As global markets grapple with inflationary pressures and trade policy uncertainties, small-cap stocks have been particularly impacted, with indices like the S&P MidCap 400 and Russell 2000 experiencing notable declines. Despite these challenges, the easing of U.S. inflation offers a glimmer of hope for investors seeking potential opportunities in undiscovered gems that may thrive amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wholetech System Hitech | 8.29% | 14.93% | 19.87% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Lungyen Life Service (TPEX:5530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lungyen Life Service Corporation operates in Taiwan, offering funeral facilities and services, with a market capitalization of NT$31.93 billion.

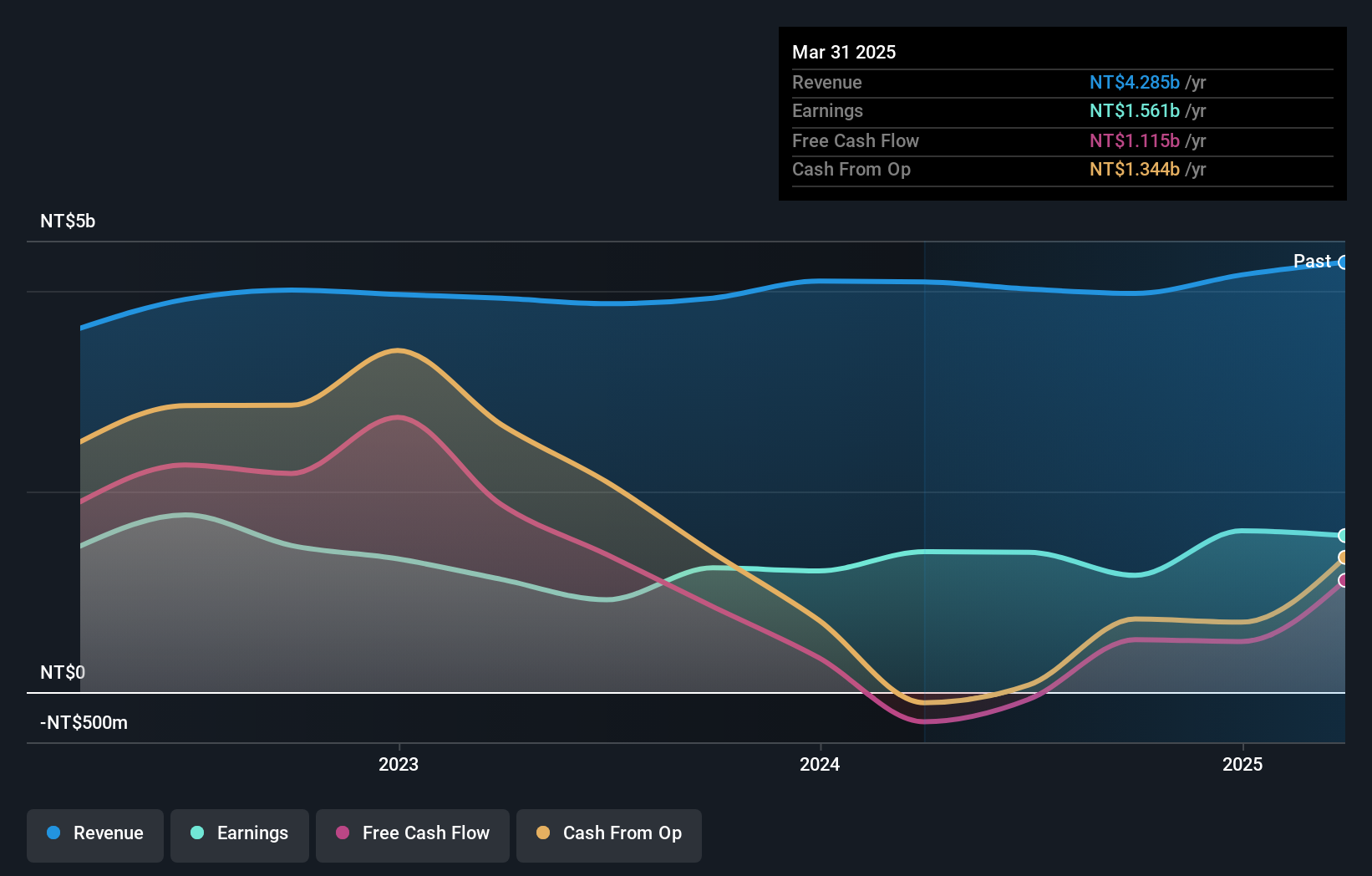

Operations: The company's primary revenue streams include life ritual services, generating NT$2.02 billion, and the sale of tower tombs, contributing NT$1.65 billion. Additional income is derived from construction sales and property leasing.

Lungyen Life Service, a smaller player in its sector, has demonstrated robust financial health with earnings growth of 32.9% last year, outpacing the Consumer Services industry by a significant margin. The company reported net income of TWD 1.61 billion for 2024, up from TWD 1.21 billion in the previous year, highlighting its high-quality earnings profile. Despite a decrease in consolidated revenues to TWD 636 million for January through December 2025 compared to the prior year, Lungyen's debt-to-equity ratio has impressively reduced from 17% to just under 4% over five years, indicating prudent financial management.

- Take a closer look at Lungyen Life Service's potential here in our health report.

Assess Lungyen Life Service's past performance with our detailed historical performance reports.

Juroku Financial GroupInc (TSE:7380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Juroku Financial Group, Inc. offers a range of banking and leasing products and services in Japan with a market capitalization of approximately ¥171.37 billion.

Operations: The company generates revenue through its banking and leasing segments in Japan. It has a market capitalization of approximately ¥171.37 billion, reflecting its significant presence in the financial sector. The financial data indicates a focus on diversifying income streams within these core areas to support growth and stability.

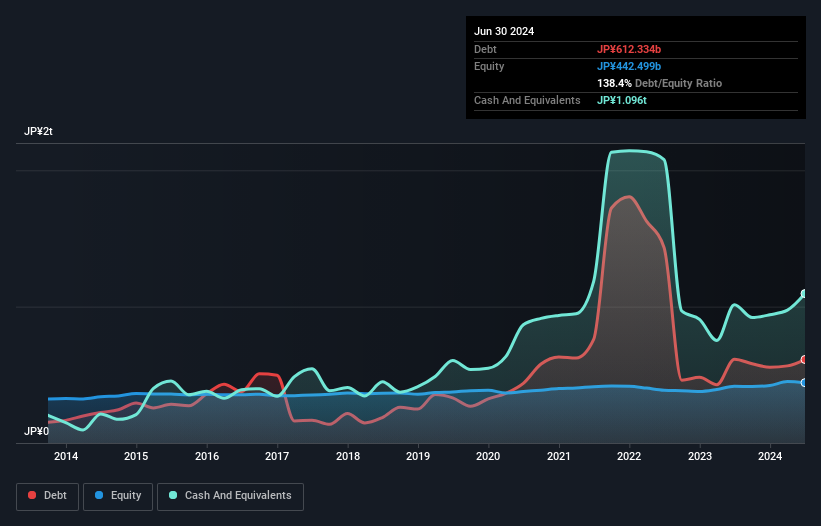

Juroku Financial Group, with assets totaling ¥7,652.2 billion and equity of ¥434.9 billion, operates in a niche space with a focus on stability. Its deposits stand at ¥6,413.3 billion against loans of ¥4,970.6 billion, reflecting a solid customer base and low-risk funding profile since 89% of liabilities come from deposits. While the net interest margin is modest at 0.8%, earnings have grown by 8.5% annually over the past five years despite an insufficient bad loan allowance at 1.3%. Trading significantly below its estimated fair value by 37%, this financial entity offers potential for value-seeking investors amidst industry challenges.

Suruga Bank (TSE:8358)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Suruga Bank Ltd. offers a range of banking and financial services to both individual and corporate clients in Japan, with a market capitalization of ¥249.11 billion.

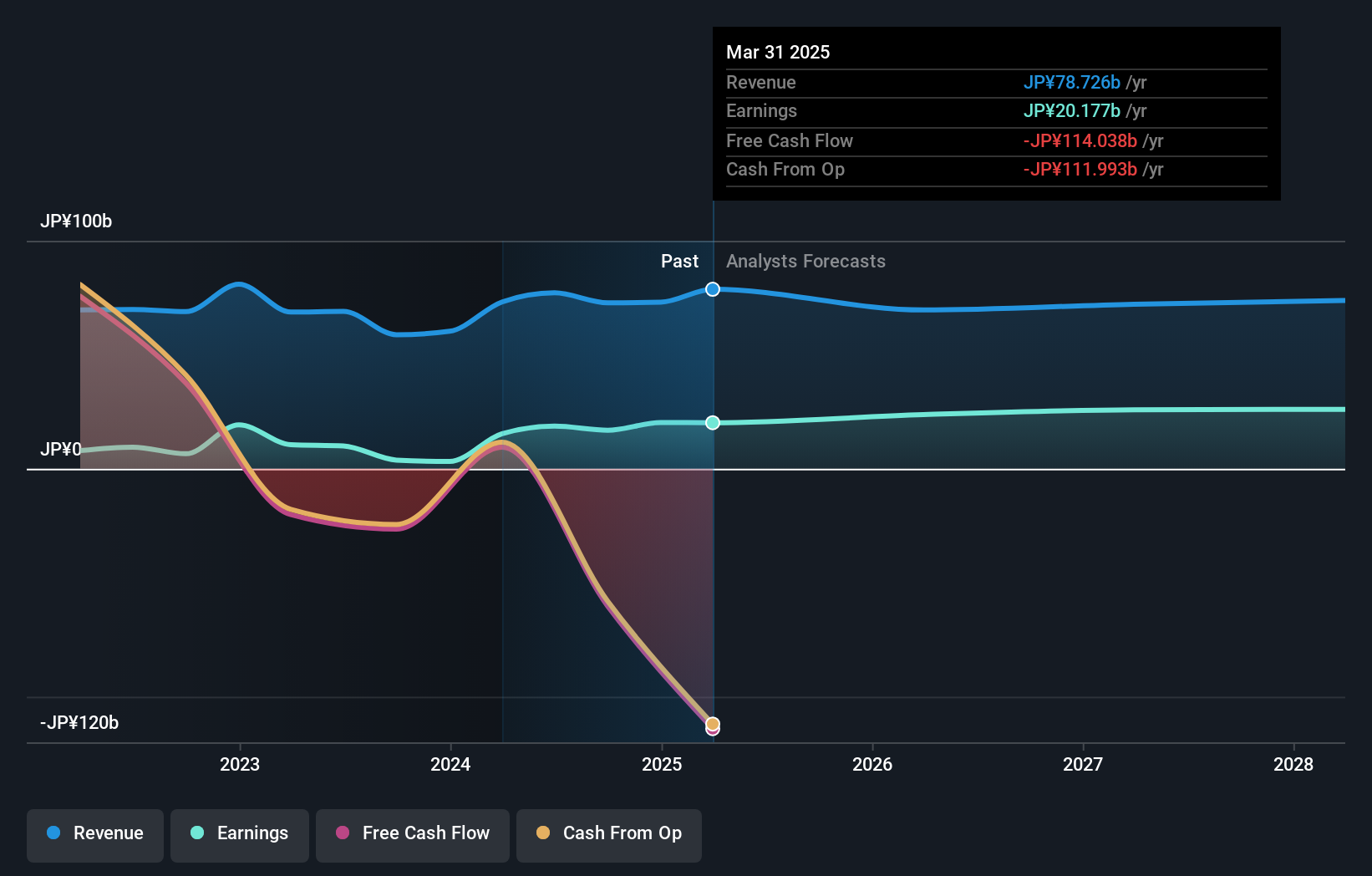

Operations: Suruga Bank generates revenue primarily from its banking segment, which accounts for ¥83.80 billion. The bank's market capitalization stands at ¥249.11 billion.

Suruga Bank, with assets totaling ¥3.45 trillion and equity of ¥301.5 billion, is navigating a challenging landscape with a high level of bad loans at 7.7% of total loans and an insufficient allowance for these non-performing loans at 55%. Despite this, the bank's earnings surged by 534% last year, outpacing the industry average significantly. Suruga Bank's reliance on low-risk customer deposits for funding enhances its stability. A share repurchase program aims to improve shareholder returns by buying back up to 4.5 million shares worth ¥6 billion before April 30, 2025, reflecting strategic financial management amidst ongoing challenges.

- Get an in-depth perspective on Suruga Bank's performance by reading our health report here.

Understand Suruga Bank's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 3205 Global Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Suruga Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8358

Suruga Bank

Provides various banking and financial products and services to individuals and corporate customers in Japan.

Proven track record with adequate balance sheet.