Organo Corporation's (TSE:6368) 28% Share Price Surge Not Quite Adding Up

The Organo Corporation (TSE:6368) share price has done very well over the last month, posting an excellent gain of 28%. The last month tops off a massive increase of 134% in the last year.

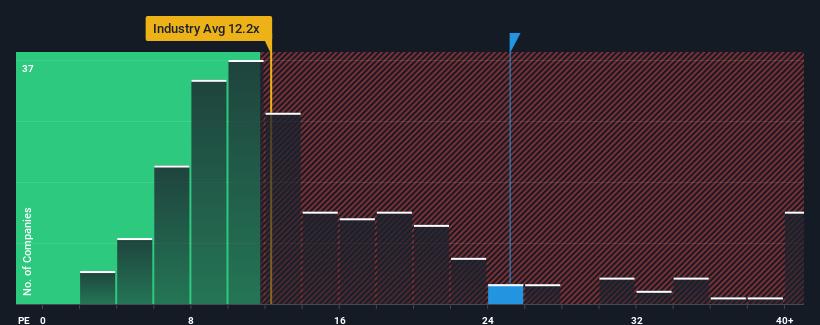

Following the firm bounce in price, Organo may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 25.2x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Organo has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Organo

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Organo's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 26% last year. Pleasingly, EPS has also lifted 157% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% during the coming year according to the three analysts following the company. That's shaping up to be similar to the 11% growth forecast for the broader market.

In light of this, it's curious that Organo's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Organo's P/E?

The strong share price surge has got Organo's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Organo's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Organo that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6368

Organo

Operates as a water treatment engineering company in Japan, Taiwan, China, Southeast Asia, and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives