As global markets react to the recent U.S. election results, small-cap stocks have captured significant investor attention, with the Russell 2000 Index leading gains despite not reaching record highs. Amidst this backdrop of economic optimism and policy shifts, identifying promising small-cap stocks requires a keen understanding of growth potential and resilience in fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Kappa Create | 83.86% | 0.22% | 14.37% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.53% | 16.85% | 21.57% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Hennge K.K (TSE:4475)

Simply Wall St Value Rating: ★★★★★★

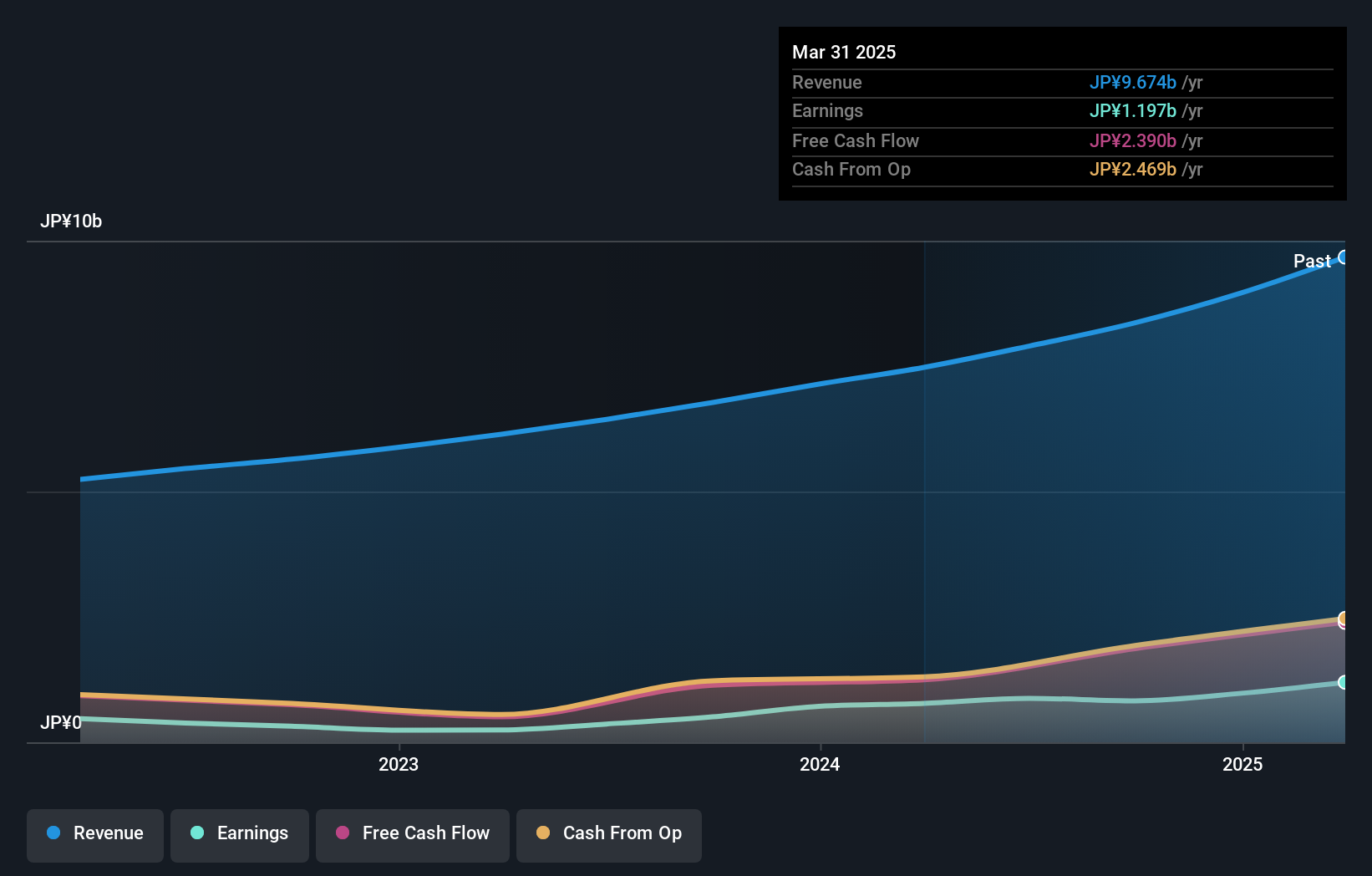

Overview: Hennge K.K. offers cloud security services globally and has a market capitalization of ¥39.72 billion.

Operations: The company generates revenue primarily through its cloud security services. Its net profit margin stands at 9.50%, reflecting the efficiency of its operations in converting revenue into profit.

Hennge K.K. showcases robust financial health, with earnings surging 62.8% over the past year, outpacing the IT industry's 10.9% growth rate. This debt-free company has managed to keep its finances clean for five years, ensuring no concerns over interest payments and highlighting its high-quality earnings profile. Despite a highly volatile share price recently, Hennge remains profitable with free cash flow standing strong at ¥1.25 billion as of March 2024 and levered free cash flow reaching ¥1.14 billion by September 2023. The recent announcement of fiscal year results on November 8th adds anticipation around its performance trajectory.

- Dive into the specifics of Hennge K.K here with our thorough health report.

Review our historical performance report to gain insights into Hennge K.K's's past performance.

Shibuya (TSE:6340)

Simply Wall St Value Rating: ★★★★★★

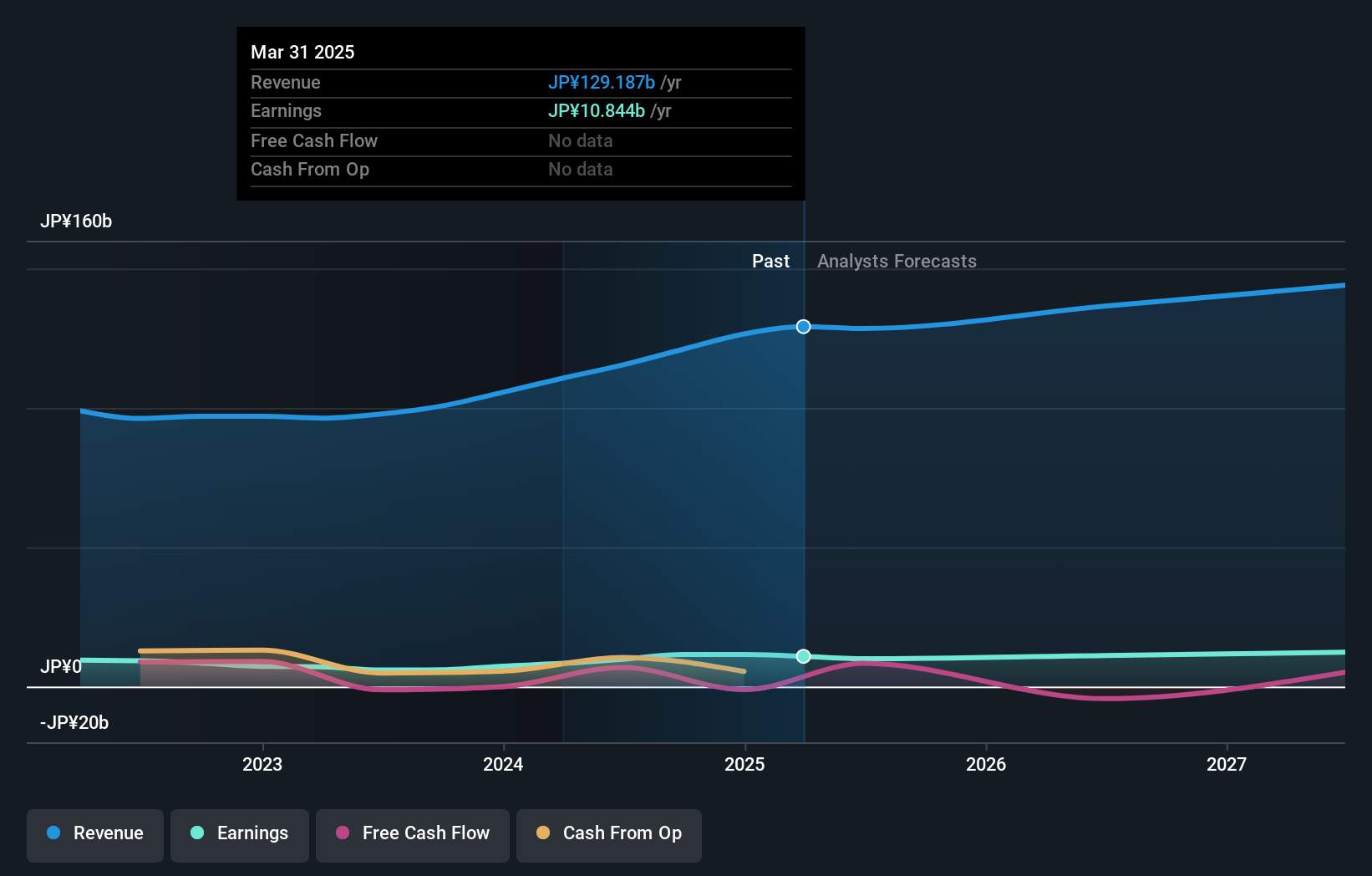

Overview: Shibuya Corporation manufactures and sells packaging and other systems both in Japan and internationally, with a market cap of ¥103.75 billion.

Operations: Shibuya Corporation generates revenue primarily through its packaging systems. The company's financial performance is marked by a notable net profit margin trend, reflecting its efficiency in managing costs relative to revenue.

Shibuya stands out with its robust earnings growth of 91.5% over the past year, significantly outpacing the Machinery industry's 1.5%. Its price-to-earnings ratio of 9.8x offers good value relative to the broader JP market's 13.5x, suggesting potential undervaluation. The company demonstrates financial health with a reduced debt-to-equity ratio from 8.2% to 4.3% over five years and more cash than total debt, indicating strong balance sheet management. High-quality past earnings and positive free cash flow further bolster its profile, while future earnings are projected to grow at an annual rate of nearly 5%.

- Click to explore a detailed breakdown of our findings in Shibuya's health report.

Gain insights into Shibuya's historical performance by reviewing our past performance report.

Starts (TSE:8850)

Simply Wall St Value Rating: ★★★★★★

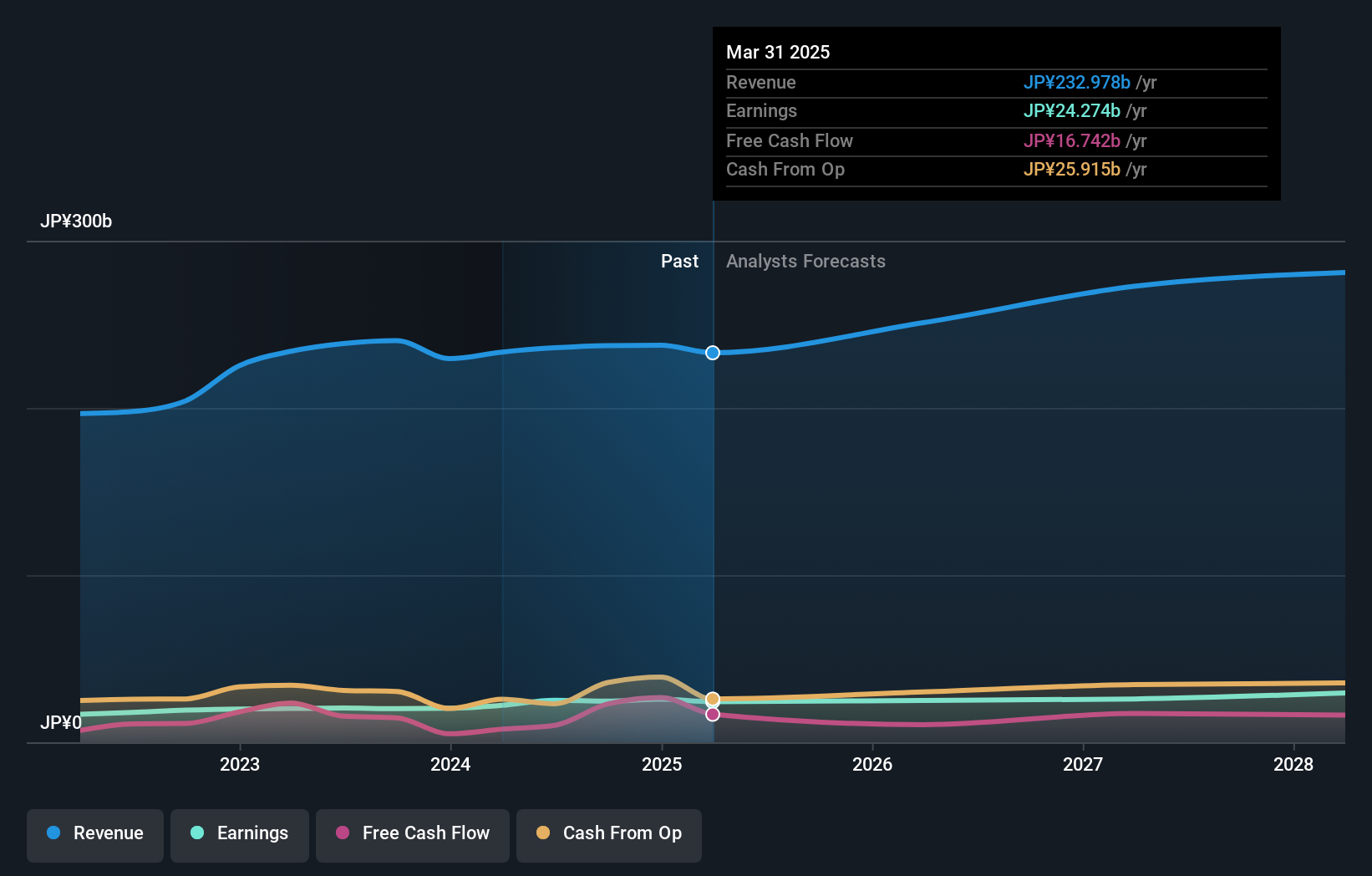

Overview: Starts Corporation Inc. operates in construction, real estate management, and tenant recruitment both in Japan and internationally, with a market cap of ¥176.58 billion.

Operations: Starts generates revenue primarily from its construction and real estate management segments. The company's net profit margin has shown a notable trend, reflecting its operational efficiency in these sectors.

Starts Corporation, a small cap entity, has shown robust financial health with earnings growing by 22% last year, outpacing the Real Estate industry's 16.7%. The company is trading at a good value compared to its peers and is priced 25.5% below its estimated fair value. Over the past five years, Starts' debt to equity ratio improved from 80.1% to 39%, indicating enhanced financial stability. Recently, Starts announced a share repurchase program worth ¥5.45 billion for up to 1.65 million shares, aiming to return profits to shareholders and potentially enhance shareholder value further.

- Click here and access our complete health analysis report to understand the dynamics of Starts.

Examine Starts' past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 4673 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hennge K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4475

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives