- Japan

- /

- Electrical

- /

- TSE:5801

Furukawa Electric Co., Ltd.'s (TSE:5801) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Furukawa Electric Co., Ltd. (TSE:5801) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 81%, which is great even in a bull market.

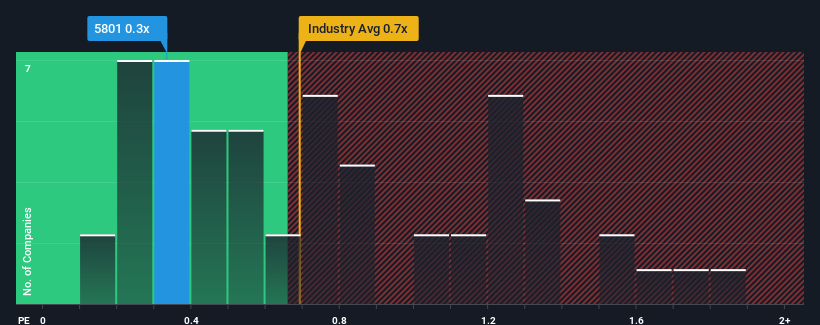

Even after such a large drop in price, there still wouldn't be many who think Furukawa Electric's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Japan's Electrical industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Furukawa Electric

What Does Furukawa Electric's P/S Mean For Shareholders?

Furukawa Electric certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Furukawa Electric will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Furukawa Electric's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 1.1% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 4.5% growth per annum, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Furukawa Electric's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Furukawa Electric's P/S?

Furukawa Electric's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Furukawa Electric's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Furukawa Electric, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Furukawa Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5801

Furukawa Electric

Manufactures and sells telecommunications, energy, automobile, electronic, and construction products worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives