- Japan

- /

- Electrical

- /

- TSE:5801

Why Furukawa Electric (TSE:5801) Is Up 7.5% After Approving Major HVDC Cable Investment Backed by Subsidy

Reviewed by Sasha Jovanovic

- On October 8, 2025, Furukawa Electric Co., Ltd. held a board meeting to approve a major capital expenditure for establishing a 500kV-class HVDC cable manufacturing line, backed by a government subsidy, with operations targeted to begin by 2030.

- This initiative underscores Furukawa Electric’s intention to strengthen its position in renewable energy infrastructure and support the global shift toward carbon neutrality.

- We'll explore how government-backed investment in HVDC cable production could reshape Furukawa Electric's investment narrative in the context of renewable energy expansion.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Furukawa Electric's Investment Narrative?

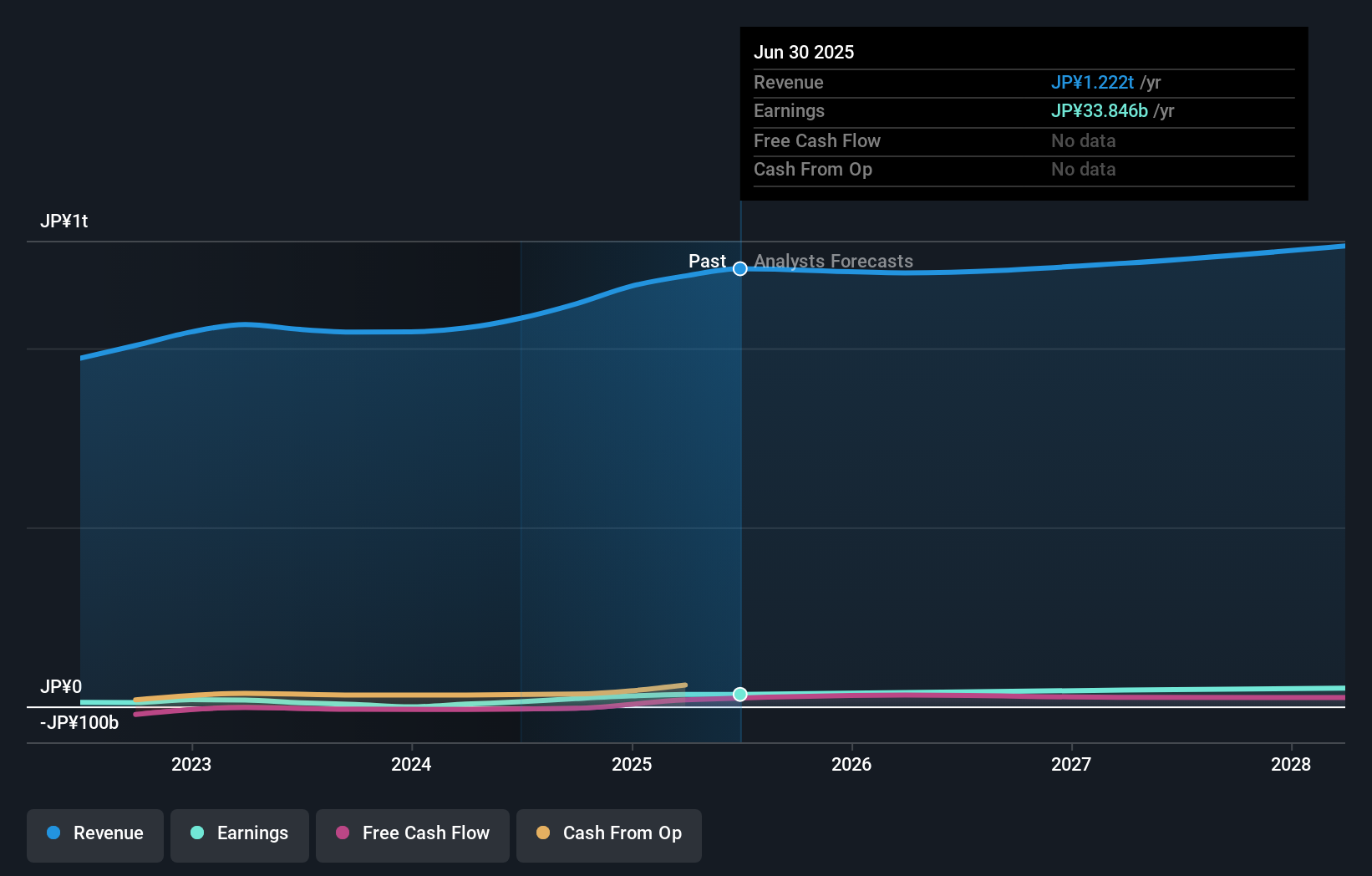

For anyone considering Furukawa Electric, the big picture centers on belief in Asia’s long-term transition towards renewable energy and the critical infrastructure required to support it. The recent board approval for significant HVDC cable manufacturing, backed by government subsidies, is a clear signal that Furukawa Electric aims to become a more central player in energy transmission solutions. This could reshape near-term catalysts by introducing expectations for new revenue streams and greater relevance in sustainability initiatives, especially as governments worldwide ramp up decarbonization targets. Previously, short-term focus was on dividend sustainability, market volatility, and adjusting to management changes, but this capex commitment shifts attention to project execution risks, capital allocation, and how effectively the company can deliver on growth aspirations by 2030. Market volatility and the company’s relatively high price-to-earnings ratio remain immediate factors to watch. Yet, execution risk for this major project is something investors should not overlook.

Furukawa Electric's shares are on the way up, but they could be overextended by 19%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Furukawa Electric - why the stock might be worth 16% less than the current price!

Build Your Own Furukawa Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Furukawa Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Furukawa Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Furukawa Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5801

Furukawa Electric

Manufactures and sells communications, energy, automotive and batteries products, and electronic components worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives