- Taiwan

- /

- Semiconductors

- /

- TWSE:6937

Exploring Undiscovered Gems With Strong Potential In December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, leading to broad-based declines in U.S. stocks, with smaller-cap indexes experiencing more pronounced losses. Despite these challenges, strong economic data such as robust consumer spending and job growth offer some optimism amidst the volatility. In this context, identifying undiscovered gems with strong potential involves looking for stocks that can thrive despite market headwinds—those with solid fundamentals and resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Saison Technology | NA | 0.66% | -13.83% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shantui Construction Machinery (SZSE:000680)

Simply Wall St Value Rating: ★★★★★★

Overview: Shantui Construction Machinery Co., Ltd. provides construction machinery products both within China and internationally, with a market capitalization of CN¥14.22 billion.

Operations: Shantui Construction Machinery generates its revenue primarily from the sale of construction machinery products in both domestic and international markets. The company's financial performance is influenced by various costs, including manufacturing and distribution expenses. It is important to note that the net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

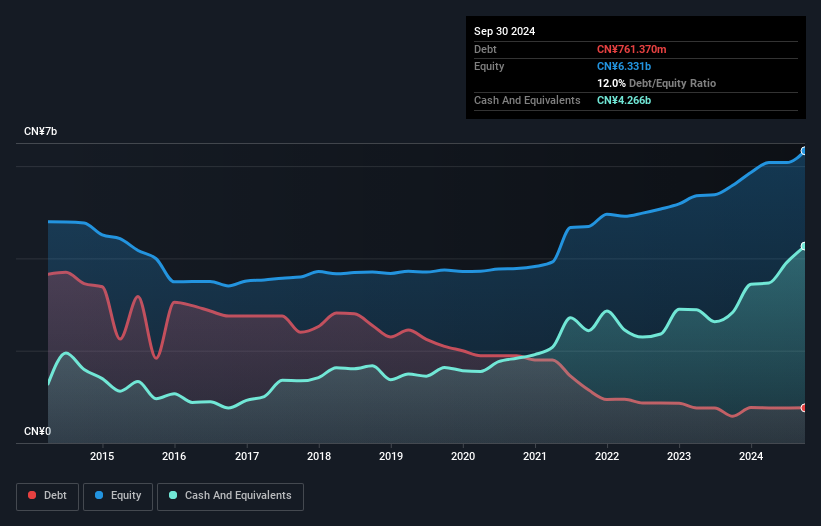

Shantui Construction Machinery, a notable player in the machinery industry, has shown significant growth with earnings up 44.6% over the past year, outpacing the industry's -0.2%. The company appears to be trading at a good value, estimated at 71.4% below fair value. Over five years, its debt-to-equity ratio improved from 55.9% to 12%, indicating strong financial management. Recent earnings for nine months ending September showed sales of CNY 9.84 billion and net income of CNY 674 million, reflecting solid performance compared to last year's figures of CNY 7.53 billion and CNY 503 million respectively.

Kiyo Bank (TSE:8370)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kiyo Bank, Ltd. is a financial institution offering a range of banking products and services to individuals, corporates, and business customers in Japan with a market cap of ¥136.34 billion.

Operations: The primary revenue stream for Kiyo Bank comes from its banking segment, generating ¥73.12 billion.

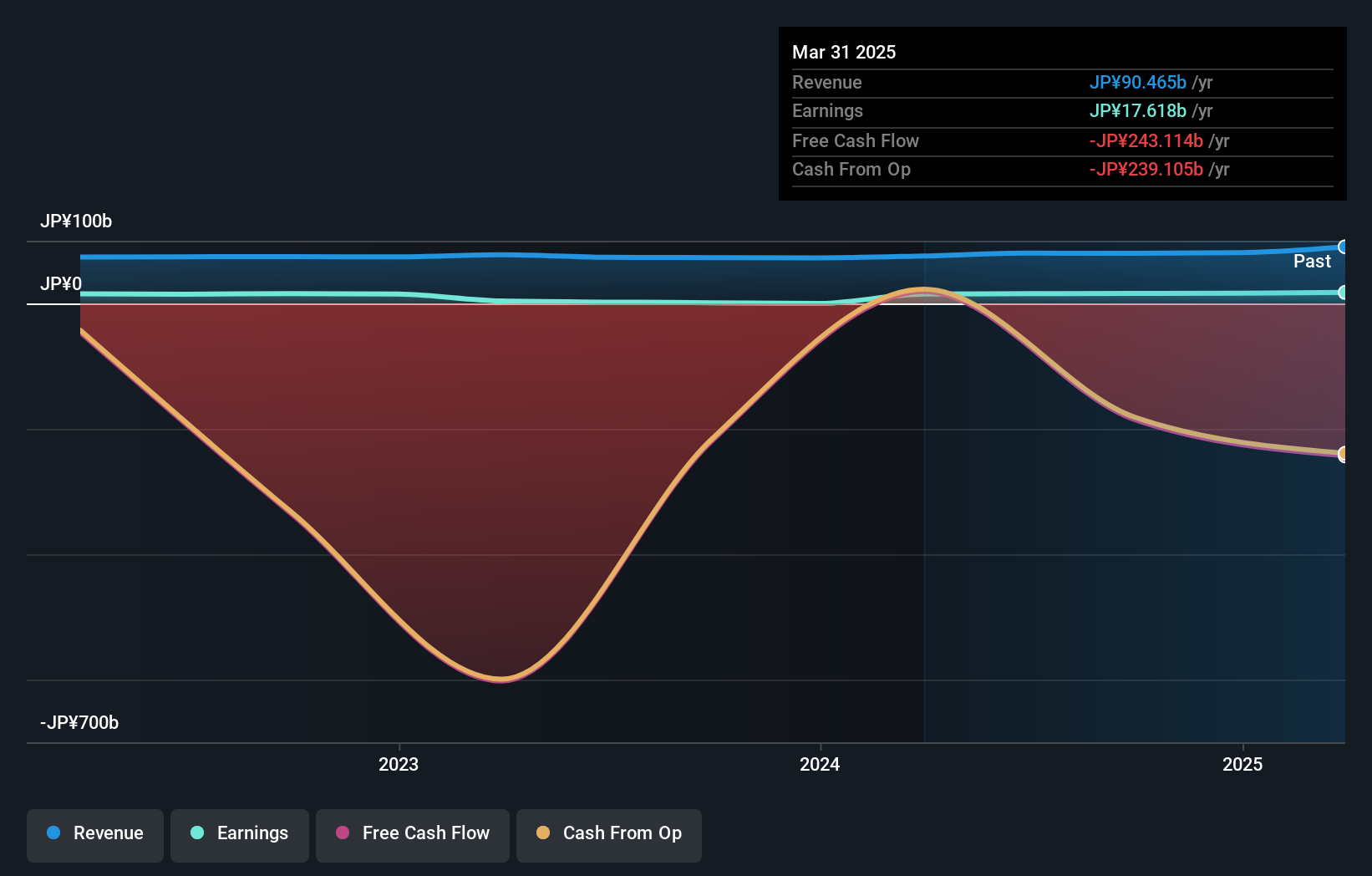

With assets totaling ¥5,805.5 billion and equity of ¥240.3 billion, Kiyo Bank operates with a robust foundation. It has deposits amounting to ¥4,647.6 billion and loans at ¥3,991.2 billion, though its net interest margin stands at a modest 0.9%. The bank's allowance for bad loans is low at 39%, reflecting prudent risk management despite an insufficient coverage ratio of 1.6% relative to total loans. Impressively, earnings soared by 1300% last year, outpacing the industry average significantly and highlighting high-quality earnings performance amidst primarily low-risk funding sources comprising 84% of liabilities.

- Dive into the specifics of Kiyo Bank here with our thorough health report.

Understand Kiyo Bank's track record by examining our Past report.

Skytech (TWSE:6937)

Simply Wall St Value Rating: ★★★★★☆

Overview: Skytech Inc. operates in the semiconductor and related technology industries, with a market capitalization of NT$24.93 billion.

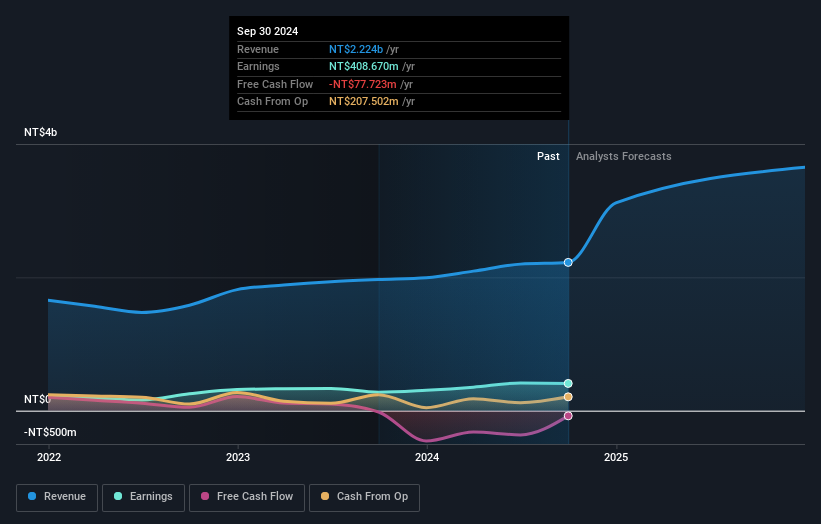

Operations: Skytech generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to NT$2.22 billion.

Skytech has been making waves with a notable earnings growth of 47.4% over the past year, outpacing the semiconductor industry's 5.9%. Despite this impressive performance, shareholders experienced dilution in the last year, and its share price has shown high volatility recently. The company reported third-quarter sales of TWD 563.63 million, up from TWD 537.75 million a year ago, although net income dipped slightly to TWD 82.89 million from TWD 89.41 million previously. For nine months ending September, sales reached TWD 1,568.96 million with net income climbing to TWD 261.16 million compared to last year's figures of TWD 1,337.55 million and TWD 159.15 million respectively.

- Get an in-depth perspective on Skytech's performance by reading our health report here.

Examine Skytech's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4612 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6937

Solid track record with excellent balance sheet.