- Japan

- /

- Auto Components

- /

- TSE:7279

Hi-Lex (TSE:7279) Q4 Profit Rebound Tests Bullish Narrative Against Lofty 77.8x P/E

Reviewed by Simply Wall St

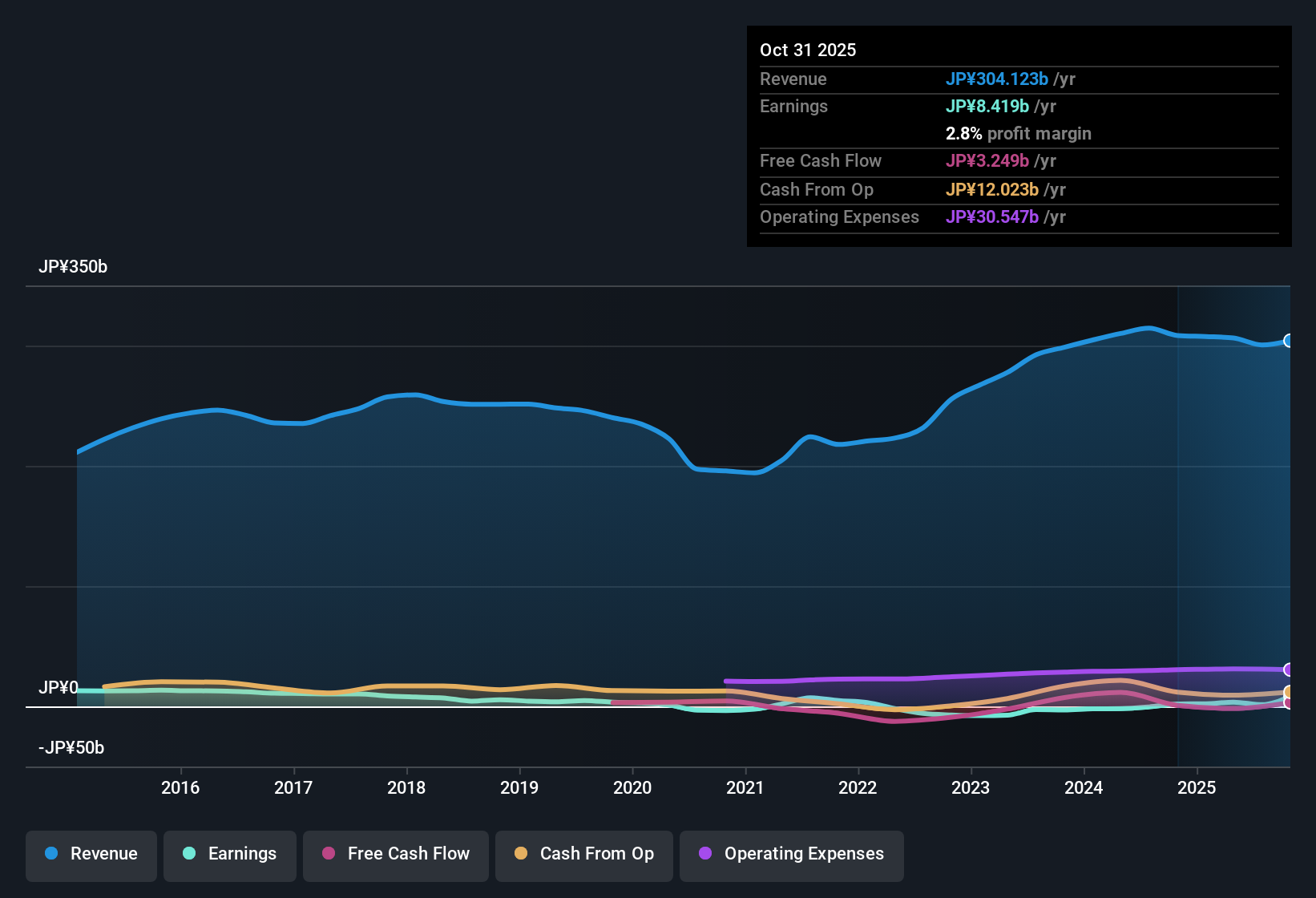

Hi-Lex (TSE:7279) has capped FY 2025 with fourth quarter revenue of ¥76.4 billion and net income of ¥5.0 billion, translating into EPS of ¥134.8. The company has seen quarterly revenue move from ¥72.9 billion in Q4 FY 2024 to ¥76.4 billion in Q4 FY 2025, while EPS swung from a loss of ¥52.3 to a profit of ¥134.8 over the same period, setting up a year in which trailing twelve month EPS reached ¥224.8 on net income of ¥8.4 billion from ¥304.1 billion in revenue. Overall, margins look healthier than a year ago, giving investors a clearer view of the underlying profitability story.

See our full analysis for Hi-Lex.With the headline numbers on the table, the next step is to see how this turnaround in revenue and EPS compares with the dominant narratives investors have been trading on, and where those stories might now need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM profit reaches ¥8.4 billion

- Over the last twelve months, Hi-Lex generated net income of ¥8.4 billion on ¥304.1 billion of revenue, with trailing EPS of ¥224.8.

- What stands out for a bullish angle is that this profit comes after prior losses, alongside about 7.1% average annual earnings growth over five years, yet:

- Recent quarterly net income moved from a loss of ¥2.0 billion in Q4 FY 2024 to a profit of ¥5.0 billion in Q4 FY 2025, showing how the trailing year captures a clear swing back into the black.

- Trailing revenue stayed in a tight band around ¥300 billion, so the improvement in EPS and net income is happening without relying on a big sales jump.

One off ¥2.6B loss distorts the picture

- The trailing twelve month figures include a single one off loss of ¥2.6 billion, which materially affects the reported profit and EPS trend.

- Critics highlight this one off as a key risk factor because:

- It means the ¥8.4 billion of trailing net income and ¥224.8 of EPS are not a clean run rate, as they blend normal operations with a large non recurring hit.

- Investors comparing FY 2025 to earlier years need to adjust for this charge to avoid over or underestimating how stable the new level of profitability really is.

Valuation stretched versus DCF fair value

- At a share price of ¥2,996 and a trailing P/E of 77.8 times, Hi-Lex trades well above both peers on 13.6 times and the auto components industry on 9.9 times, and also far above the DCF fair value of ¥221.79.

- Bears argue this valuation is the dominant risk because:

- The gap between the current price of ¥2,996 and the DCF fair value of ¥221.79 implies the stock is trading at a multiple of that intrinsic estimate even after accounting for the recent return to profit.

- With only a single year of profitability and a large ¥2.6 billion one off in the trailing numbers, the high 77.8 times P/E gives little margin for error if future earnings do not keep pace with these expectations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hi-Lex's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Hi-Lex looks richly priced with a lofty P/E, one off charges muddying the earnings picture, and only a short track record of clean profitability.

If that mix of fragile earnings and stretched valuation feels uncomfortable, use our these 908 undervalued stocks based on cash flows to quickly focus on companies where prices better reflect sustainable cash flows and offer more downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hi-Lex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7279

Hi-Lex

Operates in the automotive, industrial equipment, and medical equipment sectors in Japan and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)