- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1898

3 Reliable Dividend Stocks Offering Up To 4.9% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of a new U.S. administration and shifting economic policies, investors are keenly observing sector performance and inflation trends. With interest rates remaining a focal point, dividend stocks continue to attract attention for their potential to offer stable income amidst market volatility. In this environment, reliable dividend stocks that provide attractive yields can be appealing for those seeking consistent returns while managing risk.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.73% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

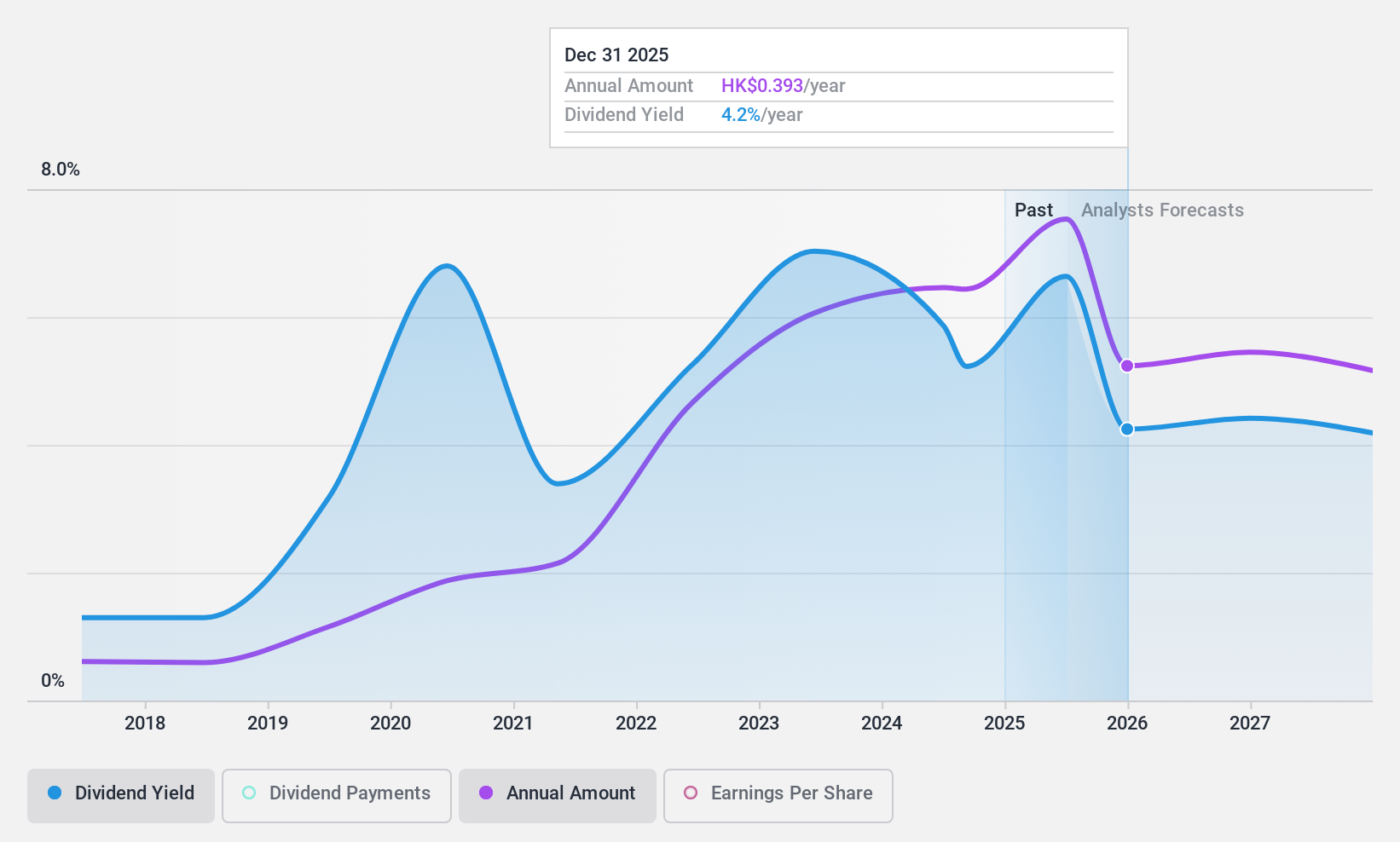

China Coal Energy (SEHK:1898)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited is involved in the mining, production, processing, trading, and sale of coal both within the People's Republic of China and internationally, with a market cap of HK$168.30 billion.

Operations: In its revenue segments, China Coal Energy Company Limited engages in the mining, production, processing, and trading of coal domestically and abroad.

Dividend Yield: 5%

China Coal Energy's dividend payments are covered by earnings with a payout ratio of 52.4% and a cash payout ratio of 31.2%, indicating sustainability from both profits and cash flows. However, the dividend has been volatile over the past decade, experiencing annual drops exceeding 20%, making it unreliable despite past growth. The company is trading at a significant discount to its estimated fair value, but its dividend yield of 4.97% is below top-tier levels in Hong Kong's market.

- Navigate through the intricacies of China Coal Energy with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of China Coal Energy shares in the market.

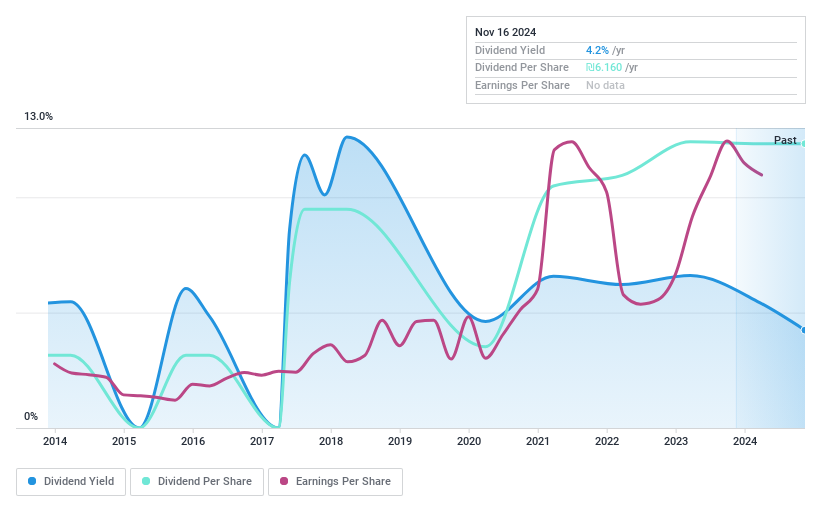

I.B.I. Investment House (TASE:IBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: I.B.I. Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market cap of ₪1.90 billion.

Operations: I.B.I. Investment House Ltd.'s revenue segments include various financial services and investment activities, contributing to its diversified income streams.

Dividend Yield: 4.1%

I.B.I. Investment House's dividends are well-covered by earnings and cash flows, with payout ratios of 45.4% and 45.1%, respectively, suggesting sustainability despite a volatile track record over the past decade. The dividend yield of 4.13% is below the top tier in Israel's market, and while dividends have increased over ten years, they remain unreliable due to volatility. The company trades at a discount to its estimated fair value, enhancing potential appeal for investors seeking value opportunities amidst dividend uncertainty.

- Get an in-depth perspective on I.B.I. Investment House's performance by reading our dividend report here.

- Our valuation report unveils the possibility I.B.I. Investment House's shares may be trading at a discount.

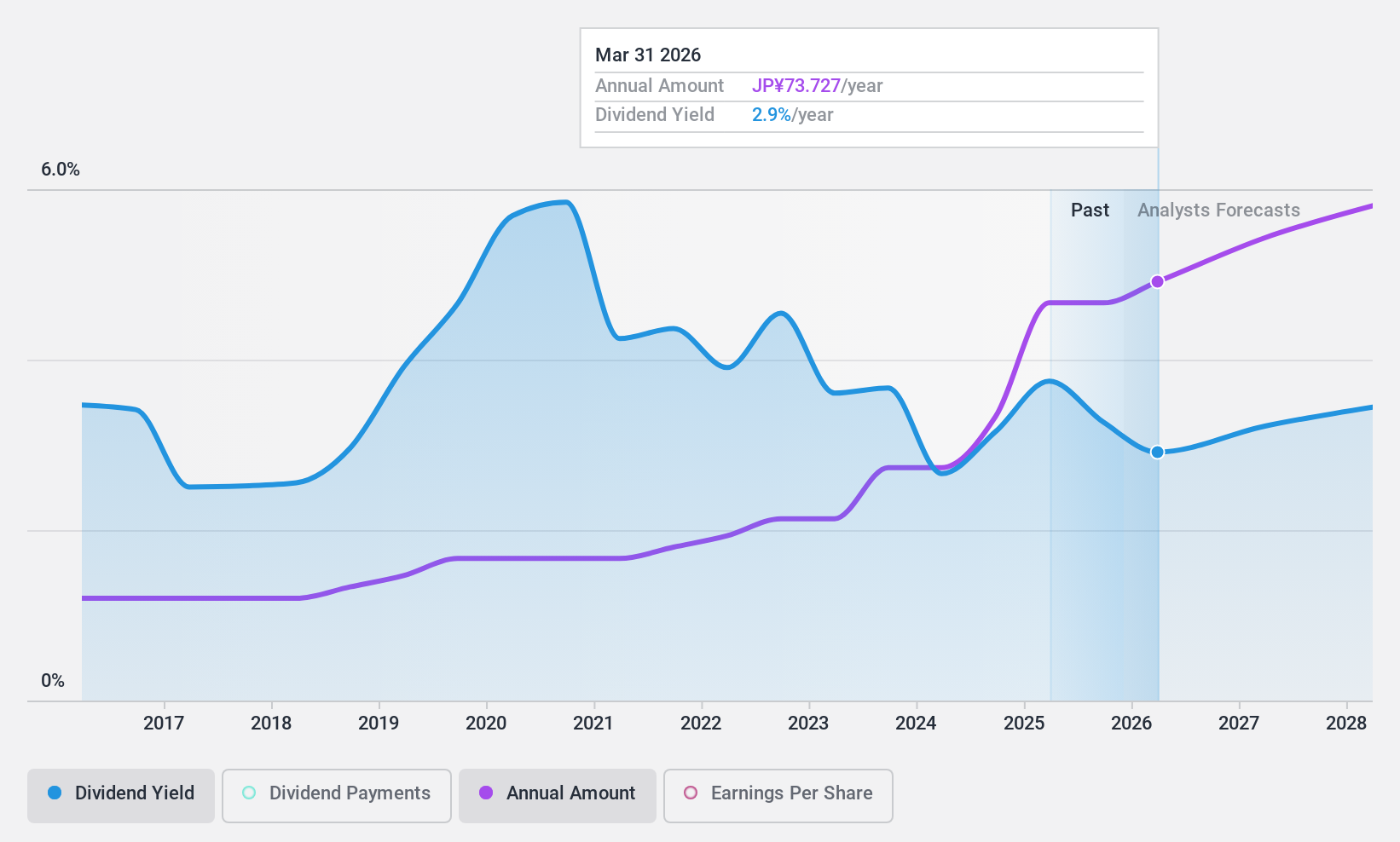

Mitsubishi UFJ Financial Group (TSE:8306)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi UFJ Financial Group, Inc. is a bank holding company involved in diverse financial services across Japan, the United States, Europe, Asia/Oceania, and globally with a market cap of ¥21.11 trillion.

Operations: The revenue segments for Mitsubishi UFJ Financial Group include a variety of financial services conducted in Japan, the United States, Europe, Asia/Oceania, and globally.

Dividend Yield: 3.9%

Mitsubishi UFJ Financial Group offers a high dividend yield of 3.87%, ranking it in the top 25% of JP market payers, with stable and growing dividends over the past decade. The payout ratio is low at 32.4%, indicating strong coverage by earnings. Recent announcements include a share buyback program worth ¥300 billion to enhance shareholder returns and a significant increase in dividends, reflecting the company's commitment to maintaining attractive returns for investors.

- Unlock comprehensive insights into our analysis of Mitsubishi UFJ Financial Group stock in this dividend report.

- According our valuation report, there's an indication that Mitsubishi UFJ Financial Group's share price might be on the cheaper side.

Next Steps

- Click this link to deep-dive into the 1964 companies within our Top Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1898

China Coal Energy

China Coal Energy Company Limited mines, produces, processes, trades in, and sells coal in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives