- Japan

- /

- Electrical

- /

- TSE:5801

Furukawa Electric (TSE:5801): Assessing Valuation After Strategic HVDC Cable Investment Plans

Reviewed by Kshitija Bhandaru

Furukawa Electric (TSE:5801) just held a board meeting to consider a major capital investment aimed at expanding into HVDC cable production. This move highlights the company's potential commitment to future infrastructure trends.

See our latest analysis for Furukawa Electric.

Furukawa Electric has been showing strong momentum as investors respond positively to both new strategic moves such as the HVDC cable expansion plan and a series of upbeat trading sessions. While the most recent 1-day share price return was modest at 1.24%, the stock surged ahead with a 90-day share price return of 38.46%, culminating in an impressive 1-year total shareholder return of 177.26%. This kind of performance, on the back of growing infrastructure demand, suggests the market is taking the company’s future-facing efforts seriously.

If Furukawa Electric’s growth story has captured your attention, now is a good time to see which other fast-growing companies with high insider ownership are making waves. Discover fast growing stocks with high insider ownership

Given Furukawa Electric’s stellar returns and renewed expansion efforts, investors have to ask themselves if there is still value left on the table, or if the market has already priced in all the future upside.

Price-to-Earnings of 20.4: Is it justified?

Furukawa Electric's latest closing price values the stock at a price-to-earnings ratio of 20.4, which encourages a closer look compared to its group of peers.

The price-to-earnings (P/E) ratio relates a company’s share price to its earnings per share and is a quick way to gauge how the market values future profits. For an industrial innovator like Furukawa Electric, where future growth can be dynamic, the P/E ratio gives insight into market expectations for profit expansion and business momentum.

At 20.4x, the P/E multiple is notably lower than the average for similar companies (31.5x) and even below our estimate of where the market could ultimately price Furukawa Electric’s future prospects (fair ratio: 31.7x). This suggests the market is not giving full credit for the company’s robust earnings growth and recent business strategy announcements.

Even when compared to the broader Japanese Electrical industry average P/E, which stands at 13.2x, Furukawa Electric still trades at a premium. This highlights investor enthusiasm but also a measure of conservatism relative to fair value estimates. Should the company’s growth narrative play out as projected, there may be material upside yet to be unlocked, especially if sentiment aligns with the higher fair P/E ratio.

Explore the SWS fair ratio for Furukawa Electric

Result: Price-to-Earnings of 20.4 (UNDERVALUED)

However, slower-than-expected revenue growth or weaker net income momentum could present challenges to the current optimism and lead to a reassessment of valuation upside.

Find out about the key risks to this Furukawa Electric narrative.

Another View: Discounted Cash Flow Perspective

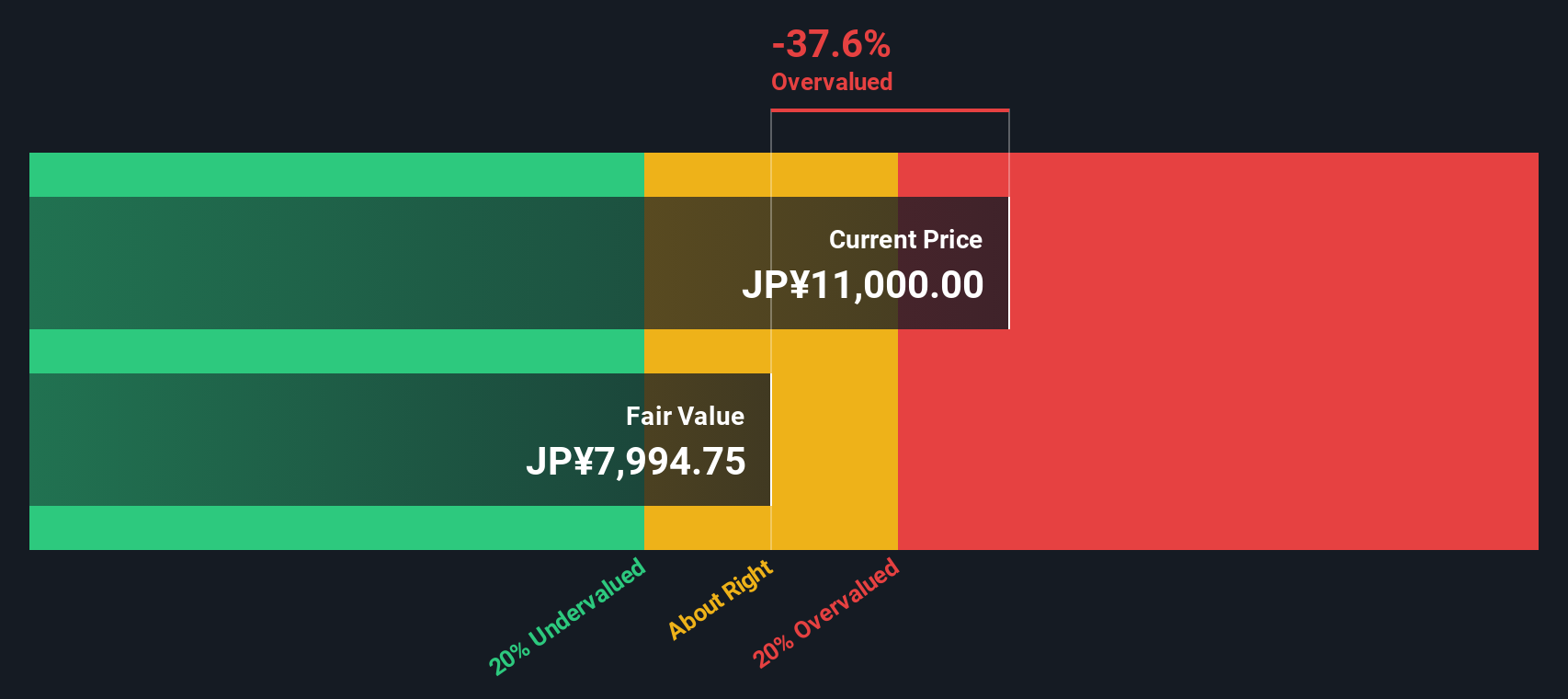

While the market seems optimistic based on earnings multiples, our DCF model tells a different story. According to this approach, Furukawa Electric’s shares are trading above the estimated fair value. This raises questions about how much future growth is already priced in. Could the market have gotten ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Furukawa Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Furukawa Electric Narrative

If you want to see the numbers for yourself or think there’s an angle we haven’t covered, you’re welcome to build your own story in just a few minutes. Do it your way

A great starting point for your Furukawa Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let opportunities pass you by. Take advantage of these specialized stock lists to uncover exciting trends and stocks you can act on today.

- Secure a head start on the future of artificial intelligence by reviewing these 25 AI penny stocks, where companies are pushing boundaries in automation and smart solutions.

- Tap into stable returns and potential income by checking out these 19 dividend stocks with yields > 3%, featuring stocks with yields greater than 3% for savvy investors seeking regular payouts.

- Position yourself at the forefront of next-generation computing with these 26 quantum computing stocks, highlighting businesses advancing the promising world of quantum technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5801

Furukawa Electric

Manufactures and sells communications, energy, automotive and batteries products, and electronic components worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives