- Japan

- /

- Construction

- /

- TSE:1968

Taihei Dengyo Kaisha And 2 More Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to react to evolving political landscapes and economic indicators, U.S. stocks have surged toward record highs fueled by optimism surrounding trade policies and advancements in artificial intelligence. In this dynamic environment, dividend stocks like Taihei Dengyo Kaisha offer investors a potential source of steady income and stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.39% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★☆ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Taihei Dengyo Kaisha (TSE:1968)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taihei Dengyo Kaisha, Ltd. operates in the plant construction industry both in Japan and internationally, with a market capitalization of ¥97.77 billion.

Operations: Taihei Dengyo Kaisha, Ltd.'s revenue is primarily derived from its Construction segment, generating ¥46.15 billion, and its Maintenance and Renovation segment, contributing ¥85.49 billion.

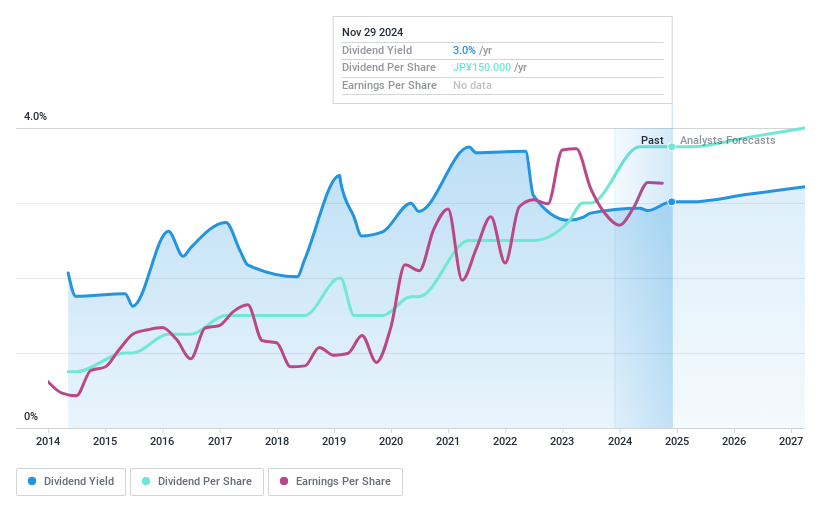

Dividend Yield: 3.1%

Taihei Dengyo Kaisha presents a mixed picture for dividend investors. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 27.6% and 46.2%, respectively. Despite this, the dividend yield of 3.11% is lower than the top tier in Japan, and its dividend history has been volatile over the past decade, impacting reliability. However, trading at a price-to-earnings ratio of 10.2x suggests good relative value compared to peers in the JP market (13.5x).

- Click here to discover the nuances of Taihei Dengyo Kaisha with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Taihei Dengyo Kaisha is trading behind its estimated value.

Fuji Nihon (TSE:2114)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fuji Nihon Corporation manufactures and sells refined sugar and sugar-related products in Japan, with a market cap of ¥27.93 billion.

Operations: Fuji Nihon Corporation's revenue is primarily derived from refined sugar, generating ¥13.56 billion, and functional materials, contributing ¥12.63 billion, along with additional income from real estate at ¥665.32 million.

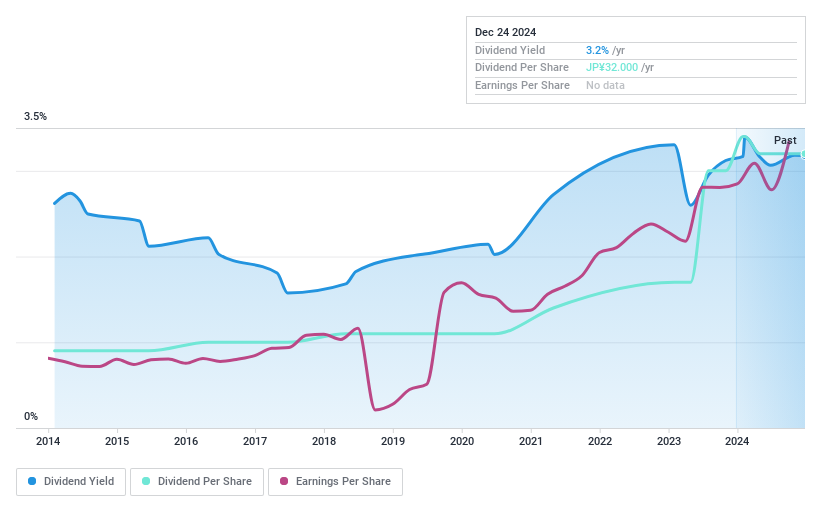

Dividend Yield: 3.1%

Fuji Nihon Corporation's dividend payments are well-covered by earnings and cash flows, with payout ratios of 33.6% and 30.6%, respectively. Despite this financial stability, the dividends have been volatile over the past decade, impacting their reliability for investors seeking consistent returns. The recent share buyback program aims to enhance shareholder value and improve capital efficiency. Additionally, the company is expanding into Thailand's cassava starch market through a strategic partnership to bolster future growth prospects.

- Navigate through the intricacies of Fuji Nihon with our comprehensive dividend report here.

- Our valuation report here indicates Fuji Nihon may be undervalued.

ValueCommerce (TSE:2491)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ValueCommerce Co., Ltd. offers marketing solutions in Japan and has a market cap of ¥26.23 billion.

Operations: ValueCommerce Co., Ltd. generates revenue through its EC Solutions segment, which accounts for ¥17.76 billion, and its Marketing Solutions segment, contributing ¥12.12 billion.

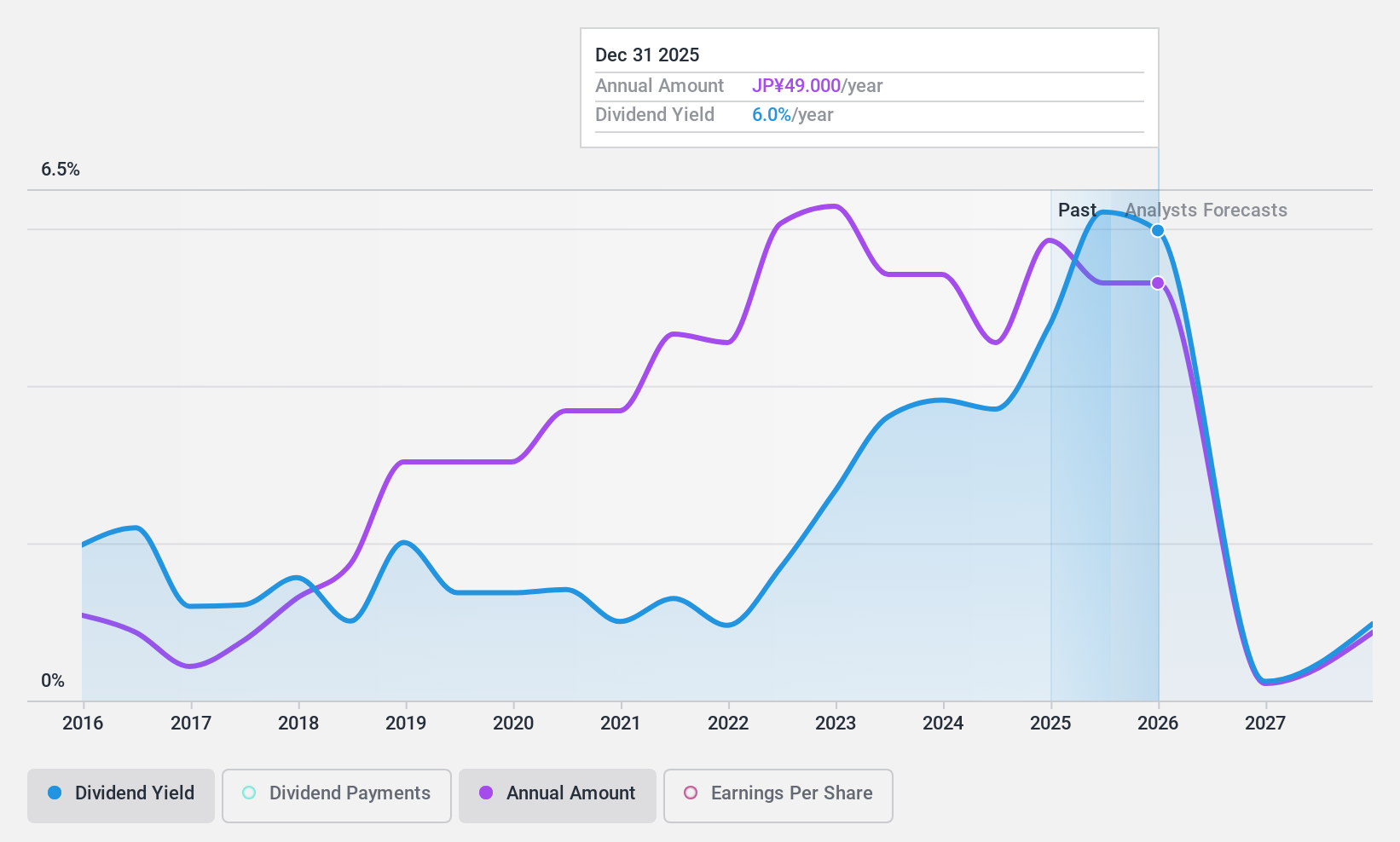

Dividend Yield: 4.5%

ValueCommerce's dividend yield is among the top 25% in Japan, with a payout ratio of 51.7% and cash payout ratio of 33.3%, indicating dividends are well-covered by earnings and cash flows. However, the company's dividend history has been volatile over the past decade, affecting its reliability for consistent income. Despite this instability, ValueCommerce trades at a significant discount to estimated fair value, suggesting potential for capital appreciation alongside its dividend offerings.

- Click here and access our complete dividend analysis report to understand the dynamics of ValueCommerce.

- The valuation report we've compiled suggests that ValueCommerce's current price could be quite moderate.

Where To Now?

- Explore the 1972 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taihei Dengyo Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1968

Taihei Dengyo Kaisha

Engages in the plant construction business in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives