- Japan

- /

- Auto Components

- /

- TSE:7250

Top 3 Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, where cautious Federal Reserve commentary and political uncertainties have weighed on investor sentiment, dividend stocks can offer a measure of stability and reliable income. As interest rate forecasts remain uncertain and economic data presents mixed signals, selecting dividend stocks with strong fundamentals becomes crucial for those seeking consistent returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

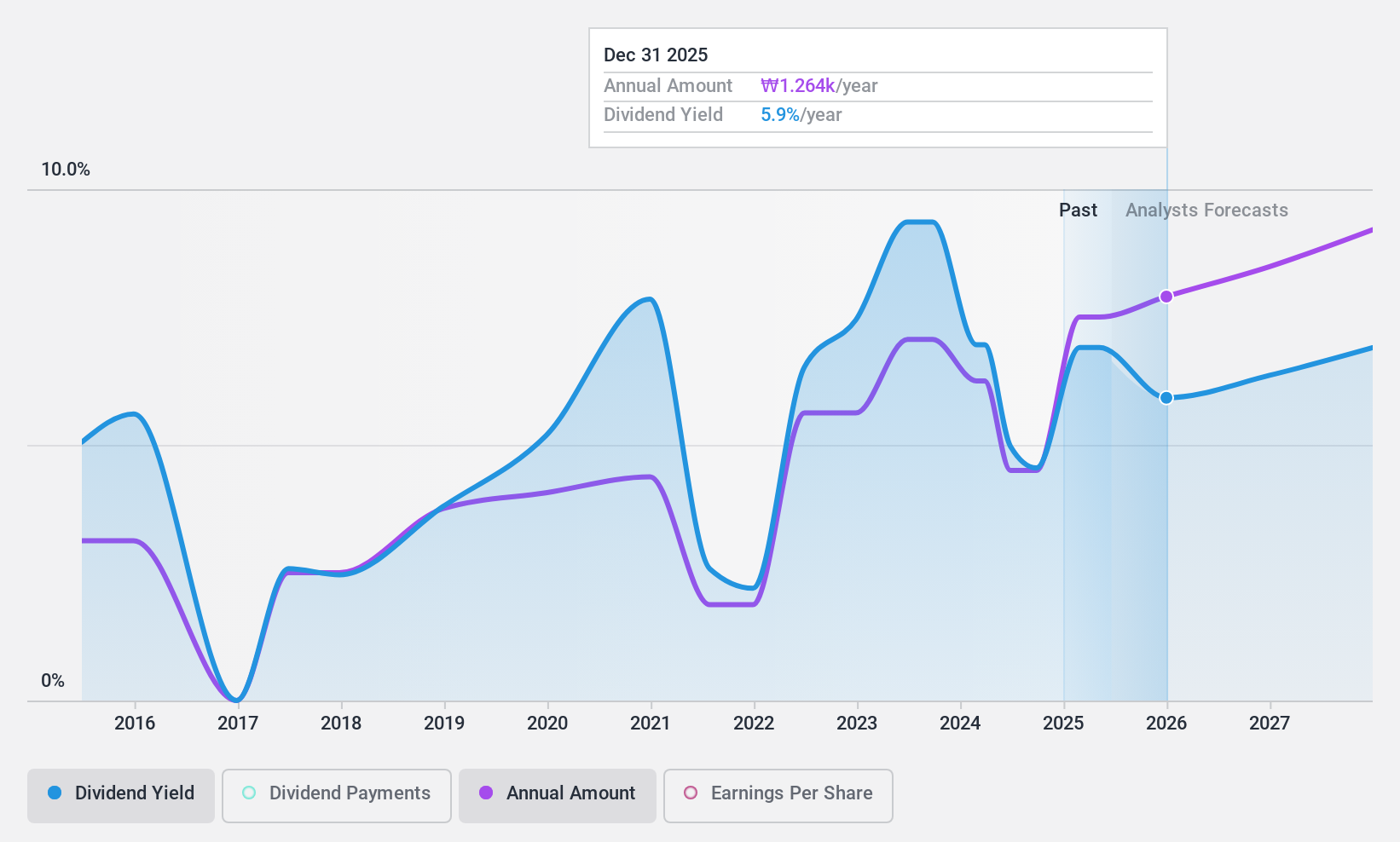

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, operates as a commercial bank offering a variety of financial services to individual, business, and institutional customers in Korea, with a market cap of approximately ₩11.62 trillion.

Operations: Woori Financial Group Inc. generates its revenue primarily through segments including Banking (₩7.45 billion), Capital (₩282.19 million), Credit Cards (₩468.39 million), and Investment Banking (-₩26.20 million).

Dividend Yield: 4.6%

Woori Financial Group's dividend yield of 4.59% ranks in the top 25% within the KR market, supported by a low payout ratio of 34.1%, indicating dividends are well covered by earnings. Despite this, its dividend history has been volatile and unreliable over the past decade, though dividends have increased overall during this period. Recent Q3 earnings showed steady net income growth to KRW 904 billion, reinforcing its financial stability amidst fluctuating dividend payments.

- Navigate through the intricacies of Woori Financial Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Woori Financial Group is priced lower than what may be justified by its financials.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products in Mainland China and internationally, with a market cap of HK$6.46 billion.

Operations: Tong Ren Tang Technologies Co. Ltd. generates revenue through its primary segments, with The Company contributing CN¥4.29 billion and Tong Ren Tang Chinese Medicine adding CN¥1.26 billion.

Dividend Yield: 3.7%

Tong Ren Tang Technologies has seen stable dividend payments over the past decade, with a modest yield of 3.7%, lower than top-tier Hong Kong payers. Despite a low payout ratio of 35.4%, dividends aren't covered by free cash flow, raising sustainability concerns. Earnings have grown annually by 7.9% over five years but are expected to decline slightly in the future. Recent board changes include Ms. Yung Mei Yee's resignation as joint company secretary without impacting operations or governance stability.

- Click to explore a detailed breakdown of our findings in Tong Ren Tang Technologies' dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Tong Ren Tang Technologies shares in the market.

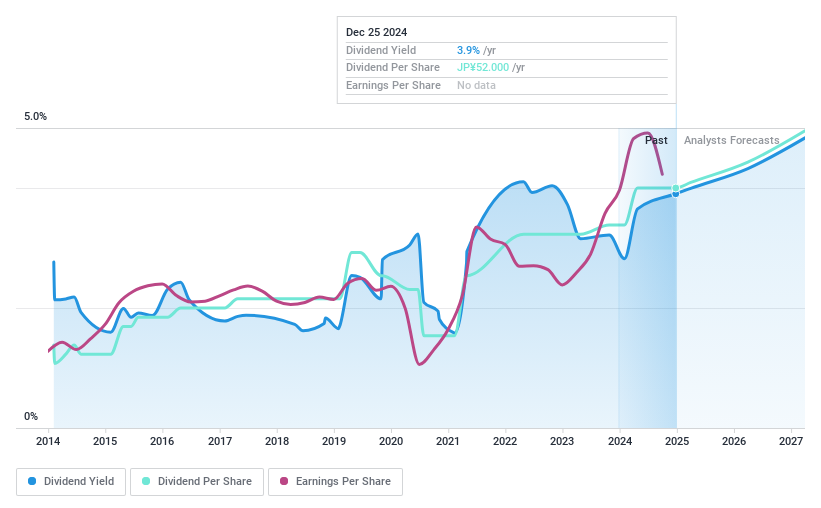

Pacific Industrial (TSE:7250)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Industrial Co., Ltd. manufactures and sells automotive and electronic equipment parts both in Japan and internationally, with a market cap of ¥75.23 billion.

Operations: The company's revenue segments include the Valve Products Business, generating ¥57.05 billion, and the Press and Resin Products Business, contributing ¥146.96 billion.

Dividend Yield: 3.9%

Pacific Industrial's dividend yield of 3.91% ranks in the top 25% of Japan's market, yet its payments are unreliable and volatile over the past decade. Despite a low payout ratio of 21.3%, dividends aren't supported by free cash flows, casting doubt on sustainability. The company trades at a favorable value with a P/E ratio of 5.2x against the market's 13.5x but faces forecasted earnings declines averaging 5.8% annually over three years.

- Get an in-depth perspective on Pacific Industrial's performance by reading our dividend report here.

- Our expertly prepared valuation report Pacific Industrial implies its share price may be lower than expected.

Next Steps

- Discover the full array of 1962 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pacific Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7250

Pacific Industrial

Manufactures and sells automotive and electronic equipment parts in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives