- China

- /

- Auto Components

- /

- SZSE:000589

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major indices experiencing moderate gains amidst holiday trading, investors are increasingly seeking stability through dividend stocks. In such an environment, stocks that offer reliable dividend payouts can provide a steady income stream and potential buffer against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.08% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Guizhou TyreLtd (SZSE:000589)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guizhou Tyre Co., Ltd. is involved in the research, development, production, and sale of tires in China and has a market cap of CN¥8.01 billion.

Operations: Guizhou Tyre Co., Ltd.'s revenue is primarily derived from its manufacture and sale of various tires, totaling CN¥10.41 billion.

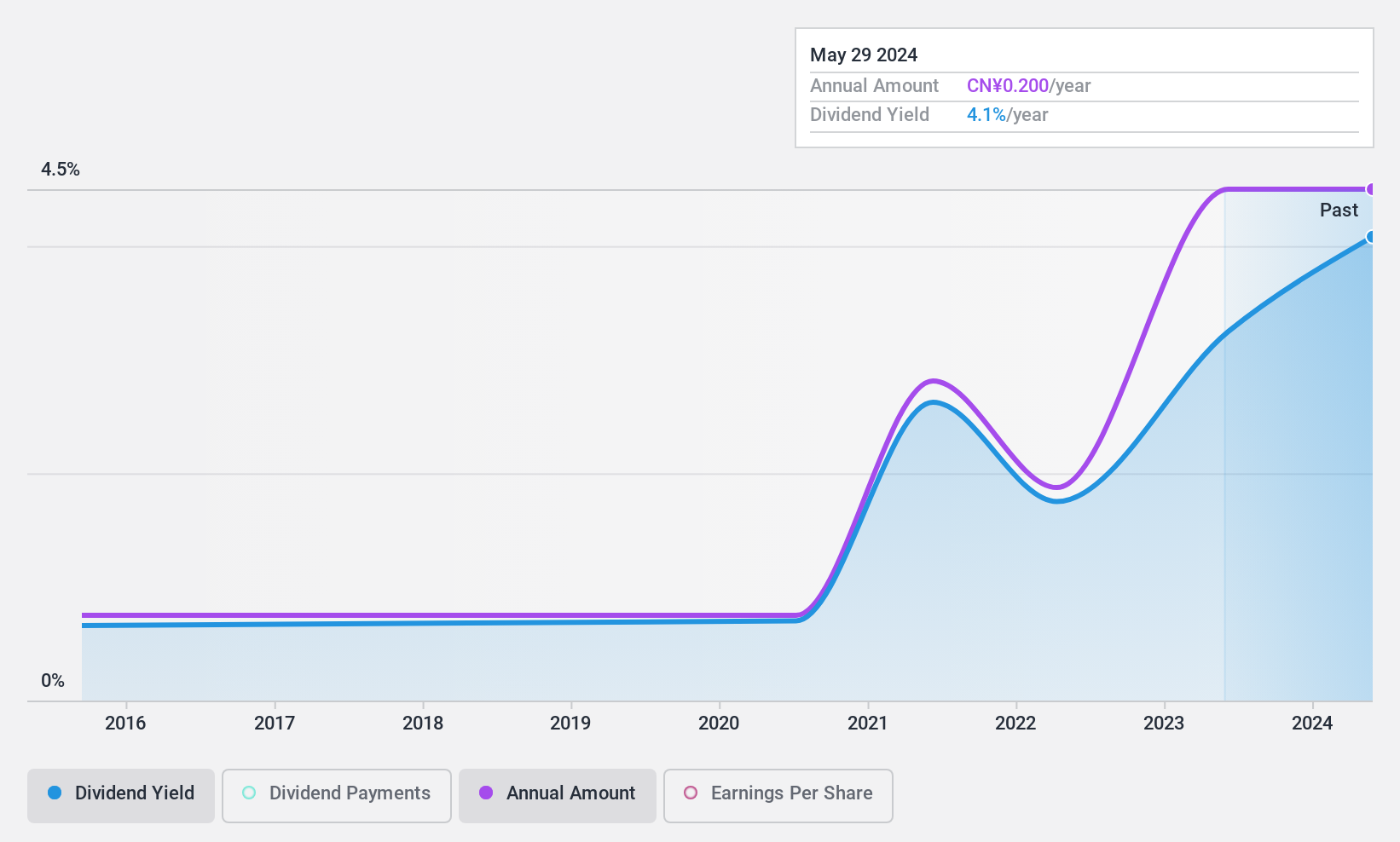

Dividend Yield: 3.9%

Guizhou Tyre Ltd. offers a dividend yield of 3.87%, placing it in the top 25% of CN market payers, though its dividends have been volatile over the past decade and are not covered by free cash flows. The payout ratio is a low 33.8%, suggesting earnings cover dividends, but sustainability concerns persist due to lack of free cash flow coverage. Recent buybacks totaling CNY 32.99 million could indicate management's confidence despite declining net income in recent earnings reports.

- Navigate through the intricacies of Guizhou TyreLtd with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Guizhou TyreLtd is priced higher than what may be justified by its financials.

Bando Chemical Industries (TSE:5195)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bando Chemical Industries, Ltd. manufactures and markets belts and belt-related products across Japan, China, the rest of Asia, Europe, America, and internationally with a market cap of approximately ¥80.98 billion.

Operations: Bando Chemical Industries generates revenue from three main segments: Automotive Parts Business at ¥56.27 billion, Industrial Materials Segment at ¥37.42 billion, and High-Performance Elastomer Products Business at ¥13.91 billion.

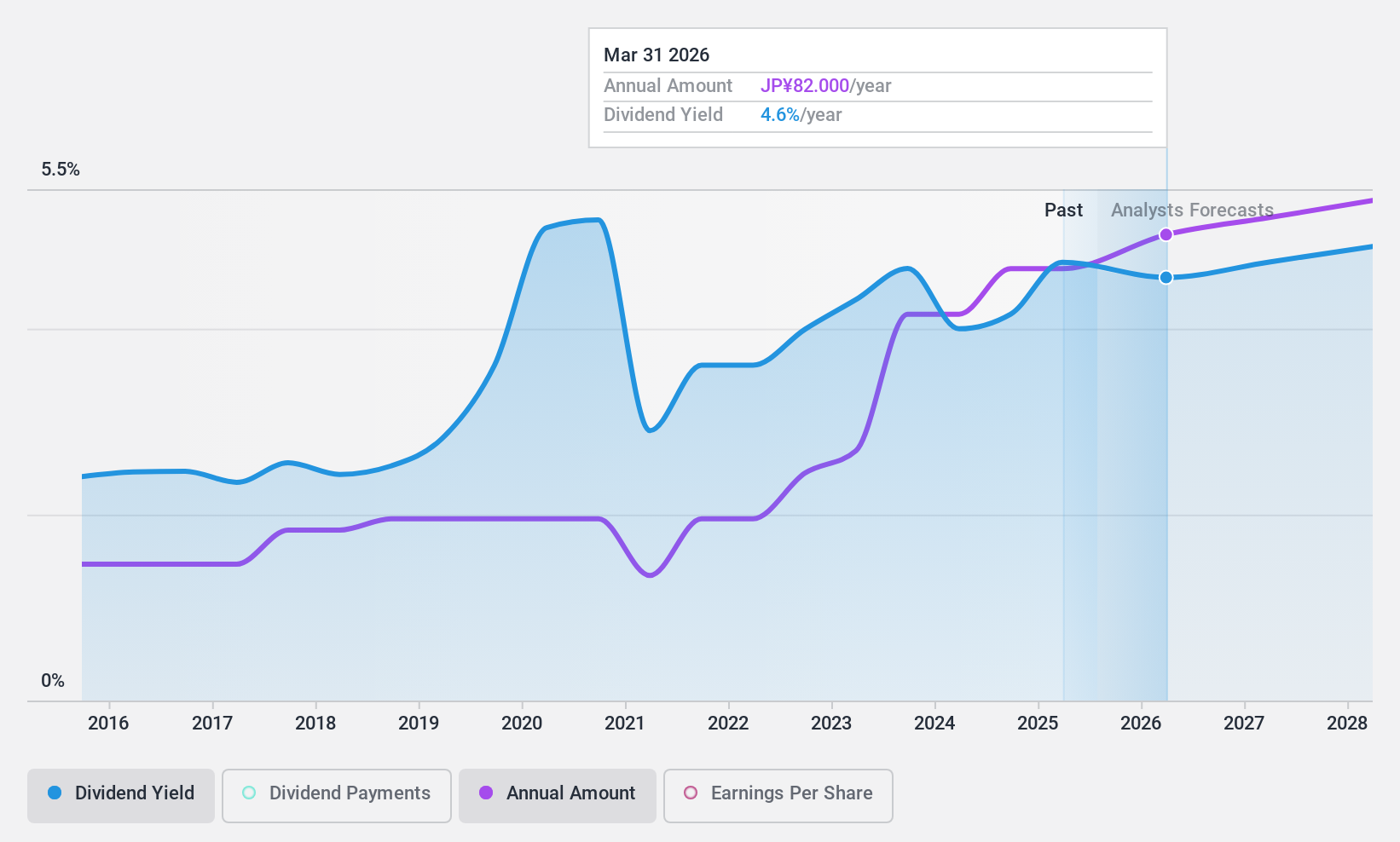

Dividend Yield: 4%

Bando Chemical Industries offers a dividend yield of 3.98%, ranking in the top 25% in Japan, with dividends covered by earnings (56.2% payout ratio) and cash flows (39.7%). However, its dividend history is unstable, showing volatility over the past decade. Recent strategic partnerships and share buybacks totaling ¥981.96 million may signal management's confidence despite these inconsistencies, potentially supporting long-term dividend sustainability and growth prospects amidst evolving market strategies.

- Delve into the full analysis dividend report here for a deeper understanding of Bando Chemical Industries.

- In light of our recent valuation report, it seems possible that Bando Chemical Industries is trading beyond its estimated value.

Onoken (TSE:7414)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onoken Co., Ltd. is involved in the sale and import/export of steel in Japan, with a market cap of ¥38.15 billion.

Operations: Onoken Co., Ltd.'s revenue segments include ¥53.99 billion from Kanto/Tohoku, ¥154.87 billion from Kyushu/China, and ¥74.93 billion from Kansai/Chukyo regions.

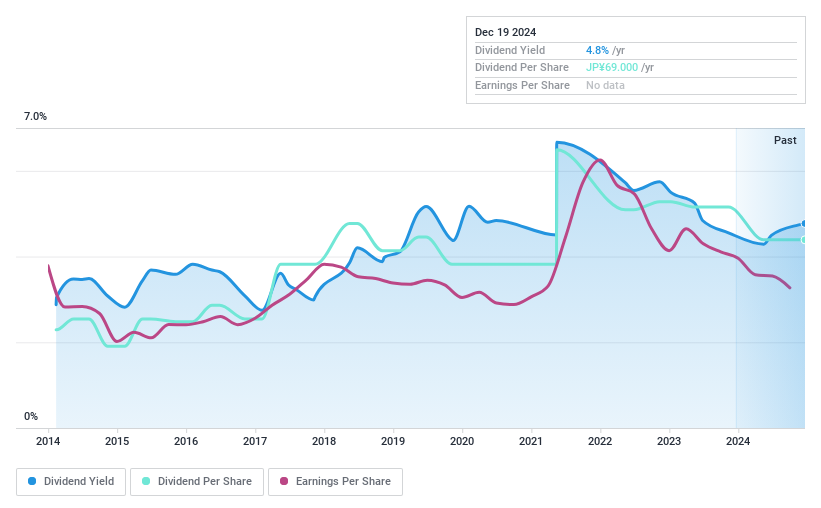

Dividend Yield: 4.6%

Onoken's dividend yield of 4.58% is among the top 25% in Japan, although dividends are not covered by free cash flows and have shown volatility over the past decade. The recent decrease from ¥36 to ¥34 per share highlights this instability. Despite trading at a significant discount to its estimated fair value, high debt levels and lack of free cash flow coverage suggest potential risks for dividend sustainability, even as earnings guidance remains positive with expected net sales of ¥282.20 billion.

- Dive into the specifics of Onoken here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Onoken shares in the market.

Key Takeaways

- Dive into all 1943 of the Top Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000589

Guizhou TyreLtd

Engages in the research, development, production, and sale of tires in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives