Market Cool On Freund Corporation's (TSE:6312) Revenues Pushing Shares 31% Lower

Freund Corporation (TSE:6312) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 5.3% in the last year.

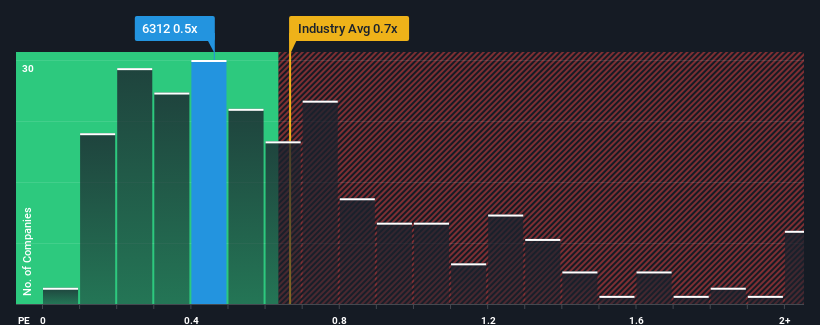

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Freund's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Japan is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Freund

What Does Freund's Recent Performance Look Like?

Recent times have been advantageous for Freund as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Freund will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Freund?

Freund's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 9.6% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.5%, which is noticeably less attractive.

With this information, we find it interesting that Freund is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following Freund's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Freund's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 3 warning signs for Freund that you should be aware of.

If you're unsure about the strength of Freund's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6312

Freund

Develops, manufactures, and sells granulation and coating equipment and plant engineering for the pharmaceutical, food, chemical, and other industries in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives