- Japan

- /

- Construction

- /

- TSE:1820

Nishimatsu Construction Co., Ltd.'s (TSE:1820) P/E Is Still On The Mark Following 29% Share Price Bounce

Nishimatsu Construction Co., Ltd. (TSE:1820) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 37%.

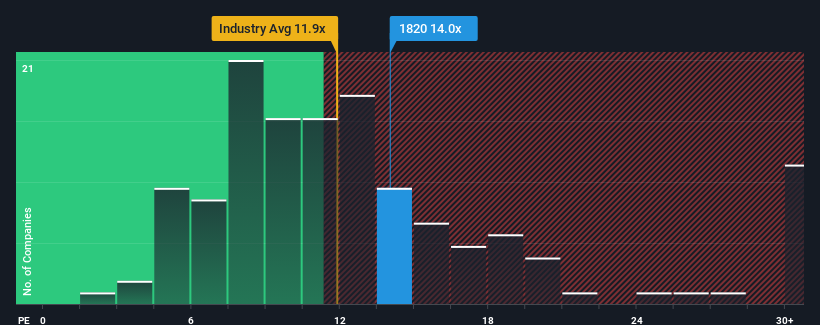

Although its price has surged higher, there still wouldn't be many who think Nishimatsu Construction's price-to-earnings (or "P/E") ratio of 14x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Nishimatsu Construction as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Nishimatsu Construction

How Is Nishimatsu Construction's Growth Trending?

The only time you'd be comfortable seeing a P/E like Nishimatsu Construction's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 84% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 7.9% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.4% each year, which is not materially different.

With this information, we can see why Nishimatsu Construction is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Nishimatsu Construction's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nishimatsu Construction maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Nishimatsu Construction (1 is a bit unpleasant!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Nishimatsu Construction. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nishimatsu Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1820

Nishimatsu Construction

Engages in the construction, development, real estate, and other businesses in Japan and internationally.

Average dividend payer and fair value.

Market Insights

Community Narratives