- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2317

3 Growth Companies With High Insider Ownership Seeing Up To 32% Earnings Growth

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable fluctuations, with U.S. stocks seeing broad-based losses and European indices facing their largest weekly declines in months. Amid this backdrop of economic volatility and tempered rate cut expectations, identifying growth companies with high insider ownership can be particularly appealing to investors seeking stability and alignment of interests in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Dinglong Co., Ltd. focuses on the research, development, production, and service of integrated circuit chip design and semiconductor materials, with a market cap of CN¥25.16 billion.

Operations: The company's revenue primarily comes from the Photoelectric Imaging Display and Semiconductor Process Materials Industry, totaling CN¥3.20 billion.

Insider Ownership: 29.9%

Earnings Growth Forecast: 32.6% p.a.

Hubei Dinglong Ltd. demonstrates strong growth potential with earnings forecasted to increase by 32.6% annually, outpacing the Chinese market average of 25.8%. Despite slower revenue growth at 17.5%, it still surpasses the market's 13.8% rate. Recent earnings reports show significant improvement, with net income rising to CNY 376.32 million from CNY 176.26 million year-over-year, indicating robust operational performance amidst high insider ownership stability over recent months.

- Delve into the full analysis future growth report here for a deeper understanding of Hubei DinglongLtd.

- Our expertly prepared valuation report Hubei DinglongLtd implies its share price may be too high.

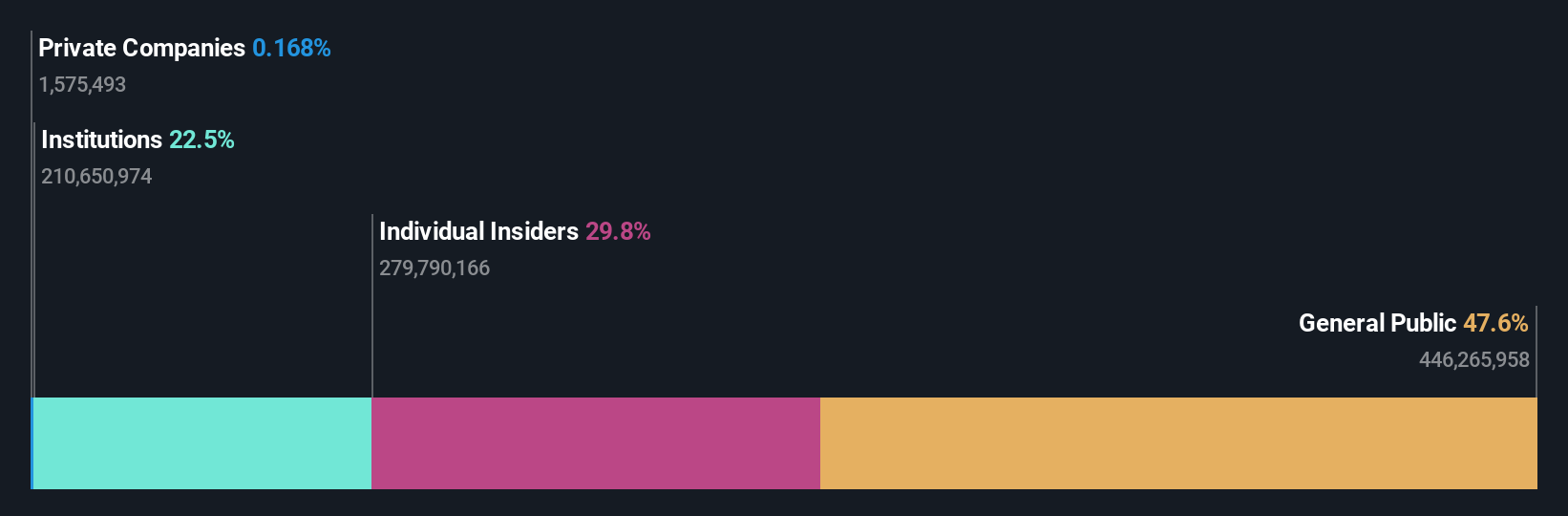

Hon Hai Precision Industry (TWSE:2317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hon Hai Precision Industry Co., Ltd. offers electronic OEM services and has a market cap of NT$2.58 trillion.

Operations: The company's revenue segments include the FII Subgroup with NT$2.58 billion and Foxconn Population at NT$4.23 billion, along with the FIH Subgroup contributing NT$181.90 million.

Insider Ownership: 12.6%

Earnings Growth Forecast: 20% p.a.

Hon Hai Precision Industry, known for its significant insider ownership, shows promising growth prospects. Earnings are projected to grow significantly at 20.1% annually, outperforming the Taiwan market's 19.2% rate. Recent earnings reports reveal a robust performance with net income rising to TWD 49.33 billion in Q3 from TWD 43.13 billion year-over-year, despite moderate revenue growth forecasts of 18.2%. The stock trades below analyst price targets and offers good value compared to industry peers.

- Unlock comprehensive insights into our analysis of Hon Hai Precision Industry stock in this growth report.

- Our valuation report here indicates Hon Hai Precision Industry may be undervalued.

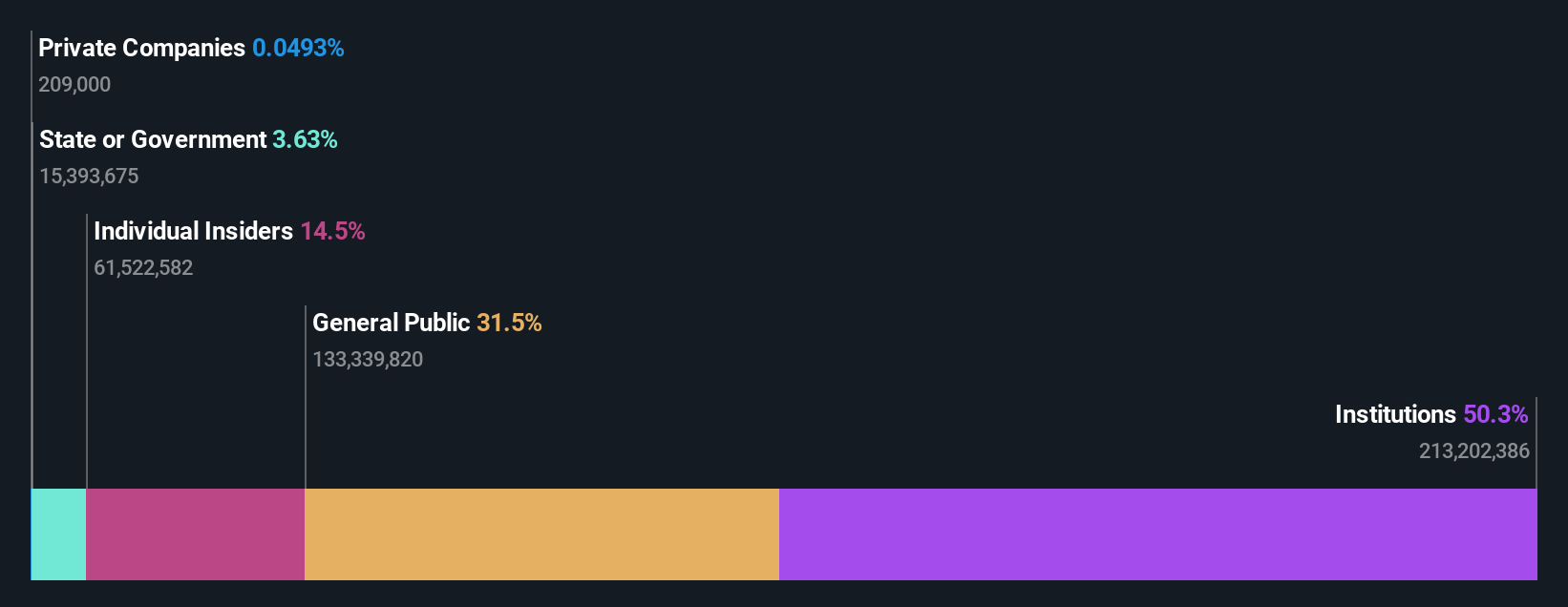

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic testing systems and instruments across Taiwan, China, the United States, and internationally with a market cap of NT$171.37 billion.

Operations: The company's revenue is primarily derived from its Measuring Instruments Business, generating NT$30.84 billion, followed by Automated Transport Engineering with NT$1.69 billion.

Insider Ownership: 14.5%

Earnings Growth Forecast: 24.9% p.a.

Chroma ATE demonstrates strong growth potential with earnings forecasted to rise 24.9% annually, surpassing the Taiwan market's 19.2% rate. Recent financial results show net income increased to TWD 1,426 million in Q3 from TWD 1,225 million year-over-year, reflecting ongoing profitability improvements despite revenue growth forecasts of 16.3%. The stock is trading below estimated fair value and boasts a high projected return on equity of 28.3%, indicating attractive long-term prospects for investors seeking growth opportunities with insider alignment.

- Dive into the specifics of Chroma ATE here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Chroma ATE's current price could be inflated.

Turning Ideas Into Actions

- Reveal the 1514 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hon Hai Precision Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2317

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)