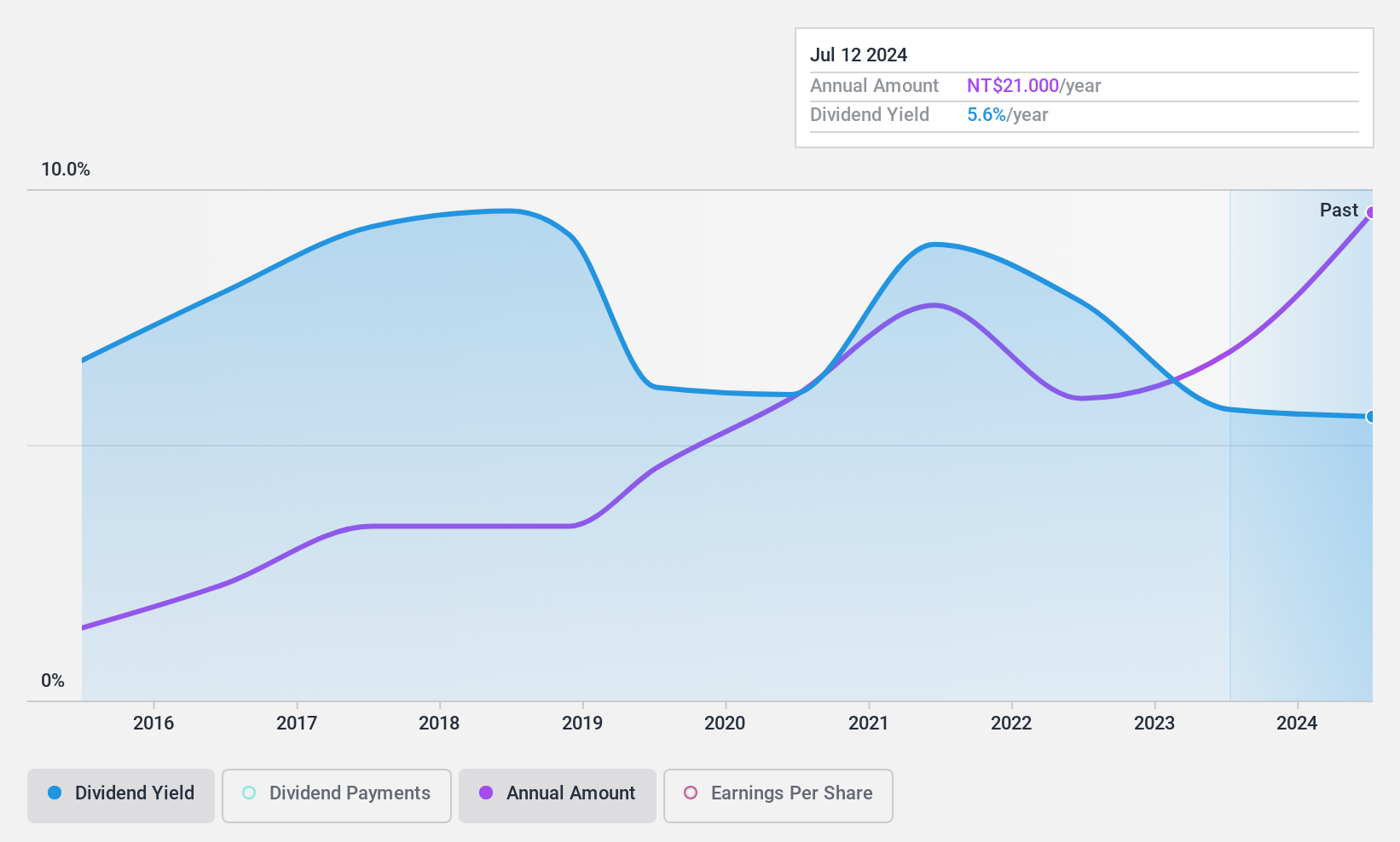

United Integrated Services (TWSE:2404)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Integrated Services Co., Ltd. offers engineering construction services across Taiwan, Mainland China, Singapore, the United States, and Japan, with a market cap of NT$64.72 billion.

Operations: United Integrated Services Co., Ltd. generates revenue primarily through its Engineering and Integration segment, which accounts for NT$59.72 billion, alongside Maintenance and Design services contributing NT$69.60 million.

Dividend Yield: 5.6%

United Integrated Services offers a dividend yield of 5.56%, ranking it in the top 25% of Taiwan's market. The dividends are covered by earnings and cash flows, with payout ratios at 82.8% and 70.4%, respectively, suggesting sustainability despite an unstable track record over the past decade. Although trading at approximately 8.5% below fair value, its dividend history has been volatile, showing both growth and unreliability in payments over ten years.

- Click here and access our complete dividend analysis report to understand the dynamics of United Integrated Services.

- The valuation report we've compiled suggests that United Integrated Services' current price could be quite moderate.

Where To Now?

- Get an in-depth perspective on all 1941 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2404

United Integrated Services

Provides engineering construction services in Taiwan, Mainland China, Singapore, the United states, and Japan.

Solid track record with excellent balance sheet and pays a dividend.