3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 38.7%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by climbing U.S. stock indexes and heightened inflation expectations, investors are keenly observing the interplay between economic data and policy decisions. With indices like the S&P 500 and Nasdaq Composite nearing record highs, identifying stocks potentially trading below their intrinsic value becomes increasingly appealing. In this environment, a good stock is often characterized by strong fundamentals that may not yet be fully recognized by the market, offering potential opportunities for those looking to capitalize on undervaluation amidst broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.99 | 49.6% |

| Samwha ElectricLtd (KOSE:A009470) | ₩43150.00 | ₩86111.21 | 49.9% |

| Thomas Cook (India) (BSE:500413) | ₹125.25 | ₹249.45 | 49.8% |

| Wienerberger (WBAG:WIE) | €33.08 | €65.84 | 49.8% |

| Elin Electronics (NSEI:ELIN) | ₹127.89 | ₹255.10 | 49.9% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38300.00 | ₫76325.14 | 49.8% |

| Solum (KOSE:A248070) | ₩17580.00 | ₩34915.02 | 49.6% |

| Hensoldt (XTRA:HAG) | €40.78 | €81.50 | 50% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

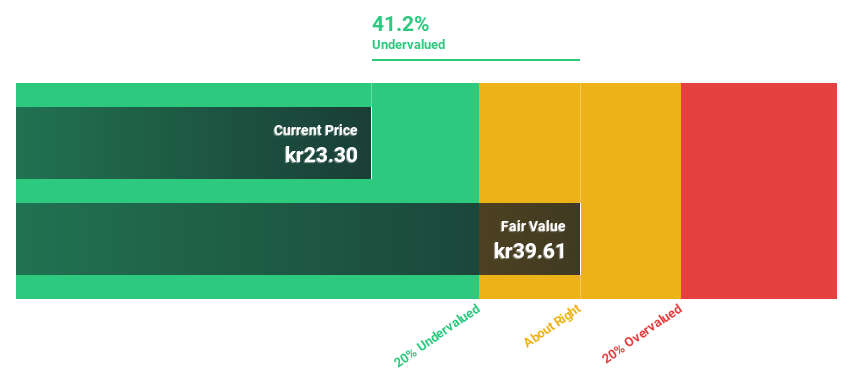

LINK Mobility Group Holding (OB:LINK)

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market cap of NOK6.98 billion.

Operations: The company's revenue segments include Central Europe with NOK1.69 billion, Western Europe at NOK2.11 billion, Northern Europe contributing NOK1.54 billion, and Global Messaging generating NOK1.66 billion.

Estimated Discount To Fair Value: 38%

LINK Mobility Group Holding's recent financial performance highlights significant growth, with net income rising to NOK 255.48 million from NOK 67.28 million the previous year. Trading at NOK 24.75, it is considered undervalued based on discounted cash flow analysis, with a fair value estimate of NOK 39.92—38% higher than its current price. Despite large one-off items affecting earnings quality, forecasted earnings and revenue growth surpass Norwegian market averages, suggesting potential for future value realization despite low return on equity projections.

- Our comprehensive growth report raises the possibility that LINK Mobility Group Holding is poised for substantial financial growth.

- Take a closer look at LINK Mobility Group Holding's balance sheet health here in our report.

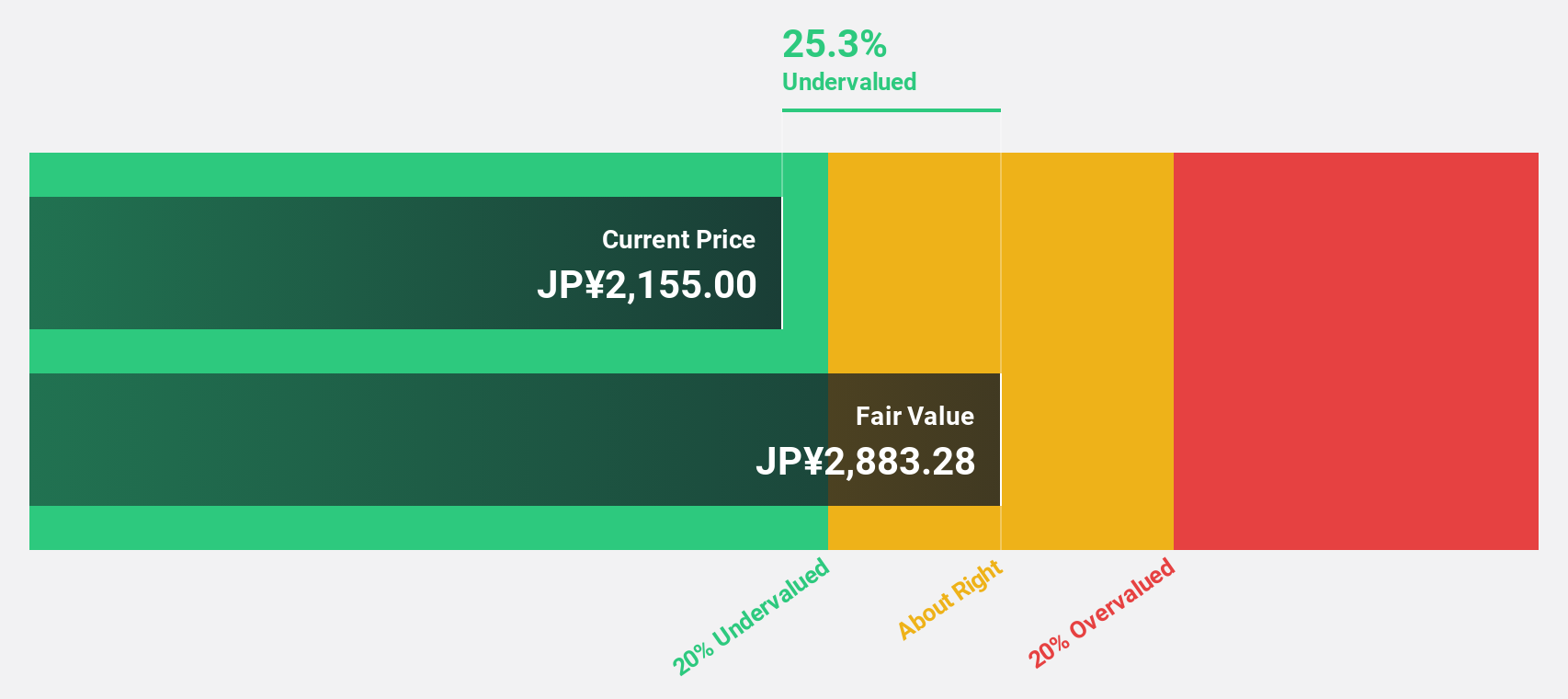

Nishi-Nippon Financial Holdings (TSE:7189)

Overview: Nishi-Nippon Financial Holdings, Inc. manages and operates banks and other companies offering financial and non-financial solutions in Japan, Hong Kong, China, and Singapore with a market cap of ¥283.45 billion.

Operations: Revenue Segments (in millions of ¥): The company's revenue is derived from its operations in banking and financial services across Japan, Hong Kong, China, and Singapore.

Estimated Discount To Fair Value: 38.7%

Nishi-Nippon Financial Holdings is trading at ¥2,039, significantly below its estimated fair value of ¥3,327.39 based on discounted cash flow analysis. The company anticipates profit growth of 23% annually, outpacing the Japanese market average. Recent guidance projects a profit of ¥30 billion for fiscal year-end March 2025. Despite an unstable dividend history and low future return on equity forecasts, revenue growth remains robust at 17.3% annually compared to the market's 4.2%.

- Upon reviewing our latest growth report, Nishi-Nippon Financial Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Nishi-Nippon Financial Holdings.

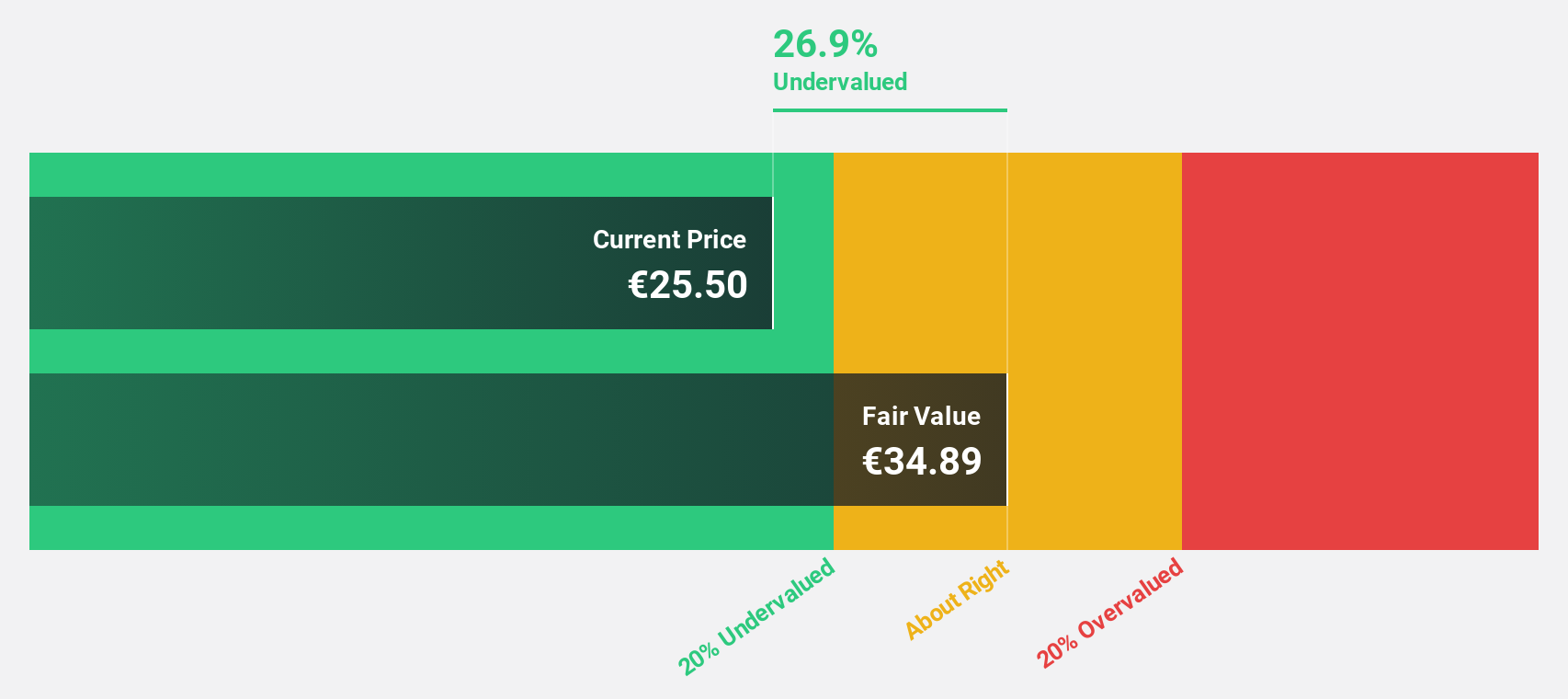

Kontron (XTRA:SANT)

Overview: Kontron AG provides internet of things (IoT) solutions in Austria and internationally, with a market cap of €1.26 billion.

Operations: The company's revenue segments include €1.16 billion from Europe, €294.77 million from Global operations, and €429.91 million from Software + Solutions.

Estimated Discount To Fair Value: 23%

Kontron is trading at €20.5, below its fair value estimate of €26.63, suggesting it may be undervalued based on cash flows. The company forecasts significant earnings growth of over 20% annually, with revenue expected to reach up to EUR 2 billion in 2025. Recent major contracts in the defense sector worth EUR 165 million and USD 20 million enhance its strategic positioning and potential for further market expansion despite slower revenue growth projections compared to earnings growth.

- Our earnings growth report unveils the potential for significant increases in Kontron's future results.

- Click here to discover the nuances of Kontron with our detailed financial health report.

Make It Happen

- Dive into all 921 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, manages and operates banks and other companies that provide financial and non-financial solutions in Japan, Hong Kong, China, and Singapore.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives