- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2402

Undiscovered Gems with Promising Potential for December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have faced particular challenges, with the S&P 600 experiencing notable declines. Despite these headwinds, the resilience observed in economic indicators such as consumer spending and job growth suggests opportunities for discerning investors to identify promising small-cap stocks that may be undervalued amidst broader market volatility. In this context, discovering stocks with strong fundamentals and innovative potential can offer intriguing prospects for those looking to explore lesser-known opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

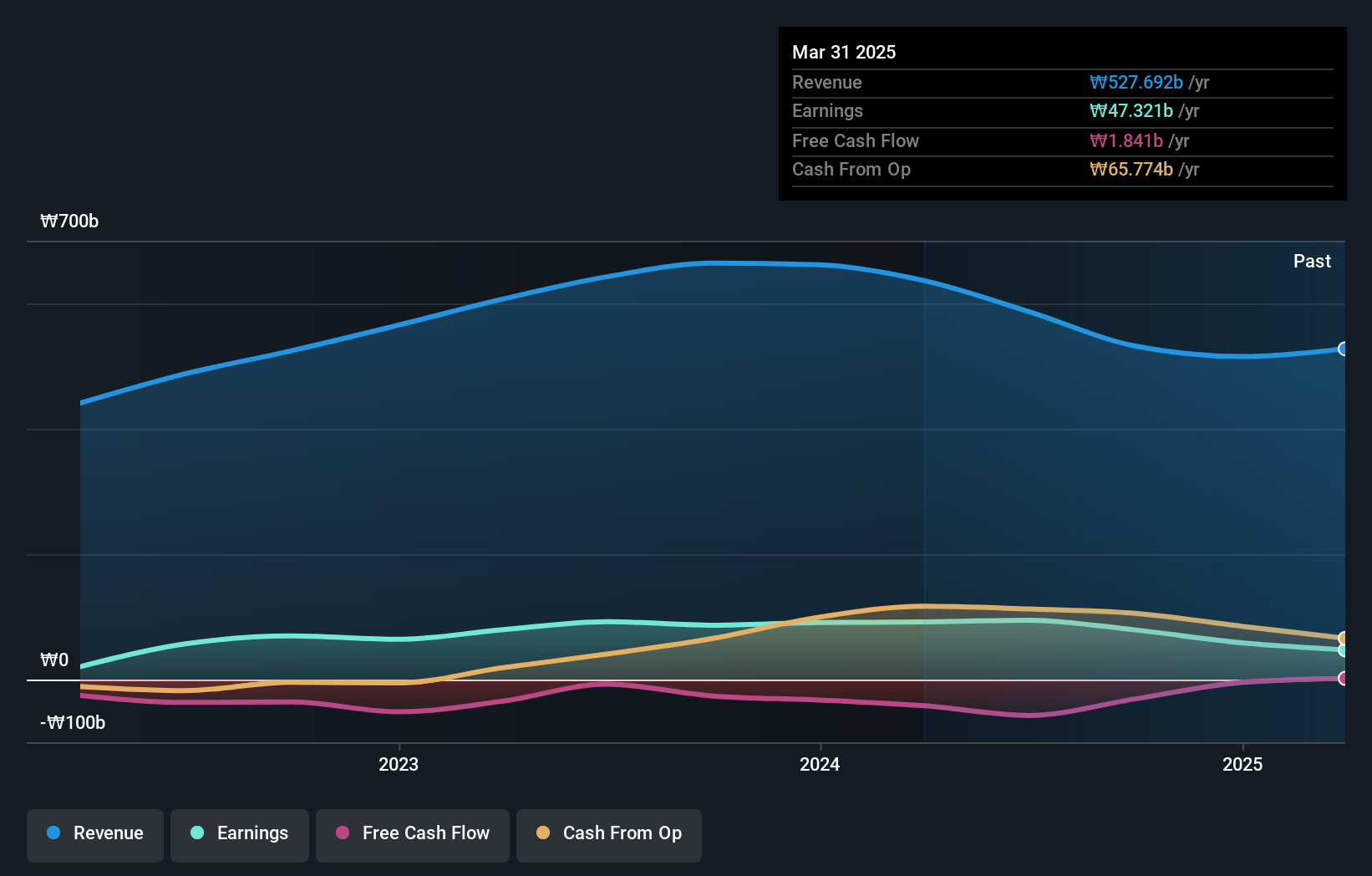

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★★

Overview: Soulbrain Holdings Co., Ltd. develops, manufactures, and supplies core materials for the semiconductor, display, and secondary battery cell industries in South Korea and internationally with a market cap of ₩847.13 billion.

Operations: Soulbrain Holdings generates revenue primarily from product manufacturing, contributing ₩369.61 billion, and distribution and service activities, which add ₩108.98 billion.

Soulbrain Holdings, a relatively small player in the market, is trading at 76% below its estimated fair value, highlighting potential undervaluation. Despite facing an earnings growth challenge with a negative -8.7% over the past year compared to the chemicals industry average of 21%, it has high-quality past earnings and maintains a satisfactory net debt to equity ratio of 2.5%. The company's interest payments are well covered by EBIT at 6.8 times coverage, indicating financial stability. Recently, Soulbrain announced a share repurchase program worth KRW 10 billion aimed at stabilizing stock prices and enhancing shareholder value.

- Click here to discover the nuances of Soulbrain Holdings with our detailed analytical health report.

Understand Soulbrain Holdings' track record by examining our Past report.

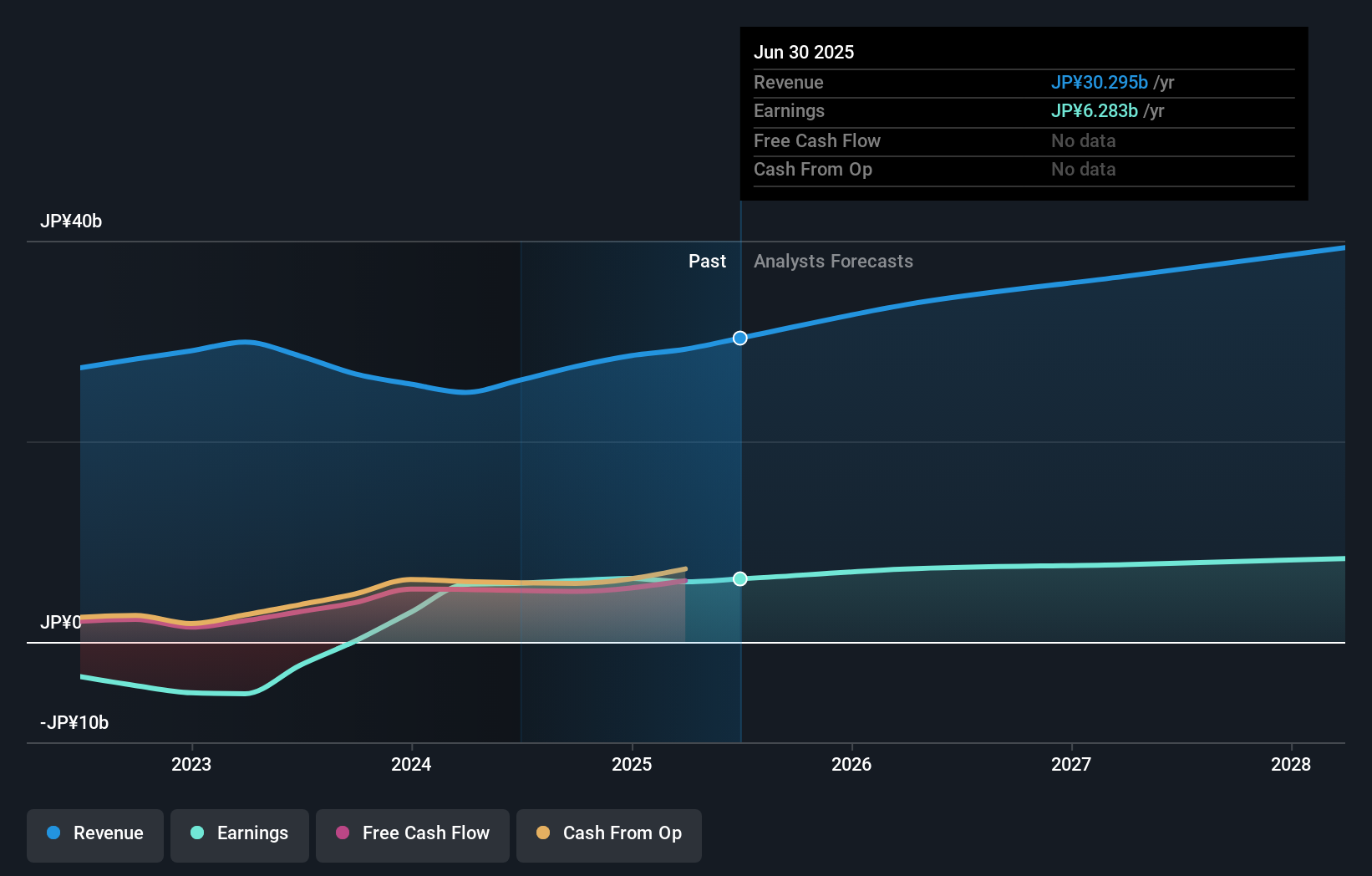

Lifenet Insurance (TSE:7157)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lifenet Insurance Company offers life insurance products and services across Japan, North America, and internationally, with a market cap of ¥150.03 billion.

Operations: The company generates revenue primarily through its life insurance products and services offered in various regions. It operates with a market cap of ¥150.03 billion, focusing on expanding its presence internationally.

Lifenet Insurance stands out in the insurance sector with its impressive earnings growth of 5791%, far surpassing the industry average of 45%. This debt-free company not only boasts high-quality earnings but also maintains a positive free cash flow, showcasing its financial health. Over the past year, Lifenet's performance has been robust without any debt concerns, and it likely benefits from efficient operations and strategic positioning. With forecasts predicting a steady annual growth rate of 7.9%, Lifenet seems well-positioned for continued success in an evolving market landscape.

- Unlock comprehensive insights into our analysis of Lifenet Insurance stock in this health report.

Evaluate Lifenet Insurance's historical performance by accessing our past performance report.

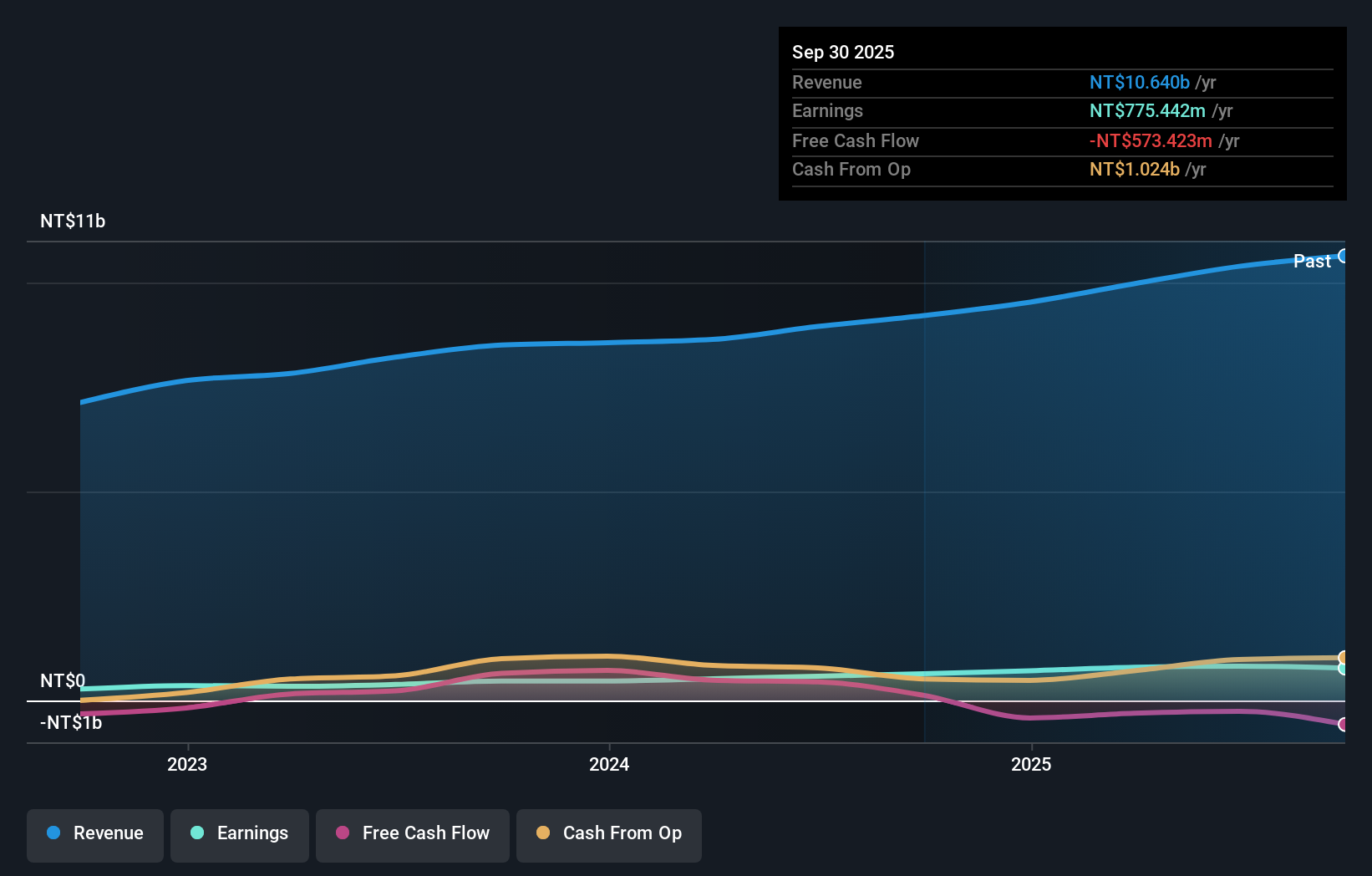

Ichia Technologies (TWSE:2402)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ichia Technologies, Inc. is engaged in the manufacturing, processing, and trading of components and materials for various sectors including electronics and communications across the United States, Europe, and Asia with a market capitalization of approximately NT$11.78 billion.

Operations: With a market capitalization of approximately NT$11.78 billion, Ichia Technologies generates revenue primarily from the production and sales of soft boards and buttons, amounting to NT$9.21 billion.

Ichia Technologies, a nimble player in the electronics sector, showcases robust financial health with its interest payments well covered by EBIT at 538 times. The company outpaced industry growth with earnings surging 36.7% last year. Its net debt to equity ratio stands satisfactorily low at 5.6%. Recent highlights include a notable revenue increase of TWD 858 million in November, marking a 14% rise from the previous year. For Q3 of 2024, sales reached TWD 2,660 million and net income hit TWD 230 million, reflecting solid operational performance and strategic momentum within its niche market.

Key Takeaways

- Delve into our full catalog of 4627 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2402

Ichia Technologies

Manufactures, processes, and trades in components and materials for electronics, home appliances, electronical engineering, electrical equipment, communications, and computers in the United States, Europe, and Asia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives