LIXIL Corporation (TSE:5938) has announced that it will pay a dividend of ¥45.00 per share on the 6th of June. Based on this payment, the dividend yield on the company's stock will be 4.6%, which is an attractive boost to shareholder returns.

View our latest analysis for LIXIL

LIXIL's Earnings Easily Cover The Distributions

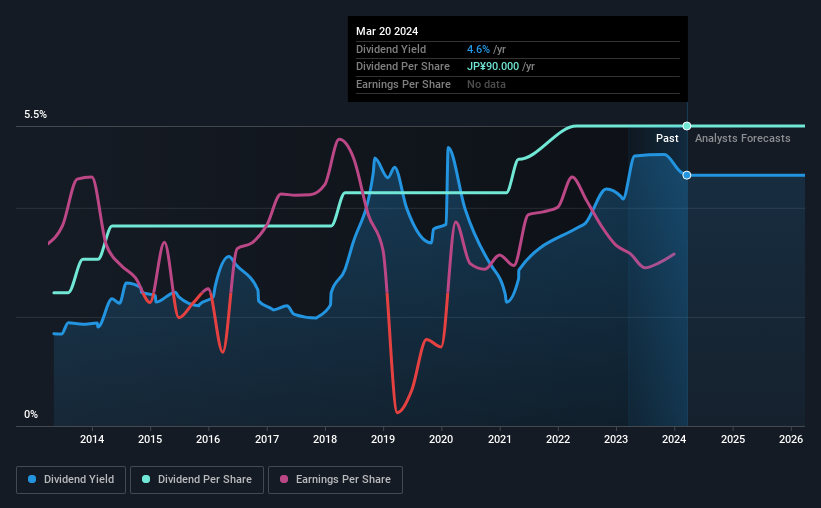

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the dividend made up 155% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

The next year is set to see EPS grow by 166.6%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 62% which brings it into quite a comfortable range.

LIXIL Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of ¥40.00 in 2014 to the most recent total annual payment of ¥90.00. This works out to be a compound annual growth rate (CAGR) of approximately 8.4% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

LIXIL May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Although it's important to note that LIXIL's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

LIXIL's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think LIXIL is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 2 warning signs for LIXIL that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5938

LIXIL

Through its subsidiaries, operates water technology and housing technology business in Japan and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives