How Hitachi's AI-Powered Smart Mining Bet At Hitachi Construction Machinery (TSE:6305) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier in 2025, Hitachi Construction Machinery Co., Ltd. announced a minority investment in Rithmik Solutions as part of Rithmik’s latest financing round, aiming to combine its global equipment footprint with Rithmik’s real-time AI-powered analytics for smart mining.

- The move underlines Hitachi Construction Machinery’s push to build open digital platforms that can boost mining productivity while helping reduce environmental impact across operations.

- Next, we’ll examine how this AI-driven smart mining collaboration could shape Hitachi Construction Machinery’s broader investment narrative and growth priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Hitachi Construction Machinery's Investment Narrative?

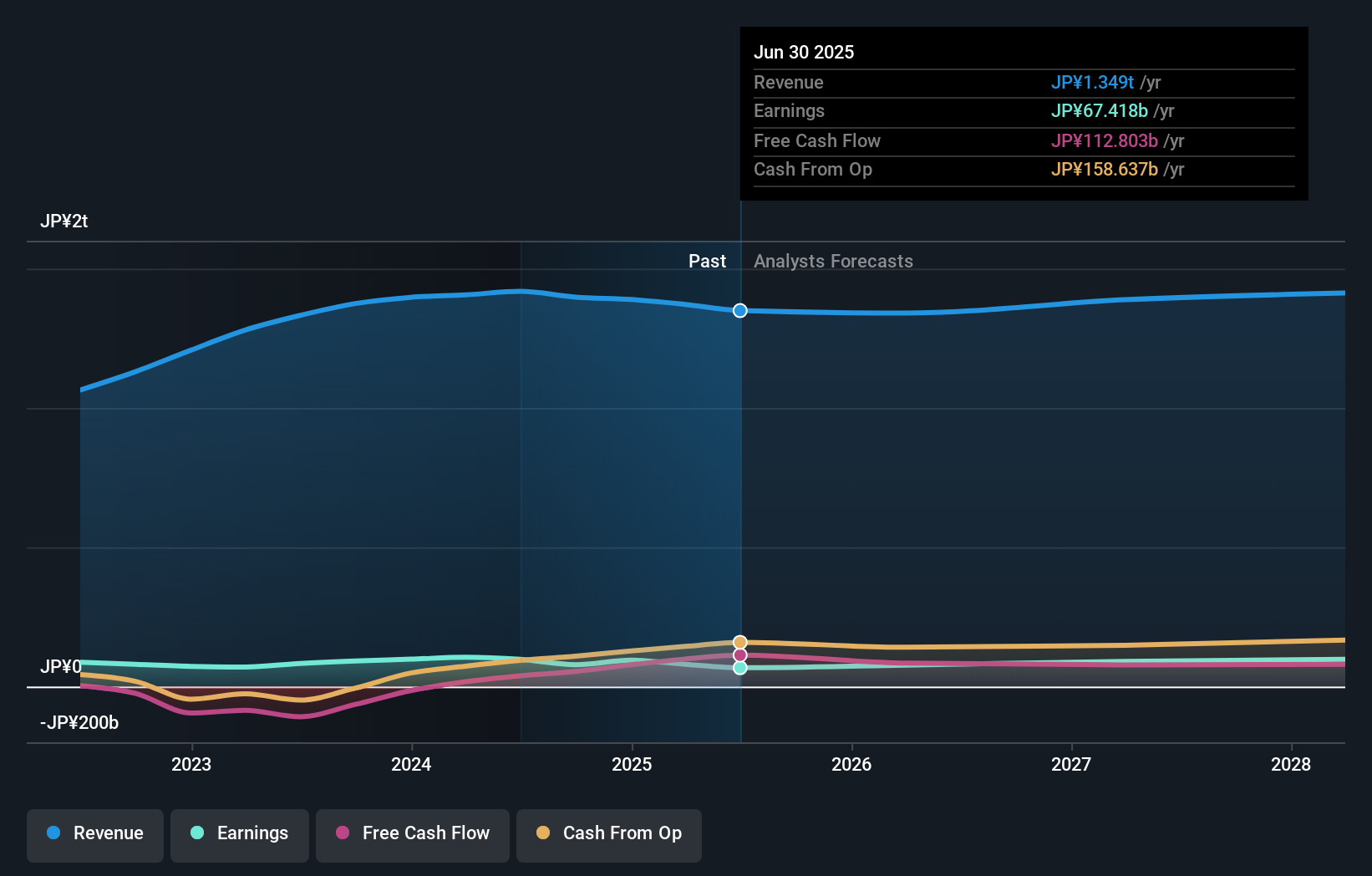

To own Hitachi Construction Machinery, you need to believe that a solid, globally exposed equipment maker can keep turning decent, if unspectacular, growth into shareholder returns while gradually improving its digital edge. Near term, the key catalysts remain how management executes against its trimmed 2026 guidance of ¥1,320,000 million in revenue and ¥74,000 million in net income, as well as how consistently it can support its dividend after recent shifts. The minority stake in Rithmik looks directionally positive for the mining and digital story, but on its own it is unlikely to move the financial needle in the short run. It does, however, reinforce management’s intent to add higher-margin, data-driven services at a time when the market is already pricing the stock at a discount to many peers.

However, one emerging risk around dividend consistency is worth a closer look for shareholders. Hitachi Construction Machinery's shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Hitachi Construction Machinery - why the stock might be worth as much as 6% more than the current price!

Build Your Own Hitachi Construction Machinery Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hitachi Construction Machinery research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hitachi Construction Machinery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hitachi Construction Machinery's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi Construction Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6305

Hitachi Construction Machinery

Manufactures and sells construction machineries in Japan, the Americas, Europe, Russia, CIS, Africa, the Middle East, Asia, Oceania, and China.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026