- Taiwan

- /

- Semiconductors

- /

- TWSE:6257

Undiscovered Gems Featuring These 3 Promising Small Caps

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a downturn, with smaller-cap indexes like the S&P 600 facing significant challenges amid cautious Federal Reserve commentary and political uncertainties. Despite this volatility, economic indicators such as robust consumer spending and strong job data suggest underlying resilience in the economy. In such an environment, identifying promising small-cap stocks requires a focus on companies with solid fundamentals and growth potential that can weather broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Taihei Dengyo Kaisha (TSE:1968)

Simply Wall St Value Rating: ★★★★★★

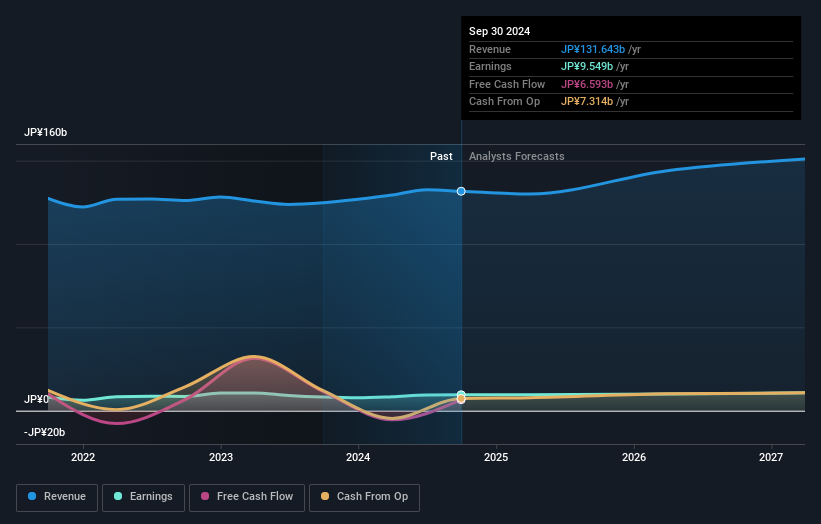

Overview: Taihei Dengyo Kaisha, Ltd. operates in the plant construction industry both in Japan and internationally, with a market capitalization of ¥102.96 billion.

Operations: Taihei Dengyo Kaisha generates revenue primarily from its plant construction activities. The company's net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

Taihei Dengyo Kaisha, a smaller player in the industry, shows promise with its earnings growing at 13.2% annually over the past five years. The company trades at a price-to-earnings ratio of 10.8x, which is attractive compared to the JP market's 13.4x. Despite some shareholder dilution recently, it boasts more cash than total debt and has successfully reduced its debt-to-equity ratio from 23.9% to 13.6% over five years. While its recent annual growth of 17% lags behind the construction industry's average of 20.7%, Taihei's high-quality earnings and solid interest coverage suggest stability and potential for future growth.

- Take a closer look at Taihei Dengyo Kaisha's potential here in our health report.

Understand Taihei Dengyo Kaisha's track record by examining our Past report.

Tohokushinsha Film (TSE:2329)

Simply Wall St Value Rating: ★★★★★★

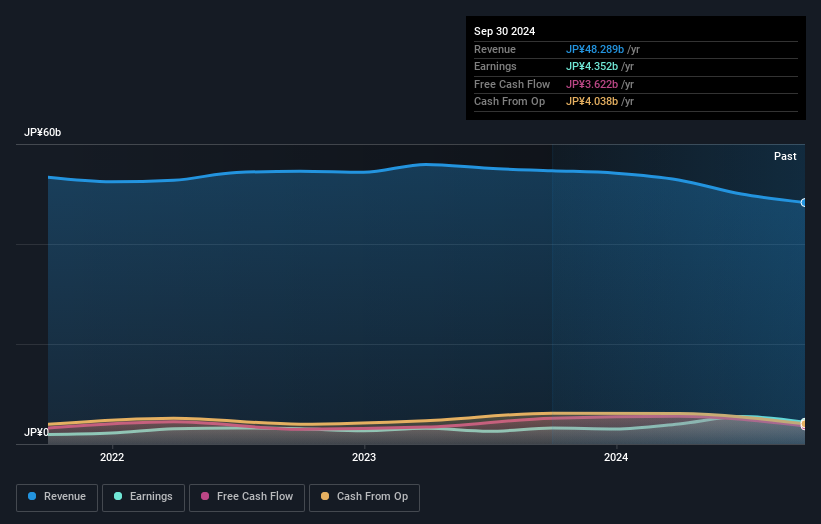

Overview: Tohokushinsha Film Corporation is a Japanese media company with diverse operations in film production, advertising, and property management, and has a market capitalization of ¥82.31 billion.

Operations: Tohokushinsha Film Corporation generates revenue primarily from advertising production, content production, media, and property segments, with advertising production contributing ¥28.09 billion and content production ¥11.21 billion. The company’s diverse revenue streams highlight its focus on various aspects of the media industry in Japan.

Tohokushinsha Film seems to be carving a niche with its robust financials. Over the past year, earnings surged by 36.6%, outpacing the entertainment industry's -7% performance. The company enjoys a favorable price-to-earnings ratio of 18.9x, which is below the industry average of 29.5x, suggesting potential value for investors. Additionally, its debt-to-equity ratio has impressively reduced from 1.2% to 0.1% over five years, reflecting prudent financial management. However, recent dividends dropped from ¥19 to ¥6.67 per share in Q2 FY2025, indicating possible adjustments in payout strategy amidst these dynamics and one-off gains impacting results significantly at ¥2.4 billion.

Sigurd Microelectronics (TWSE:6257)

Simply Wall St Value Rating: ★★★★★☆

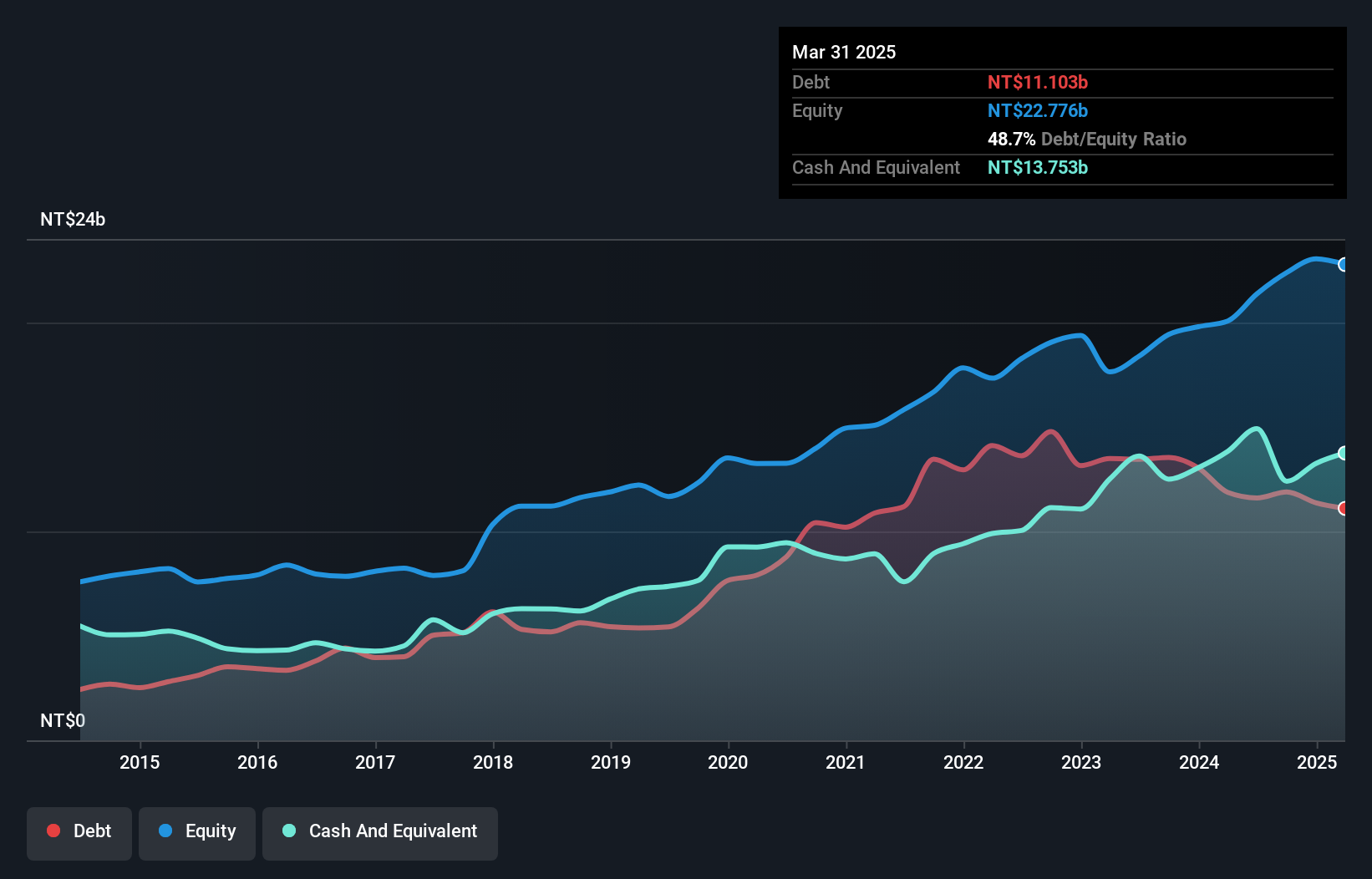

Overview: Sigurd Microelectronics Corporation, with a market cap of approximately NT$33.05 billion, operates in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) across Taiwan, Singapore, America, China, and other international markets.

Operations: Sigurd Microelectronics generates revenue primarily from its Packaging and Testing Business, which contributes NT$17.27 billion, alongside a smaller segment from Trading at NT$42.64 million.

Sigurd Microelectronics stands out in the semiconductor sector with a notable earnings growth of 30.6% over the past year, surpassing industry averages. Despite a slight increase in its debt-to-equity ratio from 51.3% to 53.1% over five years, it remains financially robust with more cash than total debt and no concerns about interest coverage. Trading at a price-to-earnings ratio of 14.7x, it offers good value compared to the TW market's 20.7x average. Recent quarterly sales hit TWD 4,588 million, yet net income decreased to TWD 482 million from TWD 736 million last year due to shareholder dilution impacts.

- Get an in-depth perspective on Sigurd Microelectronics' performance by reading our health report here.

Explore historical data to track Sigurd Microelectronics' performance over time in our Past section.

Where To Now?

- Click through to start exploring the rest of the 4624 Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6257

Sigurd Microelectronics

Engages in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) in Taiwan, Singapore, America, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.