- Taiwan

- /

- Auto Components

- /

- TWSE:2228

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are seeking stability amid fluctuating indices and economic signals. With U.S. stocks experiencing broad-based declines and concerns about interest rate paths, dividend stocks offer a potential avenue for consistent income in uncertain times. A good dividend stock often combines reliable payouts with strong fundamentals, providing a buffer against market volatility while potentially enhancing portfolio resilience.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Iron Force Industrial (TWSE:2228)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iron Force Industrial Co., Ltd. manufactures and trades airbag inflators for automotive safety systems both in Taiwan and internationally, with a market cap of NT$8.03 billion.

Operations: Iron Force Industrial Co., Ltd.'s revenue primarily comes from its operations in Mainland Area (NT$2.48 billion), Taiwan (NT$1.94 billion), and Europe (NT$693.49 million).

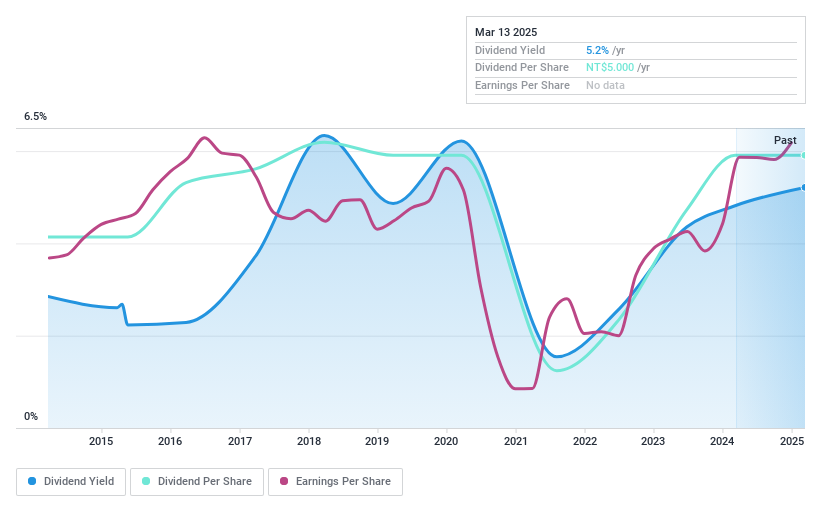

Dividend Yield: 5%

Iron Force Industrial's dividend yield of 4.95% ranks in the top 25% of Taiwan's market, but it's not covered by free cash flows and has been volatile over the past decade. Despite a reasonable payout ratio of 55.9%, shareholders have faced dilution, and dividends are considered unreliable due to historical volatility. The company's earnings grew significantly by 51.8% last year, yet high non-cash earnings raise concerns about quality and sustainability.

- Dive into the specifics of Iron Force Industrial here with our thorough dividend report.

- Upon reviewing our latest valuation report, Iron Force Industrial's share price might be too optimistic.

Zippy Technology (TWSE:2420)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zippy Technology Corp. designs, manufactures, and trades micro switches and power supplies across Taiwan, the United States, Mainland China, Germany, Italy, and internationally with a market cap of NT$9.59 billion.

Operations: Zippy Technology Corp.'s revenue is derived from its Power Business Unit, which contributes NT$1.40 billion, and its Switch Business Unit, which accounts for NT$1.85 billion.

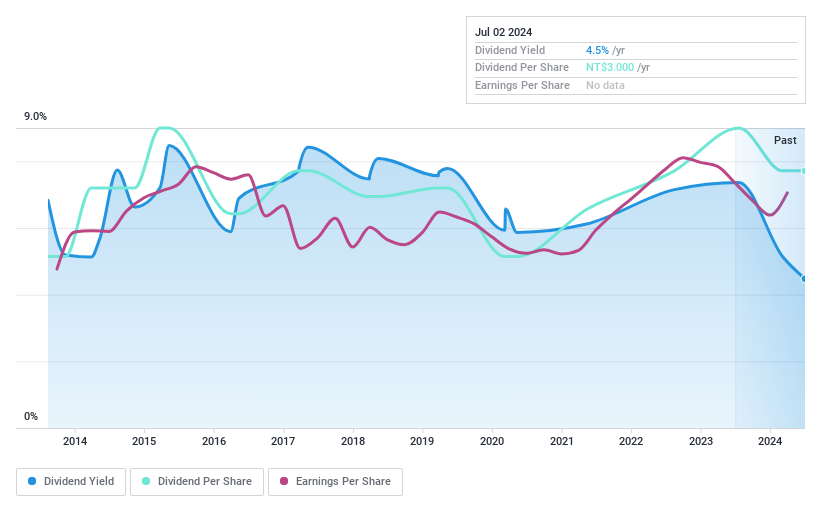

Dividend Yield: 4.8%

Zippy Technology's dividend yield of 4.78% is among the top 25% in Taiwan, supported by a payout ratio of 73.4% and a cash payout ratio of 52.9%, indicating sustainability from earnings and cash flows. However, dividends have been volatile over the past decade, raising concerns about reliability despite recent earnings growth to TWD 520.12 million for nine months ending September 2024. Recent financial leadership changes may impact future stability and strategy execution.

- Click to explore a detailed breakdown of our findings in Zippy Technology's dividend report.

- Our valuation report here indicates Zippy Technology may be undervalued.

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MediaTek Inc. is involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan, the rest of Asia, and internationally with a market cap of NT$2.25 trillion.

Operations: MediaTek Inc. generates revenue of NT$522.10 billion from its multimedia and mobile phone chips and other integrated circuit design products.

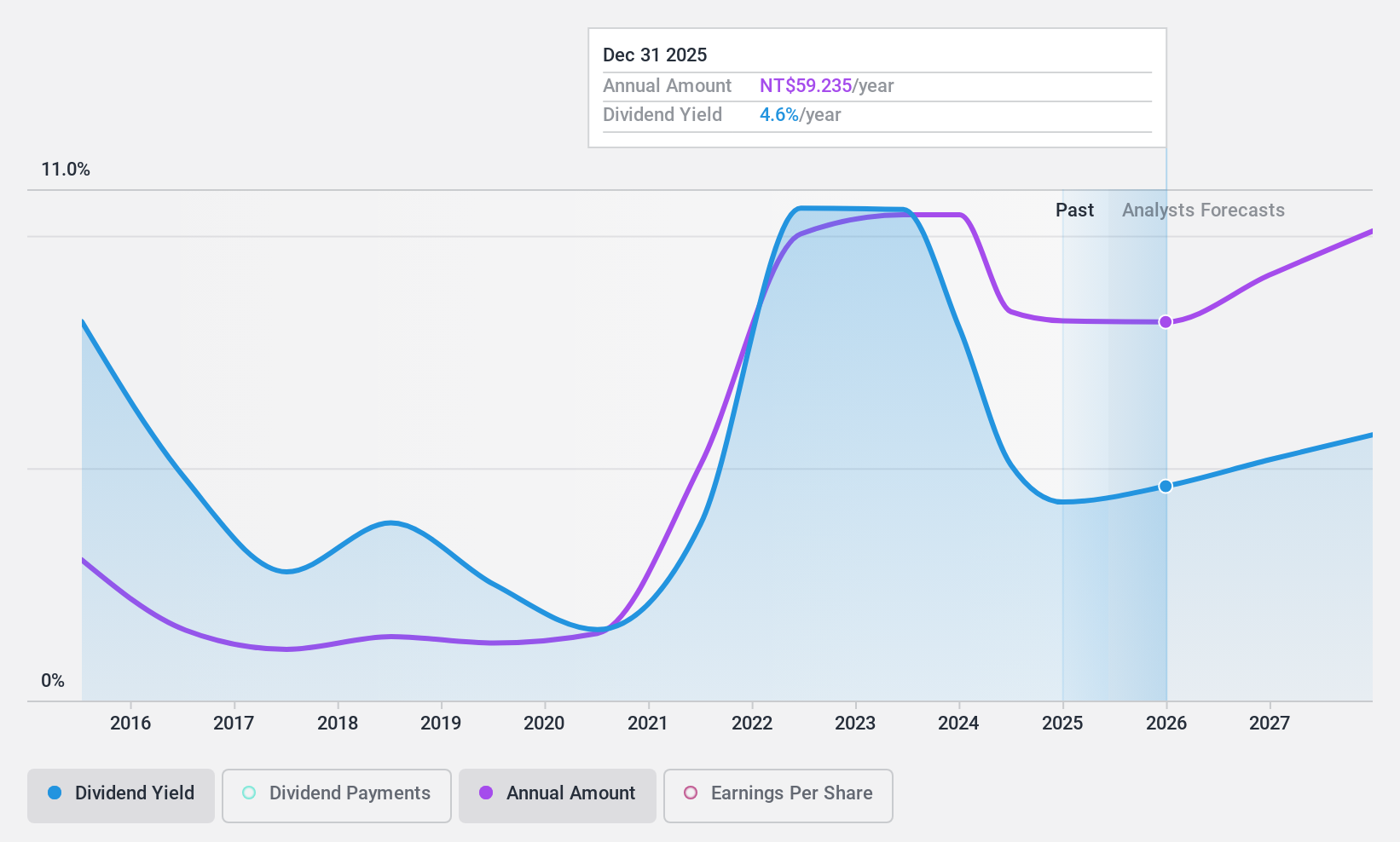

Dividend Yield: 4.2%

MediaTek's dividend yield of 4.21% is below the top quartile in Taiwan, with a payout ratio of 87.2% and a cash payout ratio of 49.6%, suggesting adequate coverage by earnings and cash flows despite an unstable dividend history. Recent financial performance shows growth, with Q3 net income rising to TWD 25.35 billion from TWD 18.48 billion year-over-year, but dividends remain volatile over the past decade, impacting reliability perceptions for investors seeking stability.

- Click here and access our complete dividend analysis report to understand the dynamics of MediaTek.

- Our valuation report unveils the possibility MediaTek's shares may be trading at a premium.

Summing It All Up

- Unlock our comprehensive list of 1957 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2228

Iron Force Industrial

Manufactures and trades in airbag inflators for automotive safety systems in Taiwan and internationally.

Flawless balance sheet with proven track record and pays a dividend.