- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

High Growth Tech And 2 More Stocks With Promising Expansion

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing U.S. inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones have recorded significant gains, reflecting a positive shift in investor sentiment. In this environment of cautious optimism, identifying high-growth tech stocks with promising expansion potential becomes crucial for investors seeking to capitalize on emerging opportunities while navigating the complexities of current economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

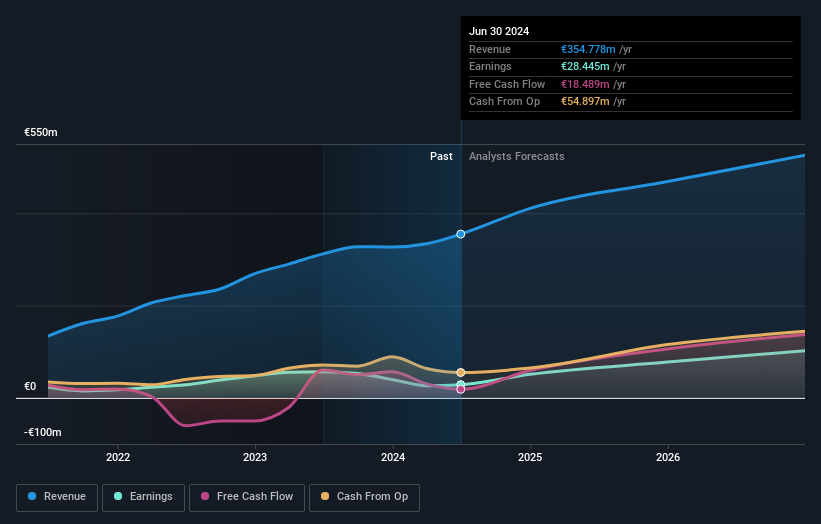

Overview: Better Collective A/S is a digital sports media company with operations in Europe, North America, and internationally, and it has a market capitalization of SEK6.70 billion.

Operations: The company generates revenue primarily through its Publishing segment, which accounts for €252.96 million, and Paid Media, contributing €107.54 million.

Better Collective, a player in the interactive media and services sector, has demonstrated resilience with its earnings forecast to grow by an impressive 41.8% annually, outpacing the Swedish market's average of 14.2%. Despite a challenging year that saw a reduction in net profit margin from 16.1% to 7.3%, the company's commitment to innovation is evident from its R&D investments aimed at enhancing its technological capabilities. With annual revenue growth projected at 7.5%, Better Collective is navigating through industry headwinds, focusing on strategic initiatives that could bolster future performance amidst recent downward adjustments in revenue forecasts for 2024, now expected between EUR 355 million and EUR 375 million.

- Click here and access our complete health analysis report to understand the dynamics of Better Collective.

Gain insights into Better Collective's past trends and performance with our Past report.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Growth Rating: ★★★★☆☆

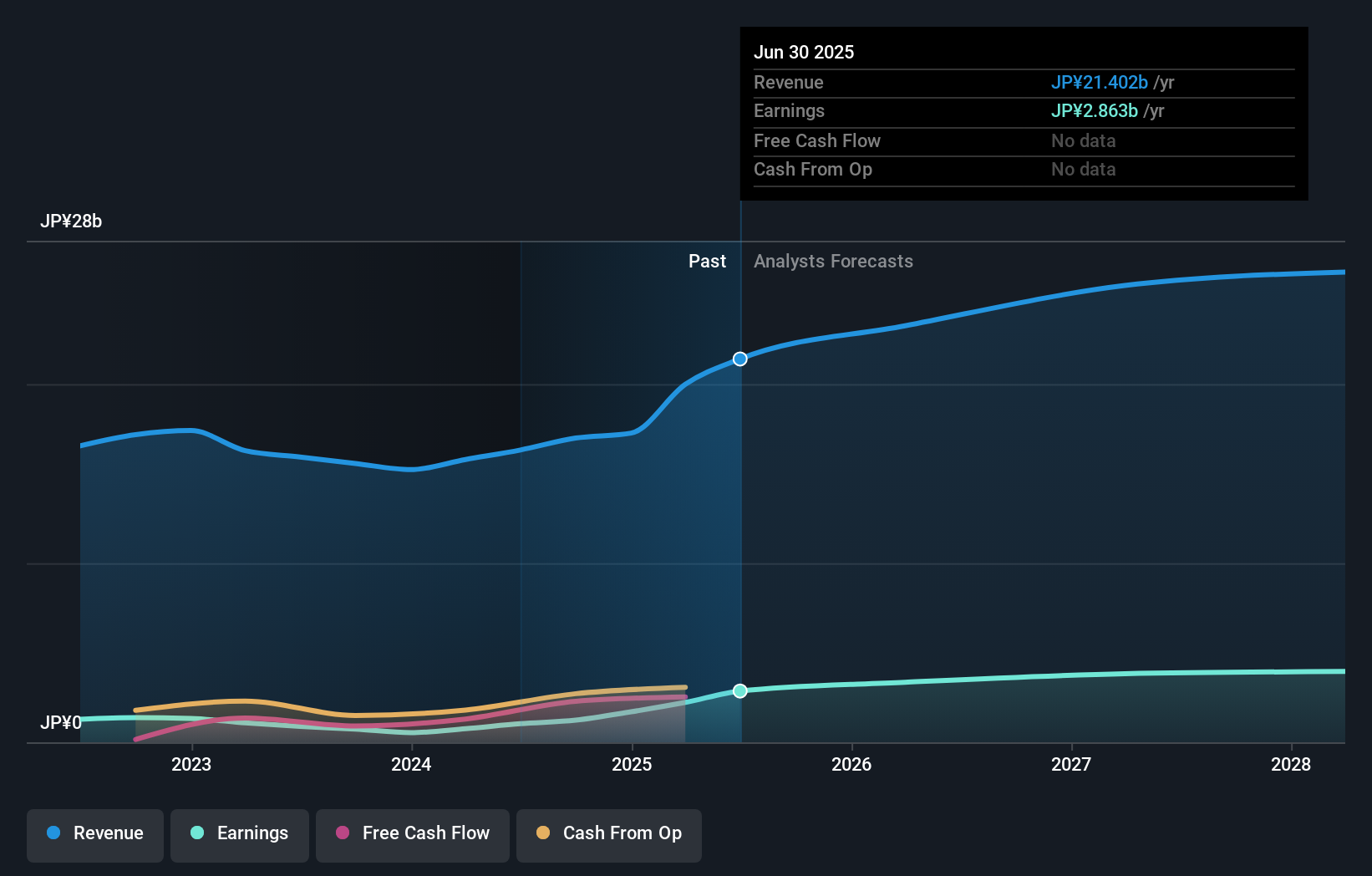

Overview: SEIKOH GIKEN Co., Ltd. specializes in the design, manufacture, and sale of optical components, lenses, and radio over fiber products both in Japan and internationally, with a market capitalization of ¥45.42 billion.

Operations: The company generates revenue primarily from two segments: Optical Products Related, contributing ¥8.23 billion, and Precision Machine Related, contributing ¥8.78 billion.

SEIKOH GIKEN, amidst a dynamic tech landscape, has shown robust financial health with earnings forecasted to surge by 25.1% annually. Outperforming its sector's average growth, the company's revenue is also expected to climb at 10.8% per year, signaling strong market positioning and innovation-driven expansion strategies. Recent strategic moves include a significant share repurchase of 250,000 shares for ¥1,315 million in December 2024, underscoring its commitment to shareholder value and capital efficiency in an evolving industry environment.

- Get an in-depth perspective on SEIKOH GIKEN's performance by reading our health report here.

Assess SEIKOH GIKEN's past performance with our detailed historical performance reports.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

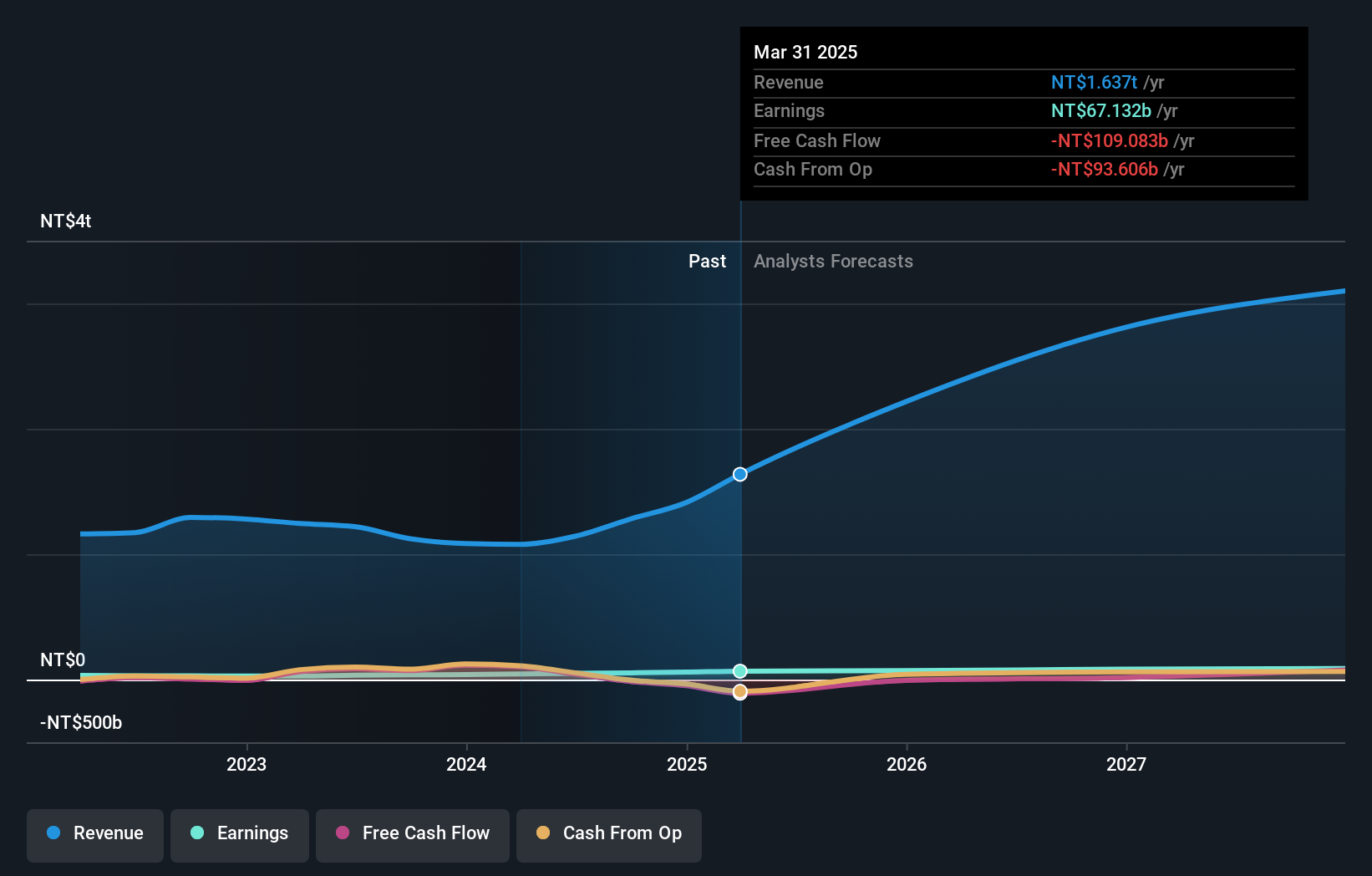

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers with operations across Asia, the Americas, Europe, and other international markets, holding a market cap of NT$1.04 trillion.

Operations: Quanta Computer Inc. generates revenue primarily from its Electronics Sector, contributing NT$2.78 billion to its financials. The company operates across multiple regions, including Asia, the Americas, and Europe.

Quanta Computer has demonstrated a compelling growth trajectory, with a notable 36.8% annual increase in revenue and an earnings surge of 41% over the past year, outpacing its industry's average. These figures underscore its robust market positioning and ability to capitalize on emerging tech trends. The company's recent active participation in multiple global investment forums highlights its strategic focus on expanding its industry footprint and showcasing innovation capabilities. With R&D expenses aligning closely with these ambitious growth targets, Quanta is poised to maintain its competitive edge in the evolving tech landscape.

Where To Now?

- Click here to access our complete index of 1225 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Very undervalued with high growth potential and pays a dividend.