Nippon Sheet Glass Company (TSE:5202) sheds JP¥6.4b, company earnings and investor returns have been trending downwards for past five years

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Nippon Sheet Glass Company, Limited (TSE:5202), since the last five years saw the share price fall 44%. And some of the more recent buyers are probably worried, too, with the stock falling 44% in the last year. Furthermore, it's down 33% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 18% in the same timeframe.

After losing 17% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Nippon Sheet Glass Company

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Nippon Sheet Glass Company became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 9.1% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

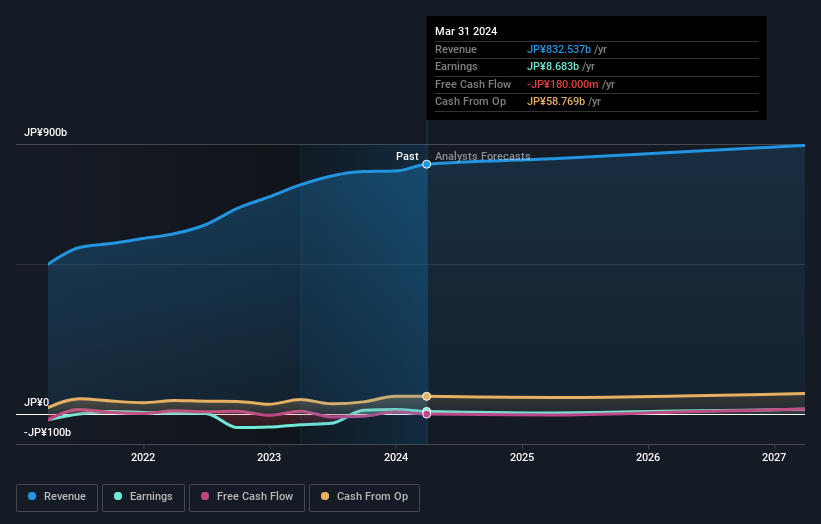

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Nippon Sheet Glass Company has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Nippon Sheet Glass Company stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market lost about 1.5% in the twelve months, Nippon Sheet Glass Company shareholders did even worse, losing 44%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Nippon Sheet Glass Company you should be aware of, and 1 of them shouldn't be ignored.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Sheet Glass Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5202

Nippon Sheet Glass Company

Engages in the manufacture and sale of glass and glazing products in Japan, Europe, North America, and South America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives