- Japan

- /

- Healthtech

- /

- TSE:4820

Discovering 3 Hidden Stock Gems with Solid Foundations

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks experienced broad declines with smaller-cap indexes like the S&P 600 faring worst. Despite these challenges, strong economic data such as robust GDP growth and retail sales offered some optimism amid concerns about future interest rate cuts. In this environment, identifying stocks with solid foundations becomes crucial as investors seek stability and potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

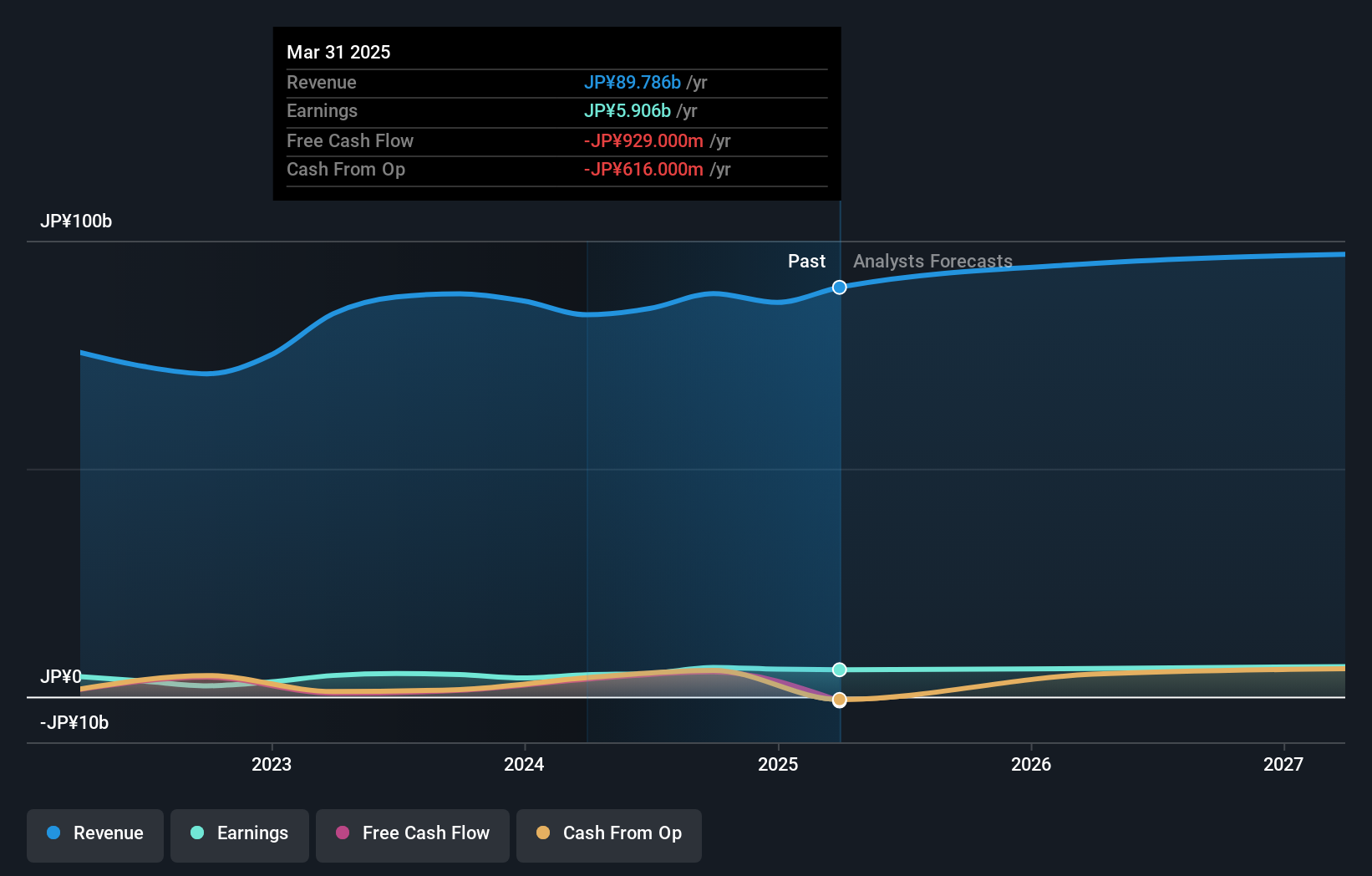

Hibiya Engineering (TSE:1982)

Simply Wall St Value Rating: ★★★★★★

Overview: Hibiya Engineering, Ltd. is a Japanese company that, along with its subsidiaries, offers a range of engineering products and services, with a market cap of ¥85.99 billion.

Operations: Hibiya Engineering generates revenue primarily from its Equipment Construction Business, contributing ¥77.50 billion, followed by the Equipment Sales Business with ¥11.52 billion. The Equipment Manufacturing Business adds ¥4.26 billion to the total revenue stream.

Hibiya Engineering, a nimble player in its field, has been making waves with its robust financial health. Notably debt-free for the past five years, it boasts high-quality earnings and positive free cash flow. The company repurchased 253,600 shares for ¥781.6 million recently, underscoring confidence in its valuation—trading at 40% below fair value estimates. Despite a volatile share price over the last three months, Hibiya's earnings growth of 32% outpaces the construction industry's average of 21%, suggesting strong operational performance and potential upside as it continues to outperform industry peers.

- Click to explore a detailed breakdown of our findings in Hibiya Engineering's health report.

Explore historical data to track Hibiya Engineering's performance over time in our Past section.

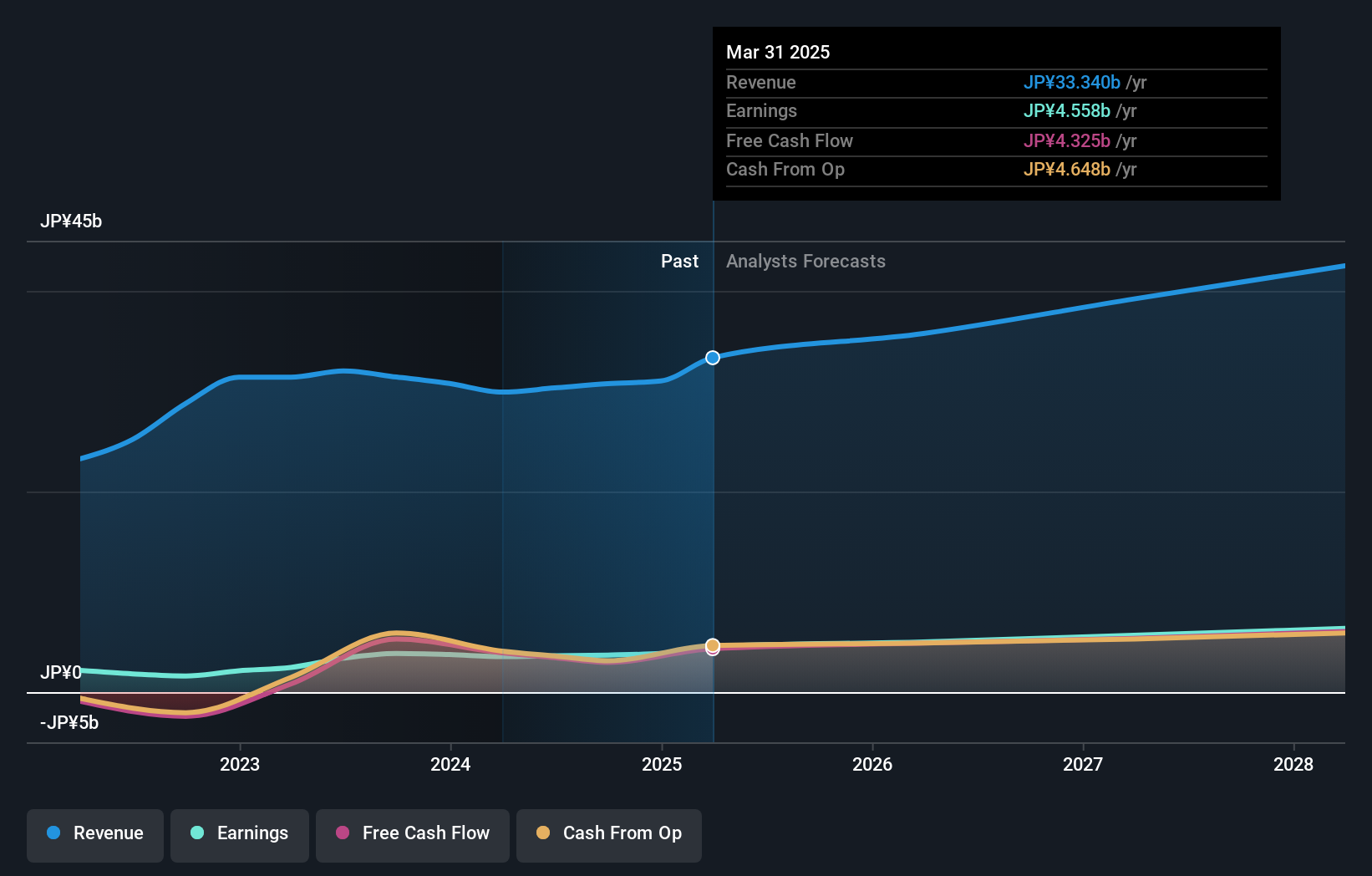

gremzInc (TSE:3150)

Simply Wall St Value Rating: ★★★★★☆

Overview: gremz, Inc. operates in Japan focusing on energy cost solutions, smart house projects, and electricity retailing with a market capitalization of ¥60.09 billion.

Operations: The company generates revenue primarily from its Electricity Retailing Business, contributing ¥18.33 billion, followed by the Energy Cost Solutions Business at ¥8.26 billion and the Smart House Project Business at ¥4.15 billion. The net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Gremz Inc., a nimble player in its sector, has shown robust financial health with free cash flow reaching JPY 2.96 billion as of September 2024 and a manageable debt to equity ratio now at 22.9%, up slightly over five years. The company is trading significantly below its estimated fair value by about 69.7%, suggesting potential undervaluation. Despite negative earnings growth of -4.3% last year, it remains profitable and forecasts an impressive earnings growth rate of nearly 21% annually moving forward, positioning itself for promising future performance amidst industry challenges.

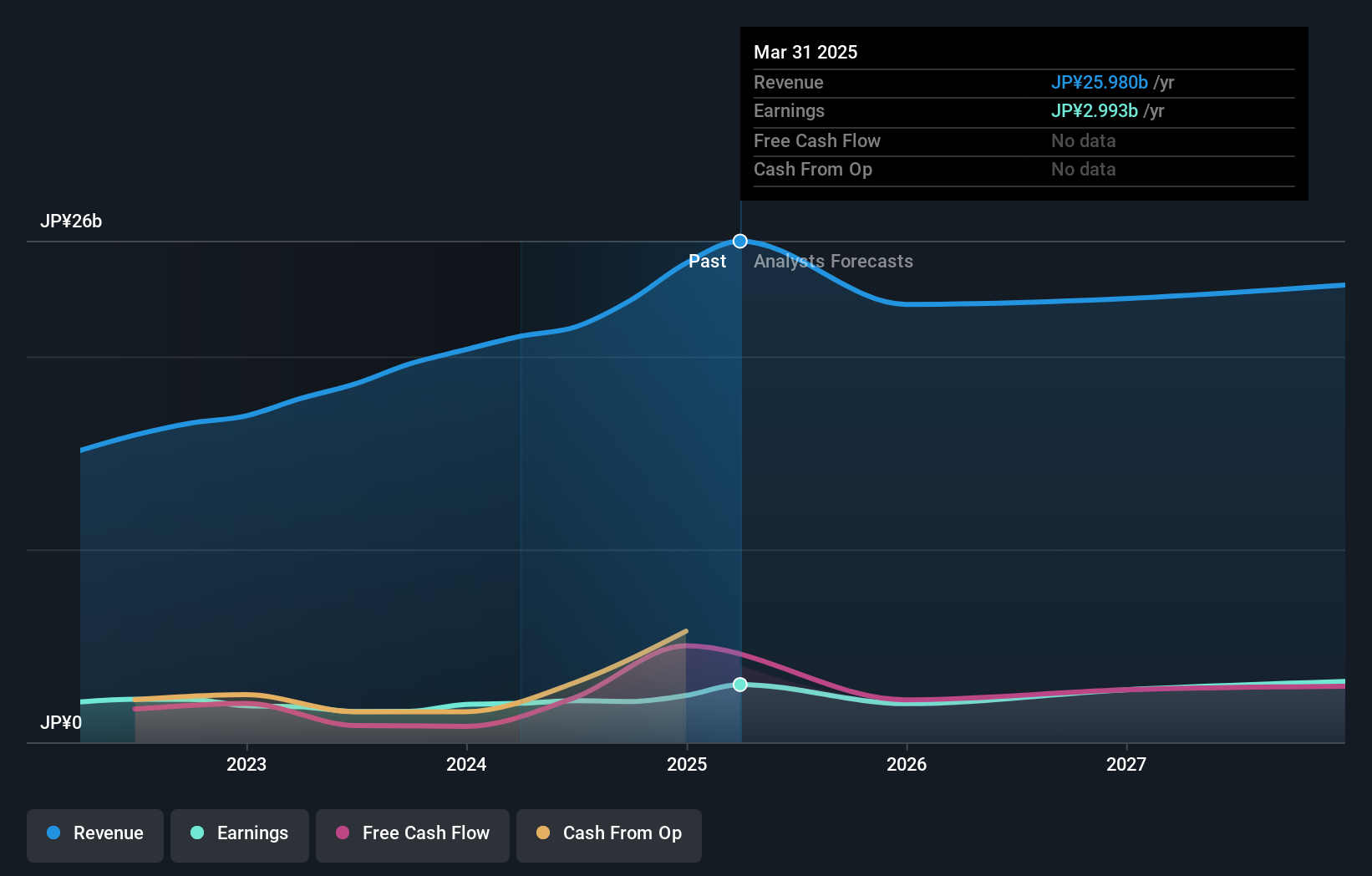

EM Systems (TSE:4820)

Simply Wall St Value Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market capitalization of ¥55.79 billion.

Operations: EM Systems generates revenue primarily from its Dispensing System Business, which accounts for ¥18.94 billion, followed by the Medical System Business at ¥2.39 billion. The company has a market capitalization of approximately ¥55.79 billion.

EM Systems, a promising player in the healthcare services sector, has seen its earnings grow by 31.7% over the past year, outpacing the industry average of 20.4%. Despite a ¥1.4 billion one-off loss affecting recent results, the company remains profitable with adequate cash to cover its total debt and interest obligations. Trading at about 25% below estimated fair value suggests potential undervaluation. Recent strategic moves include repurchasing approximately 2.28% of its shares for ¥999 million, indicating confidence in future growth prospects as earnings are projected to rise by over 12% annually.

- Dive into the specifics of EM Systems here with our thorough health report.

Understand EM Systems' track record by examining our Past report.

Make It Happen

- Gain an insight into the universe of 4627 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4820

EM Systems

Develops and sells various IT systems for pharmacies, clinics, and care/welfare other business in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion