- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2763

Global Dividend Stocks And 2 More Top Picks

Reviewed by Simply Wall St

Recent developments in global markets have been marked by a positive shift in sentiment, largely driven by the U.S.-China agreement to pause tariffs, which has fueled rallies across major indices. As inflation shows signs of cooling and trade tensions ease, investors are increasingly looking towards dividend stocks as a potential source of steady income amidst market fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.36% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

Click here to see the full list of 1554 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

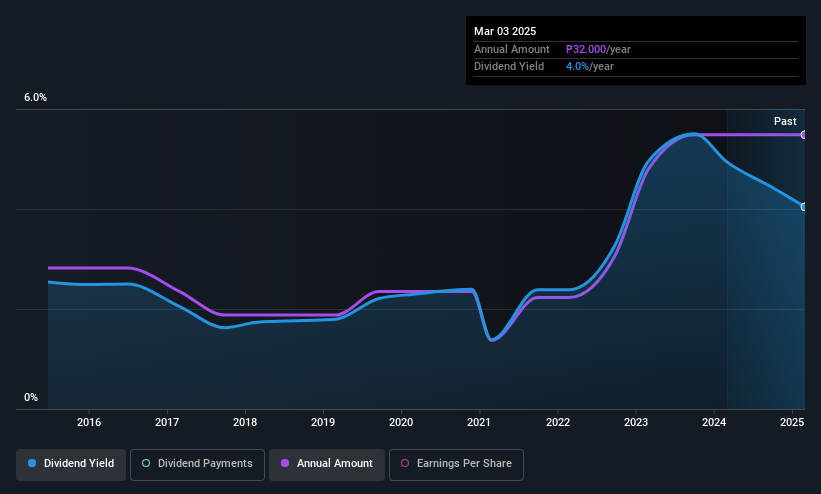

Far Eastern University (PSE:FEU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Far Eastern University, Incorporated operates the Far Eastern University in Manila, Philippines, with a market cap of ₱18.66 billion.

Operations: Far Eastern University, Incorporated generates revenue through its main campus (₱2.90 billion), other schools (₱944.69 million), and trimestral schools (₱1.85 billion).

Dividend Yield: 3.8%

Far Eastern University offers a mixed dividend profile. Its dividend yield of 3.79% is below the top tier in the Philippine market, but dividends are well-covered by earnings and cash flows with payout ratios of 40.2% and 44.9%, respectively. Despite a history of volatility, dividends have grown over the past decade. Recent earnings show stable revenue growth but declining net income, which may impact future payouts if trends continue.

- Navigate through the intricacies of Far Eastern University with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Far Eastern University's current price could be quite moderate.

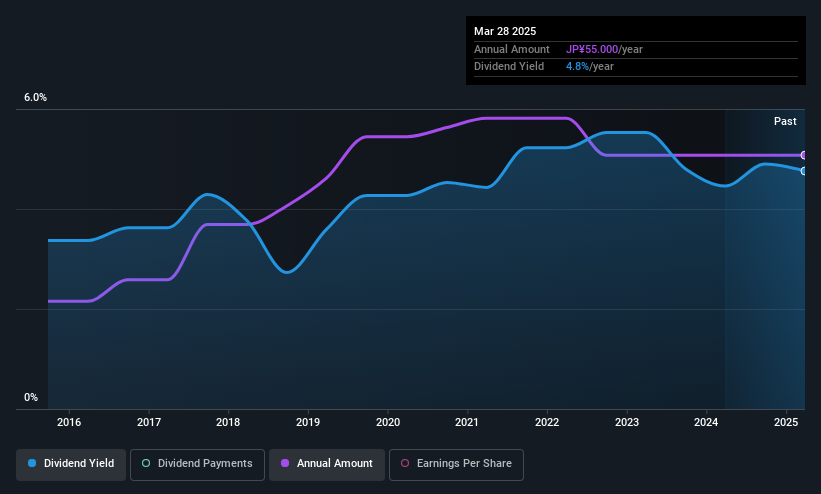

FTGroup (TSE:2763)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FTGroup Co., Ltd. provides network infrastructure services in Japan with a market cap of ¥33.62 billion.

Operations: FTGroup Co., Ltd. generates revenue through its network infrastructure services in Japan.

Dividend Yield: 4.8%

FTGroup offers a strong dividend profile with a yield of 4.82%, placing it in the top 25% of JP market payers. Dividends are well-covered by earnings and cash flows, with payout ratios at 24.3% and 26.1%, respectively. Over the past decade, dividends have been stable and consistently growing, supported by recent earnings growth of 25.2%. Currently trading at a discount to its estimated fair value, FTGroup presents an attractive opportunity for income-focused investors.

- Click here to discover the nuances of FTGroup with our detailed analytical dividend report.

- The analysis detailed in our FTGroup valuation report hints at an deflated share price compared to its estimated value.

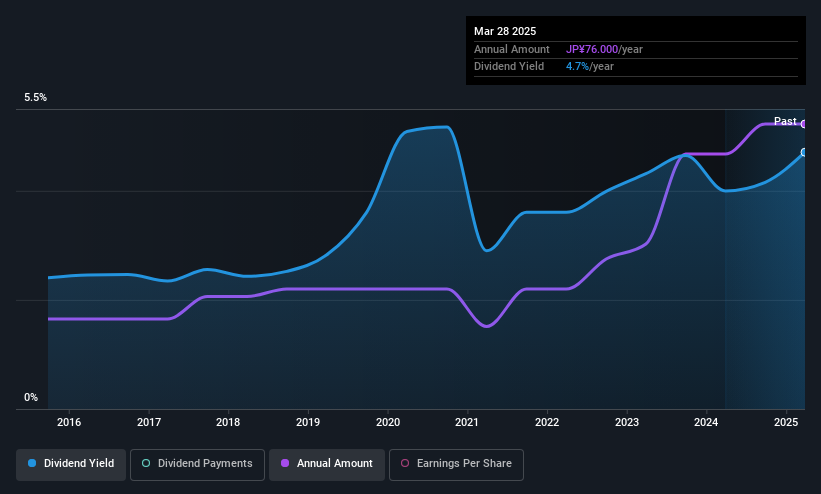

Bando Chemical Industries (TSE:5195)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bando Chemical Industries, Ltd., along with its subsidiaries, produces and sells belts and belt-related products across Japan, China, the rest of Asia, Europe, America, and other international markets with a market cap of ¥68.43 billion.

Operations: Bando Chemical Industries, Ltd. generates revenue through the production and sale of belts and belt-related products in various regions including Japan, China, the rest of Asia, Europe, America, and other international markets.

Dividend Yield: 4.7%

Bando Chemical Industries demonstrates a mixed dividend profile. While its 4.67% yield ranks in the top 25% of JP market payers, the dividend history has been volatile over the past decade. Recent dividends are covered by earnings and cash flows, with payout ratios at 59.7% and 51.4%, respectively. A share repurchase program worth ¥2 billion signals commitment to shareholder returns despite recent financial challenges, including significant impairment losses impacting profitability and margins.

- Click to explore a detailed breakdown of our findings in Bando Chemical Industries' dividend report.

- The analysis detailed in our Bando Chemical Industries valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click here to access our complete index of 1554 Top Global Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2763

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives