- Taiwan

- /

- Semiconductors

- /

- TWSE:2493

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a positive momentum fueled by easing core U.S. inflation and robust bank earnings, driving major stock indices higher after recent volatility. With value stocks outperforming growth shares and central banks signaling potential rate cuts, investors are increasingly focusing on dividend stocks as a means to secure steady income streams amidst fluctuating market conditions. In the current environment, a good dividend stock is characterized by its ability to offer reliable payouts supported by strong financial fundamentals and resilience across economic cycles.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

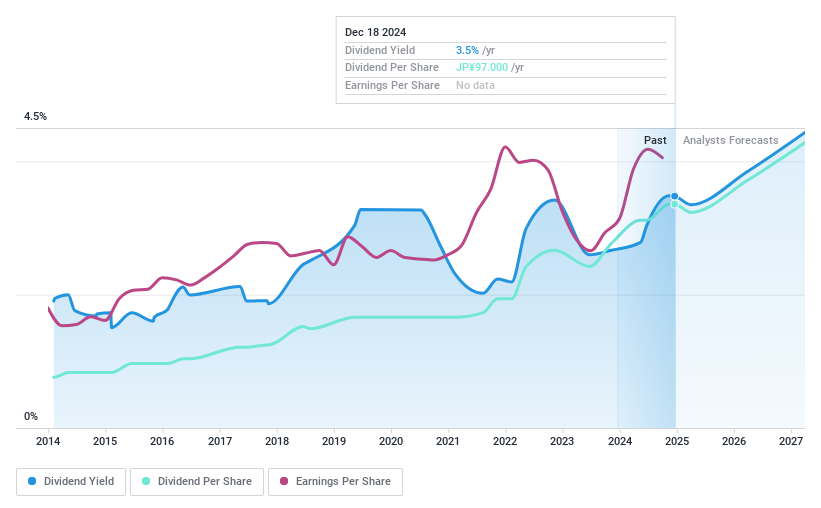

Adeka (TSE:4401)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Adeka Corporation operates in the chemicals, food products, and life science sectors with a market cap of approximately ¥288.85 billion.

Operations: Adeka Corporation's revenue is primarily derived from its Chemical Business at ¥214.38 billion, followed by the Life Science Business at ¥101.49 billion and the Food Business at ¥83.92 billion.

Dividend Yield: 3.3%

Adeka Corporation's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 41.8% and a cash payout ratio of 32.6%. The company recently increased its interim dividend to JPY 48 per share, with expectations to raise the year-end dividend to JPY 49 per share. Despite trading below fair value estimates, Adeka's dividends have been stable and growing over the past decade, though its yield is slightly below Japan's top-tier payers.

- Dive into the specifics of Adeka here with our thorough dividend report.

- Our valuation report unveils the possibility Adeka's shares may be trading at a discount.

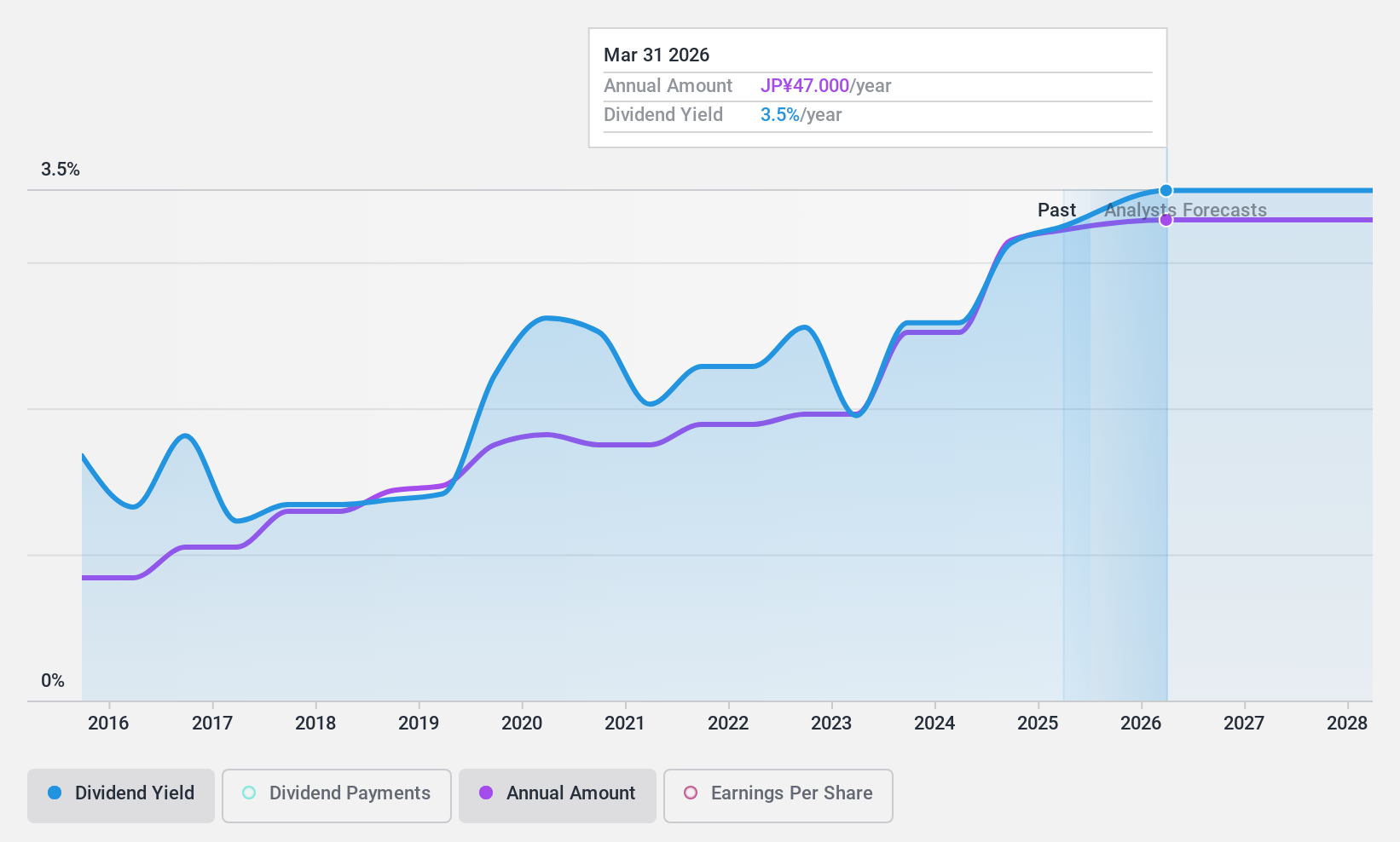

Hirakawa Hewtech (TSE:5821)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hirakawa Hewtech Corp. operates in the manufacturing and sale of cables, assemblies, electric and electronic equipment, as well as medical equipment and parts both in Japan and internationally, with a market cap of ¥20.83 billion.

Operations: Hirakawa Hewtech Corp.'s revenue is primarily derived from its Electric Wires/Processed Products segment, which accounts for ¥26.51 billion, followed by the Electronic/Medical Parts segment at ¥4.56 billion.

Dividend Yield: 2.9%

Hirakawa Hewtech's dividend payments are covered by earnings and cash flows, with a payout ratio of 31.8% and a cash payout ratio of 21.3%. Despite an increase to JPY 22 per share from JPY 18 last year, the yield remains below Japan's top-tier payers. Although dividends have grown over the past decade, they have been volatile and unreliable. The stock trades significantly below its estimated fair value, potentially offering value to investors seeking growth prospects.

- Click to explore a detailed breakdown of our findings in Hirakawa Hewtech's dividend report.

- According our valuation report, there's an indication that Hirakawa Hewtech's share price might be on the cheaper side.

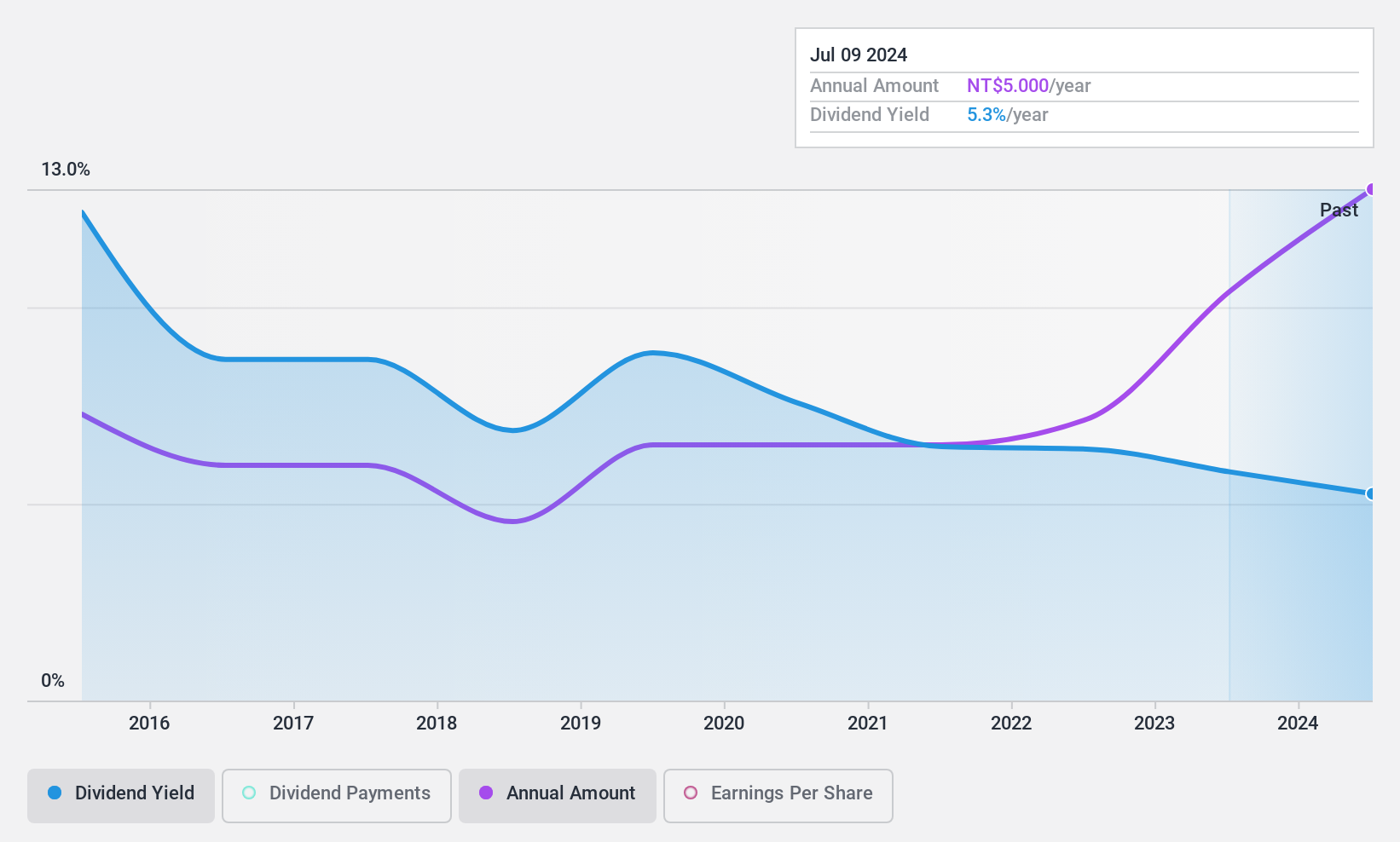

Ampoc Far-East (TWSE:2493)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ampoc Far-East Co., Ltd. researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong with a market cap of NT$10.93 billion.

Operations: Ampoc Far-East Co., Ltd.'s revenue is primarily derived from its segments in machine equipment (NT$2.12 billion), consumable materials (NT$1.55 billion), and maintenance services (NT$0.20 billion).

Dividend Yield: 5.1%

Ampoc Far-East's dividend yield of 5.1% ranks in the top 25% of Taiwan's market, yet its dividends have been volatile over the past decade. While payments are covered by earnings and cash flows, with payout ratios of 85.1% and 82.9%, respectively, their reliability remains questionable due to past fluctuations. The stock trades at a significant discount to its estimated fair value, which might appeal to investors despite recent declines in net income and earnings per share.

- Get an in-depth perspective on Ampoc Far-East's performance by reading our dividend report here.

- Our expertly prepared valuation report Ampoc Far-East implies its share price may be lower than expected.

Make It Happen

- Investigate our full lineup of 1983 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2493

Ampoc Far-East

Researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong.

Excellent balance sheet established dividend payer.