Harmonic Drive Systems Inc. (TSE:6324) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Unfortunately for some shareholders, the Harmonic Drive Systems Inc. (TSE:6324) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

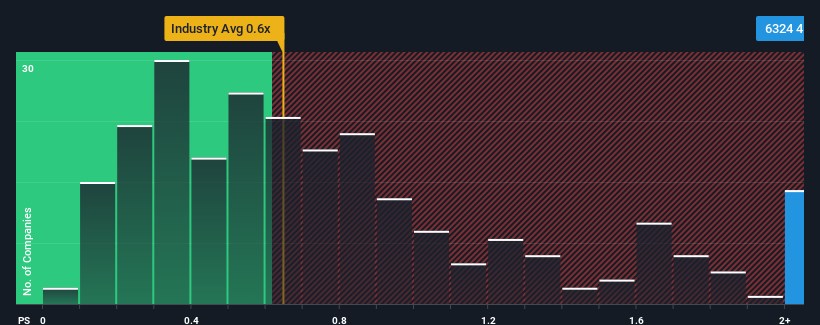

Even after such a large drop in price, you could still be forgiven for thinking Harmonic Drive Systems is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.7x, considering almost half the companies in Japan's Machinery industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Harmonic Drive Systems

How Harmonic Drive Systems Has Been Performing

While the industry has experienced revenue growth lately, Harmonic Drive Systems' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Harmonic Drive Systems.What Are Revenue Growth Metrics Telling Us About The High P/S?

Harmonic Drive Systems' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 15% per year over the next three years. With the industry only predicted to deliver 5.4% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Harmonic Drive Systems' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Harmonic Drive Systems' P/S

Even after such a strong price drop, Harmonic Drive Systems' P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Harmonic Drive Systems maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Harmonic Drive Systems with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic Drive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6324

Harmonic Drive Systems

Produces and sells precision control equipment and components worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives