Here's Why Nitto Kohki (TSE:6151) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Nitto Kohki (TSE:6151). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Nitto Kohki

How Quickly Is Nitto Kohki Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Nitto Kohki has grown EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

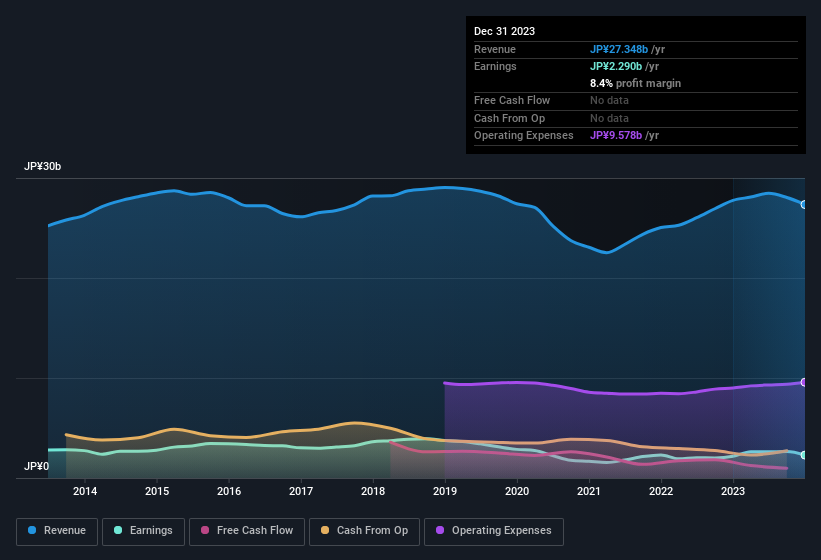

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Nitto Kohki's EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. While some people may not be too phased, this could be a sticking point for some investors.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Nitto Kohki is no giant, with a market capitalisation of JP¥45b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Nitto Kohki Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Nitto Kohki insiders have a significant amount of capital invested in the stock. Indeed, they hold JP¥4.7b worth of its stock. This considerable investment should help drive long-term value in the business. That amounts to 10% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Nitto Kohki To Your Watchlist?

One positive for Nitto Kohki is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Nitto Kohki (of which 1 is concerning!) you should know about.

Although Nitto Kohki certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Kohki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6151

Nitto Kohki

Develops, manufactures, and sells connecting fluid couplings, labor-saving machine tools, and linear motor driven free piston pumps and other pumps for various applications.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives