A Look at Nabtesco (TSE:6268) Valuation Following Completion of Share Buyback Program

Reviewed by Kshitija Bhandaru

Nabtesco (TSE:6268) just wrapped up its planned share buyback, acquiring 1,796,100 shares, or about 1.5% of outstanding stock, for ¥5.6 billion over the past two months.

See our latest analysis for Nabtesco.

Nabtesco’s share buyback appears to have given investor confidence a notable boost, with the share price climbing 39% over the past three months and delivering a one-year total shareholder return of nearly 51%. This momentum suggests the market is increasingly optimistic about Nabtesco’s growth prospects, especially in light of its recent actions to return capital to shareholders.

If this momentum in capital goods stocks has you curious about fresh opportunities, now is a great time to discover See the full list for free.

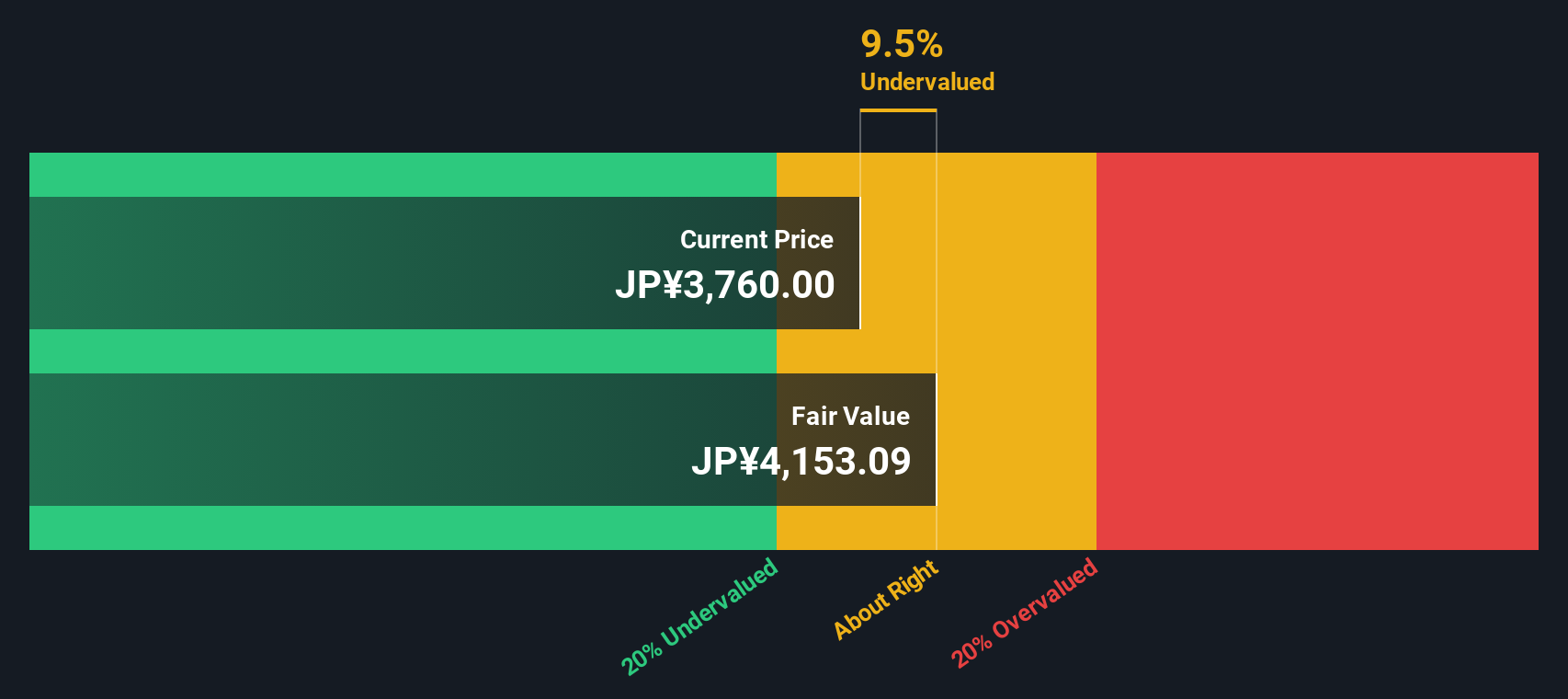

With shares soaring in recent months following the buyback, the big question remains: Is Nabtesco’s stock still undervalued, or has the surge already priced in the company’s future growth story?

Most Popular Narrative: 12% Overvalued

With Nabtesco's fair value estimate at ¥3,283 and the last closing price at ¥3,683, the narrative suggests the shares now trade notably above what consensus sees as justified. This sets the stage for a closer look at what is driving this premium.

The company's recent divestiture of its low-margin Hydraulic Equipment business allows Nabtesco to focus on higher-growth, higher-margin core segments such as precision reduction gears and motion control systems. This directly supports improvements in long-term operating profit margins and earnings quality. Nabtesco is actively reallocating capital and R&D resources toward smart motion control and advanced automation technologies. This positions the company to benefit from increasing automation and digitization trends in manufacturing and logistics, which could support sustainable future revenue growth.

Want the real story behind that lofty price tag? Bold assumptions about future profit margins and transformative automation bets set the tone for this valuation. Which numbers elevate Nabtesco above the crowd? Unlock the full narrative to see what is fueling analyst optimism and what might bring that target down to earth.

Result: Fair Value of ¥3,283 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak global trade or a downturn in demand for automation equipment could present challenges to Nabtesco’s growth story and test current market optimism.

Find out about the key risks to this Nabtesco narrative.

Another View: Discounted Cash Flow Paints a Different Picture

Looking through the lens of the SWS DCF model, Nabtesco’s shares actually appear undervalued at today’s price, trading almost 11% below our fair value estimate of ¥4,133. While market multiples suggest overvaluation, the DCF approach hints there may still be upside left. Which story will play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nabtesco Narrative

If you think there is more to the story, or want to dig into the data yourself, you can build your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Nabtesco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let game-changing opportunities pass you by. Take action with these smart investing shortcuts from Simply Wall Street’s powerful Screener:

- Identify standout potential in overlooked markets with these 3579 penny stocks with strong financials, connecting you to affordable stocks showing unusually strong financial health.

- Lock in substantial yields by using these 19 dividend stocks with yields > 3% to spot companies offering proven, high-paying dividends above 3%.

- Seize the AI revolution by finding the next big player through these 25 AI penny stocks, where cutting-edge artificial intelligence is transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nabtesco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6268

Nabtesco

Manufactures and sells equipment in the industrial, daily life, and environmental fields products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives