Harmonic Drive Systems Inc. (TSE:6324) Stocks Shoot Up 25% But Its P/S Still Looks Reasonable

Harmonic Drive Systems Inc. (TSE:6324) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 77%.

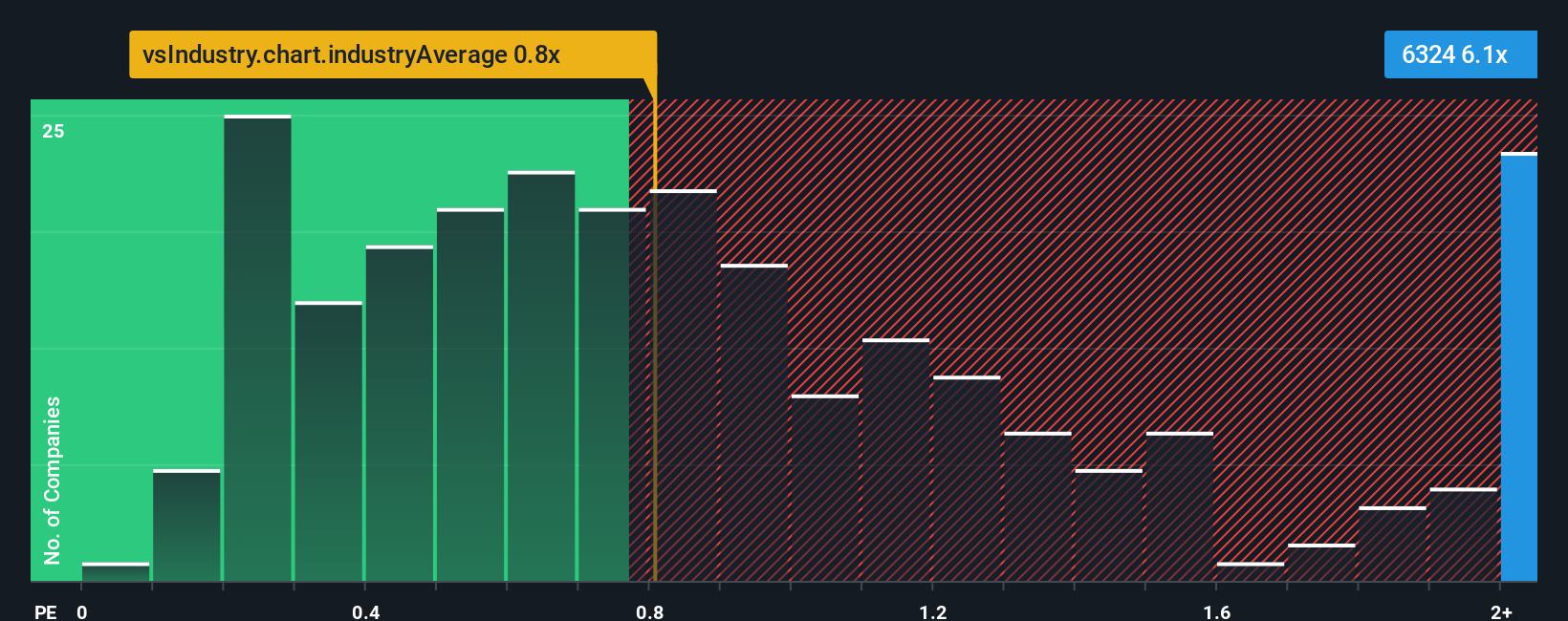

After such a large jump in price, given around half the companies in Japan's Machinery industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Harmonic Drive Systems as a stock to avoid entirely with its 6.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Harmonic Drive Systems

What Does Harmonic Drive Systems' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Harmonic Drive Systems has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Harmonic Drive Systems will help you uncover what's on the horizon.How Is Harmonic Drive Systems' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Harmonic Drive Systems' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 11% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per annum during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 5.6% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Harmonic Drive Systems' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Harmonic Drive Systems' P/S

Harmonic Drive Systems' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Harmonic Drive Systems' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Harmonic Drive Systems (1 is concerning!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Harmonic Drive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6324

Harmonic Drive Systems

Produces and sells precision control equipment and components worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026