Did the Rio Tinto Remote Mining Deal Just Shift Hitachi Construction Machinery's (TSE:6305) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Rio Tinto subsidiary Technological Resources announced a multi-year agreement with Hitachi Construction Machinery to develop remote operation and partial autonomy technologies for ultra-large hydraulic excavators.

- This collaboration leverages Rio Tinto's mining data, aiming to accelerate operator assistance, remote control, and semi-autonomous equipment capabilities for next-generation mining operations.

- We’ll explore how Hitachi’s leadership in developing autonomous mining technology may influence its broader investment narrative and future positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Hitachi Construction Machinery's Investment Narrative?

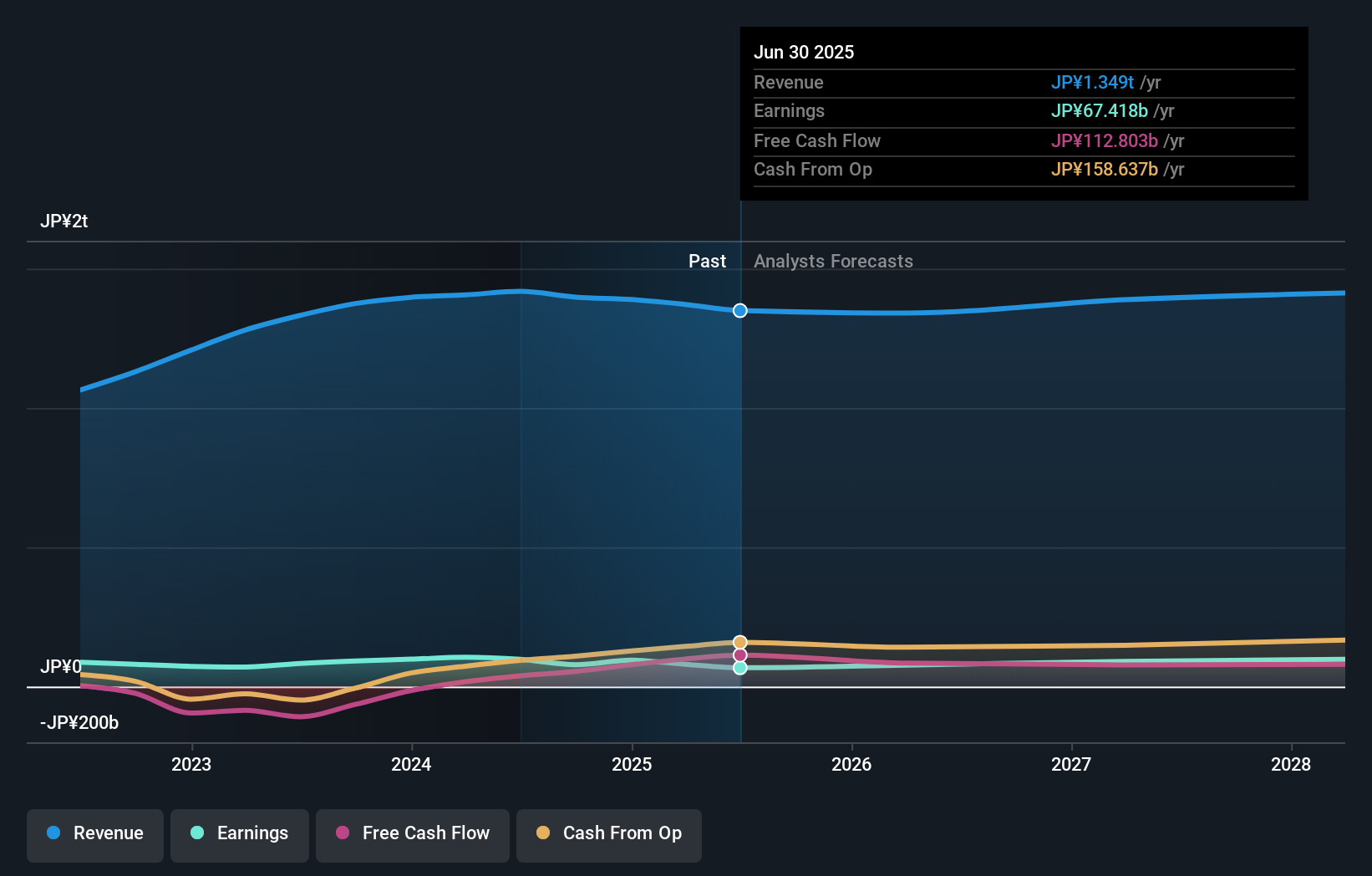

For anyone considering Hitachi Construction Machinery, the big picture hinges on confidence in the company’s push into advanced mining tech and digitalization, supported by its recent partnership with Rio Tinto’s subsidiary. This agreement, focused on remote and semi-autonomous excavators, aligns Hitachi with the industry’s automation trend and could influence investor sentiment around future growth, though the immediate financial impact may be modest given Hitachi’s scale and multi-year timeline. Prior to this news, discussion centered on dividend volatility and slower revenue growth, but leadership in mining automation now provides an extra dimension to its catalyst mix and long-term positioning. Short-term risks, such as high debt levels, recent board turnover, and a less experienced board, remain unchanged for now, as does the challenge of maintaining consistent profit margins in a competitive machinery sector.

However, growing debt and board changes are still factors investors should watch closely.

Exploring Other Perspectives

Explore 2 other fair value estimates on Hitachi Construction Machinery - why the stock might be worth 40% less than the current price!

Build Your Own Hitachi Construction Machinery Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hitachi Construction Machinery research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hitachi Construction Machinery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hitachi Construction Machinery's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi Construction Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6305

Hitachi Construction Machinery

Manufactures and sells construction machineries worldwide.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives