- Japan

- /

- Construction

- /

- TSE:1882

Undiscovered Gems With Strong Fundamentals For February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating indices and geopolitical tensions, small-cap stocks are experiencing heightened scrutiny amid volatile earnings reports and AI competition concerns. Despite these challenges, the search for undiscovered gems with robust fundamentals remains crucial for investors looking to capitalize on potential opportunities in this dynamic environment. Identifying such stocks involves focusing on strong financial health, competitive advantages, and resilience in the face of broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ELANTAS Beck India | NA | 15.21% | 25.05% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Abans Financial Services | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Johnson Electric Holdings (SEHK:179)

Simply Wall St Value Rating: ★★★★★★

Overview: Johnson Electric Holdings Limited is an investment holding company that specializes in the manufacture and sale of motion systems on a global scale, with a market cap of approximately HK$9.69 billion.

Operations: The primary revenue stream for Johnson Electric Holdings comes from its Auto Parts & Accessories segment, generating $3.73 billion. The company's financial performance can be examined through its net profit margin, which reflects the efficiency of its operations and cost management strategies.

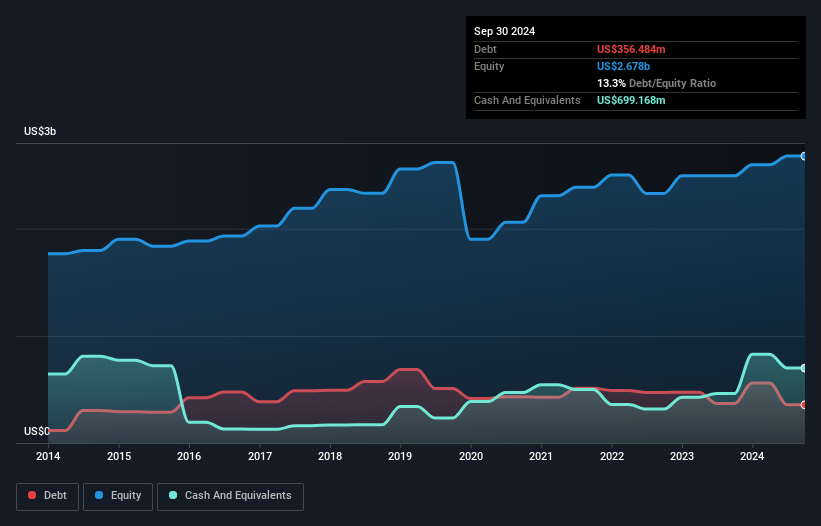

Johnson Electric Holdings, a notable player in the auto components sector, has seen its debt to equity ratio improve from 19.4% to 13.3% over five years, reflecting stronger financial health. Despite a challenging industry landscape with a -19.9% decline, the company's earnings grew by 7.5%, showcasing resilience and outperforming peers. Trading at 71.8% below estimated fair value suggests potential undervaluation for investors seeking opportunities in this space. Recent sales figures indicate a decrease of US$141 million year-over-year due to adverse exchange rates and market conditions, though net income increased slightly to US$129 million from US$120 million previously reported.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. is a company engaged in the development and production of optoelectronic components, with a market capitalization of CN¥12.20 billion.

Operations: Wuxi Taclink Optoelectronics Technology generates revenue primarily from the sale of optoelectronic components. The company's cost structure includes expenses related to production and materials, impacting its overall profitability. Notably, the gross profit margin has experienced fluctuations over recent periods, reflecting changes in cost efficiencies and pricing strategies.

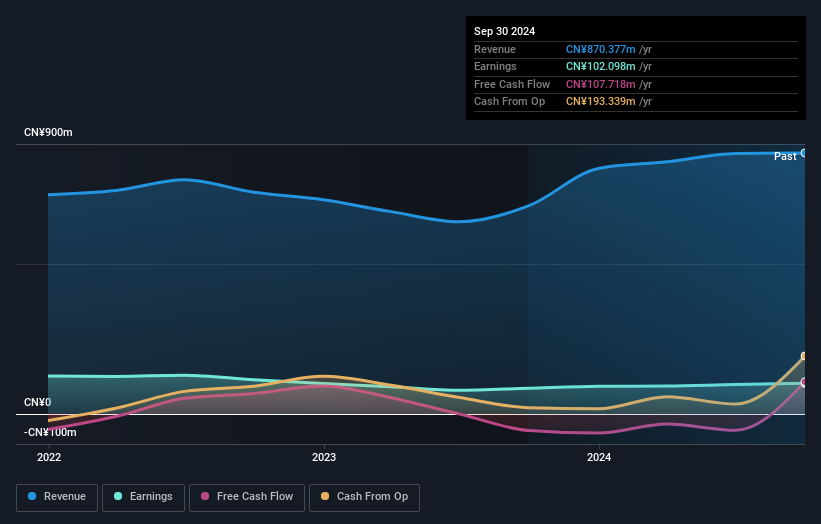

Wuxi Taclink Optoelectronics Technology, a smaller player in the electronics sector, has shown impressive financial resilience. Over the past year, earnings grew by 19%, outpacing the industry's 3% growth rate. The company reduced its debt to equity ratio from 39.8% to just 0.9% over five years, indicating strong financial management. Despite recent share price volatility, Wuxi Taclink maintains high-quality earnings and covers interest payments comfortably. With a positive free cash flow and more cash than total debt, it seems well-positioned for future growth as forecasted earnings are expected to grow at an annual rate of 33.66%.

- Click here to discover the nuances of Wuxi Taclink Optoelectronics Technology with our detailed analytical health report.

Learn about Wuxi Taclink Optoelectronics Technology's historical performance.

Toa Road (TSE:1882)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toa Road Corporation operates in the civil engineering sector in Japan with a market capitalization of approximately ¥700.71 billion.

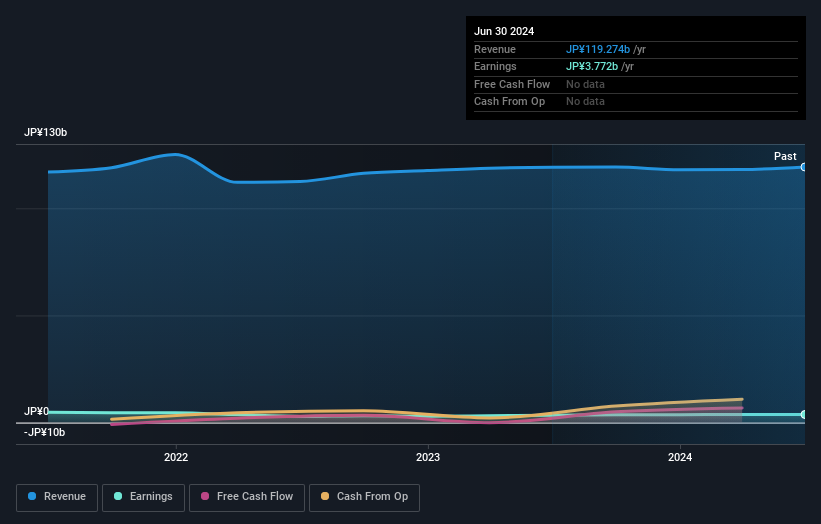

Operations: Toa Road Corporation generates revenue primarily from its Construction Business, which contributed ¥72.66 billion, and its Manufacturing and Sales, Environmental Business, etc., segment with ¥49.52 billion. The company's cost structure impacts its financial performance through the elimination of inter-segment transactions amounting to -¥1.06 billion.

Toa Road, a nimble player in the construction sector, is intriguing due to its financial dynamics and market behavior. Over the past five years, it has impressively reduced its debt-to-equity ratio from 15.7% to 2.2%, indicating effective debt management. Despite earnings growing at a modest 3.4% annually over this period, they lag behind the industry average of 20.3%. The company's free cash flow remains negative, likely impacting its ability to fund new projects without external financing. Its share price has been highly volatile recently, reflecting market uncertainty or speculation around upcoming results expected on February 6th and 7th of this year.

- Dive into the specifics of Toa Road here with our thorough health report.

Evaluate Toa Road's historical performance by accessing our past performance report.

Seize The Opportunity

- Reveal the 4719 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toa Road might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1882

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives